Filing tax-exempt forms can be a daunting task, especially when it comes to ensuring accuracy and compliance with regulatory requirements. The DTS tax-exempt form, also known as the Defense Travel System (DTS) Tax Exempt Form, is a crucial document for military personnel and defense contractors to claim tax exemptions on their travel-related expenses. In this article, we will guide you through the process of filling out the DTS tax-exempt form correctly, highlighting five essential steps to ensure a smooth and error-free experience.

Understanding the DTS Tax Exempt Form

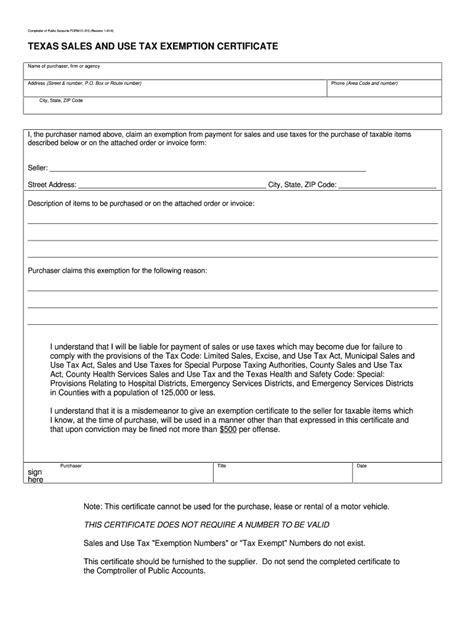

Before diving into the nitty-gritty of filling out the form, it's essential to understand what the DTS tax-exempt form is and its purpose. The form is used to claim tax exemptions on travel-related expenses, such as lodging, meals, and transportation, incurred by military personnel and defense contractors while on official business. The form is typically submitted to the Defense Travel System (DTS) for processing and reimbursement.

Step 1: Gather Required Documents and Information

To fill out the DTS tax-exempt form correctly, you'll need to gather the necessary documents and information. These may include:

- Your military identification or defense contractor ID

- Travel orders or authorization

- Receipts for travel-related expenses

- Proof of payment for expenses

- Any other supporting documentation required by the DTS

Tip: Make sure to keep all receipts and documents organized and easily accessible to avoid delays in processing.

Step 2: Complete the Form Accurately and Thoroughly

Once you have gathered all the required documents and information, it's time to fill out the DTS tax-exempt form. Make sure to complete the form accurately and thoroughly, paying close attention to the following:

- Fill out all required fields, including your name, rank, and social security number

- Ensure all dates and amounts are correct and match the supporting documentation

- Use the correct tax-exempt code for your specific situation (e.g., military personnel or defense contractor)

- Sign and date the form

Tip: Double-check your work to avoid errors and ensure a smooth processing experience.

Step 3: Calculate and Claim Tax-Exempt Expenses

Next, calculate and claim your tax-exempt expenses on the form. This may include:

- Lodging expenses, including hotel stays and other accommodations

- Meal expenses, including food and beverages

- Transportation expenses, including flights, rental cars, and other transportation costs

- Other expenses, such as laundry and dry cleaning

Tip: Make sure to follow the DTS guidelines for calculating and claiming tax-exempt expenses.

Step 4: Submit the Form and Supporting Documentation

Once you have completed the form and calculated your tax-exempt expenses, submit the form and supporting documentation to the DTS for processing. Make sure to:

- Submit the form and documentation within the required timeframe (typically 30 days from the date of travel)

- Use the correct submission method (e.g., electronic or paper)

- Keep a copy of the submitted form and documentation for your records

Tip: Follow the DTS guidelines for submitting the form and documentation to avoid delays in processing.

Step 5: Follow Up and Verify Processing

Finally, follow up and verify the processing of your DTS tax-exempt form. You can:

- Check the status of your form online or through the DTS customer service

- Verify that your tax-exempt expenses have been processed correctly

- Follow up with the DTS if there are any issues or discrepancies

Tip: Keep track of your form's progress to ensure timely reimbursement.

By following these five steps, you can ensure that your DTS tax-exempt form is filled out correctly and processed smoothly. Remember to gather required documents and information, complete the form accurately and thoroughly, calculate and claim tax-exempt expenses, submit the form and supporting documentation, and follow up and verify processing.

What is the purpose of the DTS tax-exempt form?

+The DTS tax-exempt form is used to claim tax exemptions on travel-related expenses incurred by military personnel and defense contractors while on official business.

What documents do I need to gather to fill out the DTS tax-exempt form?

+You'll need to gather your military identification or defense contractor ID, travel orders or authorization, receipts for travel-related expenses, proof of payment for expenses, and any other supporting documentation required by the DTS.

How do I calculate and claim tax-exempt expenses on the DTS tax-exempt form?

+Follow the DTS guidelines for calculating and claiming tax-exempt expenses, including lodging, meal, and transportation expenses.

We hope this article has been informative and helpful in guiding you through the process of filling out the DTS tax-exempt form correctly. Remember to follow the steps outlined above and seek assistance if needed to ensure a smooth and error-free experience.