Goods to Follow Canada Form is a crucial document for individuals and businesses importing goods into Canada. It serves as a declaration of the goods being imported and is a requirement by the Canada Border Services Agency (CBSA). In this article, we will delve into the details of the Goods to Follow Canada Form, its importance, and provide a step-by-step guide on how to fill it out correctly.

Understanding the Goods to Follow Canada Form

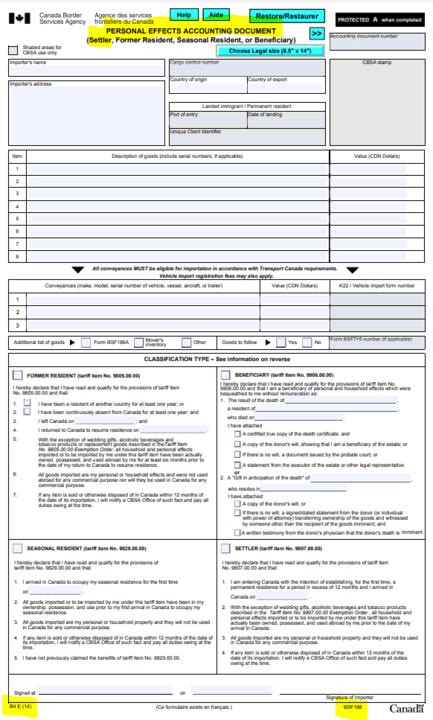

The Goods to Follow Canada Form, also known as the CBSA Declaration Form, is a document that accompanies goods being imported into Canada. It provides detailed information about the goods, including their description, value, and country of origin. The form is used by the CBSA to assess duties, taxes, and other charges applicable to the imported goods.

Why is the Goods to Follow Canada Form Important?

The Goods to Follow Canada Form is important for several reasons:

- It ensures compliance with Canadian customs regulations and laws.

- It helps to prevent smuggling and other illicit activities.

- It enables the CBSA to assess duties and taxes accurately.

- It provides a record of the goods being imported, which can be useful for auditing and tracking purposes.

Who Needs to Fill Out the Goods to Follow Canada Form?

The following individuals and businesses need to fill out the Goods to Follow Canada Form:

- Importers of goods into Canada.

- Exporters of goods from Canada.

- Carriers and freight forwarders who transport goods into or out of Canada.

- Brokers who facilitate the importation or exportation of goods.

How to Fill Out the Goods to Follow Canada Form

Filling out the Goods to Follow Canada Form requires careful attention to detail. Here is a step-by-step guide to help you fill out the form correctly:

- Section 1: Description of Goods

- Provide a detailed description of the goods being imported or exported.

- Include the Harmonized System (HS) code for each item.

- Section 2: Quantity and Value

- State the quantity of each item being imported or exported.

- Provide the value of each item in Canadian dollars.

- Section 3: Country of Origin

- Indicate the country of origin for each item.

- Section 4: Duties and Taxes

- Calculate the duties and taxes applicable to the goods.

- Section 5: Certifications and Signatures

- Sign and date the form.

- Provide certifications, such as the goods are accurately described and valued.

Common Mistakes to Avoid

When filling out the Goods to Follow Canada Form, it is essential to avoid common mistakes, such as:

- Inaccurate or incomplete information.

- Failure to provide the required certifications and signatures.

- Incorrect calculation of duties and taxes.

Penalties for Non-Compliance

Failure to comply with the Goods to Follow Canada Form requirements can result in penalties, including:

- Fines and monetary penalties.

- Seizure of goods.

- Revocation of import or export privileges.

Conclusion

In conclusion, the Goods to Follow Canada Form is a critical document for individuals and businesses importing goods into Canada. It is essential to fill out the form accurately and completely to avoid penalties and ensure compliance with Canadian customs regulations. By following the step-by-step guide provided in this article, you can ensure that you are filling out the form correctly and avoiding common mistakes.

We encourage you to share your experiences and ask questions about the Goods to Follow Canada Form in the comments section below.

What is the Goods to Follow Canada Form?

+The Goods to Follow Canada Form is a document that accompanies goods being imported into Canada. It provides detailed information about the goods, including their description, value, and country of origin.

Who needs to fill out the Goods to Follow Canada Form?

+The following individuals and businesses need to fill out the Goods to Follow Canada Form: importers of goods into Canada, exporters of goods from Canada, carriers and freight forwarders who transport goods into or out of Canada, and brokers who facilitate the importation or exportation of goods.

What are the penalties for non-compliance?

+Failure to comply with the Goods to Follow Canada Form requirements can result in penalties, including fines and monetary penalties, seizure of goods, and revocation of import or export privileges.