The 1040 form is a fundamental part of the US tax system, used by millions of Americans to report their income and claim deductions. Despite its importance, many taxpayers find the form intimidating and overwhelming. However, with practice and patience, mastering the 1040 form can become second nature.

In this article, we'll break down the process into five easy steps, helping you to confidently navigate the form and ensure you're taking advantage of all the deductions and credits available to you.

Understanding the 1040 Form

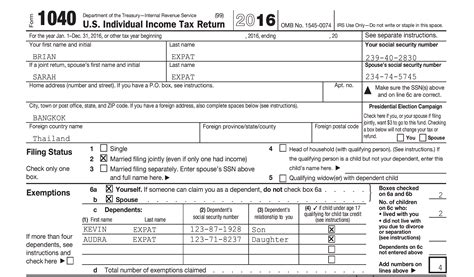

The 1040 form is the standard form used for personal income tax returns. It's where you report your income, claim deductions and credits, and calculate your tax liability. The form consists of two pages, with various sections and schedules that require different types of information.

Why is the 1040 Form Important?

The 1040 form is crucial for several reasons:

- It helps you report your income and pay the correct amount of taxes.

- It allows you to claim deductions and credits that can reduce your tax liability.

- It provides a way to report changes in your income or filing status.

Step 1: Gather Required Documents and Information

Before starting the 1040 form, it's essential to gather all the necessary documents and information. This includes:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- W-2 forms from your employer(s)

- 1099 forms for freelance or contract work

- Interest statements from banks and investments (1099-INT)

- Dividend statements (1099-DIV)

- Charitable donation receipts

- Medical expense receipts

- Mortgage interest statements (1098)

What if You're Missing Documents?

If you're missing any of the required documents, don't panic. You can:

- Contact your employer or financial institution to request a replacement.

- Use the IRS's online portal to retrieve transcripts of your W-2 and 1099 forms.

- File for an extension using Form 4868 to give yourself more time to gather the necessary documents.

Step 2: Choose Your Filing Status

Your filing status determines your tax rates and deductions. The five filing statuses are:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

How to Choose Your Filing Status

To choose your filing status, consider the following:

- Your marital status on December 31st of the tax year.

- Whether you have dependents or qualifying children.

- Whether you're eligible for head of household status.

Step 3: Report Your Income

Reporting your income is a critical part of the 1040 form. You'll need to report:

- Wages, salaries, and tips (Form W-2)

- Interest and dividend income (Forms 1099-INT and 1099-DIV)

- Capital gains and losses (Schedule D)

- Self-employment income (Schedule C)

What if You Have Multiple Sources of Income?

If you have multiple sources of income, you'll need to report each one separately. This includes:

- Adding up your W-2 income from multiple employers.

- Reporting interest and dividend income from multiple accounts.

- Calculating your self-employment income from multiple businesses.

Step 4: Claim Deductions and Credits

Claiming deductions and credits can significantly reduce your tax liability. Some common deductions and credits include:

- Standard deduction or itemized deductions (Schedule A)

- Earned Income Tax Credit (EITC)

- Child Tax Credit

- Education credits (Form 8863)

What if You're Not Sure About Deductions and Credits?

If you're unsure about which deductions and credits you're eligible for, consider:

- Consulting with a tax professional.

- Using tax software to guide you through the process.

- Reading the IRS's instructions and publications.

Step 5: Review and Submit Your Return

Once you've completed the 1040 form, review it carefully for errors and omissions. Make sure to:

- Sign and date the form.

- Attach all required schedules and forms.

- Submit your return electronically or by mail.

What if You Need to Amend Your Return?

If you need to amend your return, you can file Form 1040X. This includes:

- Correcting errors or omissions.

- Claiming additional deductions or credits.

- Reporting changes in your income or filing status.

By following these five steps, you'll be well on your way to mastering the 1040 form. Remember to stay organized, take your time, and seek help when needed. Happy filing!

Now that you've read this article, take a moment to share your thoughts and experiences with the 1040 form. Have you encountered any challenges or surprises while filing your taxes? Share your stories and tips in the comments below!

What is the 1040 form used for?

+The 1040 form is used for personal income tax returns. It's where you report your income, claim deductions and credits, and calculate your tax liability.

What documents do I need to gather before starting the 1040 form?

+You'll need to gather your Social Security number or ITIN, W-2 forms, 1099 forms, interest statements, dividend statements, charitable donation receipts, medical expense receipts, and mortgage interest statements.

How do I choose my filing status?

+Your filing status determines your tax rates and deductions. You can choose from single, married filing jointly, married filing separately, head of household, or qualifying widow(er) status. Consider your marital status, dependents, and qualifying children when choosing your filing status.