Completing a Loss of Income form can be a daunting task, especially when dealing with the complexities of the Department of Children and Families (DCF). Understanding the intricacies of the form and the necessary documentation can be overwhelming. However, with the right guidance, you can navigate this process with ease.

In this article, we will explore the five ways to complete a Loss of Income form DCF, ensuring that you provide accurate and complete information. We will delve into the necessary documentation, steps to take, and tips to keep in mind. By the end of this article, you will be well-equipped to tackle the Loss of Income form with confidence.

Understanding the Loss of Income Form DCF

The Loss of Income form is a crucial document required by the Department of Children and Families (DCF) to assess an individual's or family's eligibility for benefits. The form is used to verify income loss due to various reasons such as job loss, reduction in work hours, or changes in family circumstances.

Way 1: Gathering Necessary Documentation

Before starting the Loss of Income form, it is essential to gather all necessary documentation. This includes:

- Proof of income (pay stubs, W-2 forms, or tax returns)

- Proof of job loss or reduction in work hours (termination letter, layoff notice, or doctor's note)

- Proof of change in family circumstances (birth or death certificate, divorce or separation documents)

- Proof of income from other sources (alimony, child support, or social security benefits)

Having all necessary documentation readily available will ensure a smooth and efficient process.

Way 2: Completing the Loss of Income Form

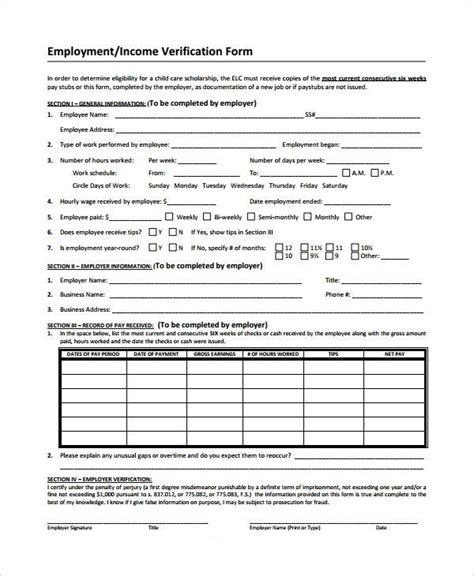

Once you have gathered all necessary documentation, it's time to complete the Loss of Income form. The form typically consists of several sections, including:

- Section 1: Applicant Information

- Section 2: Income Information

- Section 3: Job Loss or Reduction in Work Hours

- Section 4: Change in Family Circumstances

- Section 5: Signature and Certification

Ensure that you fill out each section accurately and completely, using the gathered documentation as reference.

Way 3: Verifying Income Information

Verifying income information is a critical step in completing the Loss of Income form. You will need to provide detailed information about your income, including:

- Gross income

- Net income

- Frequency of pay

- Date of last payment

Using pay stubs, W-2 forms, or tax returns, verify the income information to ensure accuracy.

Way 4: Explaining Job Loss or Reduction in Work Hours

If you have experienced job loss or a reduction in work hours, you will need to explain the circumstances surrounding the change. This includes:

- Reason for job loss or reduction in work hours

- Date of job loss or reduction in work hours

- Expected duration of job loss or reduction in work hours

Using termination letters, layoff notices, or doctor's notes, provide clear and concise explanations.

Way 5: Submitting the Completed Form

Once you have completed the Loss of Income form, it's time to submit it to the Department of Children and Families (DCF). Ensure that you:

- Sign and date the form

- Attach all necessary documentation

- Submit the form via mail, fax, or in-person

Additional Tips and Reminders

- Ensure accuracy and completeness when filling out the form

- Use clear and concise language when explaining job loss or reduction in work hours

- Attach all necessary documentation to avoid delays

- Submit the form promptly to avoid missing deadlines

By following these five ways to complete a Loss of Income form DCF, you can ensure a smooth and efficient process. Remember to gather necessary documentation, complete the form accurately, verify income information, explain job loss or reduction in work hours, and submit the completed form promptly.

We encourage you to share your experiences and tips on completing the Loss of Income form DCF in the comments section below. Your input will help others navigate this process with ease.

What is the purpose of the Loss of Income form DCF?

+The Loss of Income form is used to verify income loss due to various reasons such as job loss, reduction in work hours, or changes in family circumstances.

What documentation is required to complete the Loss of Income form?

+Documentation required includes proof of income, proof of job loss or reduction in work hours, and proof of change in family circumstances.

How do I submit the completed Loss of Income form?

+The completed form can be submitted via mail, fax, or in-person to the Department of Children and Families (DCF).