The state of Kansas requires its residents to file their tax returns by a specific deadline. However, sometimes, due to unforeseen circumstances, taxpayers may need more time to gather necessary documents or complete their tax returns. In such cases, the Kansas tax extension form, also known as Form K-40, comes into play. This form allows taxpayers to request an automatic six-month extension to file their state income tax return.

Filing for a tax extension in Kansas can be a straightforward process, especially if you understand the requirements and the steps involved. In this article, we will guide you through the process of filing Form K-40, the benefits of filing for a tax extension, and the potential consequences of not filing on time.

Benefits of Filing for a Kansas Tax Extension

Filing for a tax extension in Kansas can provide several benefits, including:

- Extra Time to File: The most obvious benefit of filing for a tax extension is the extra six months you get to file your tax return. This can be especially helpful if you are waiting for additional information or need more time to gather necessary documents.

- Avoid Late Filing Penalties: If you file for a tax extension, you can avoid late filing penalties and interest on the amount you owe. This can save you money and reduce your overall tax liability.

- Reduce Stress and Anxiety: Filing for a tax extension can also help reduce stress and anxiety related to meeting the original filing deadline. You can take your time to complete your tax return without feeling rushed or pressured.

Who Needs to File Form K-40?

Not everyone needs to file Form K-40. You should file for a tax extension in Kansas if:

- You need more time to file your state income tax return.

- You are waiting for additional information or necessary documents to complete your tax return.

- You are experiencing unforeseen circumstances that prevent you from filing on time.

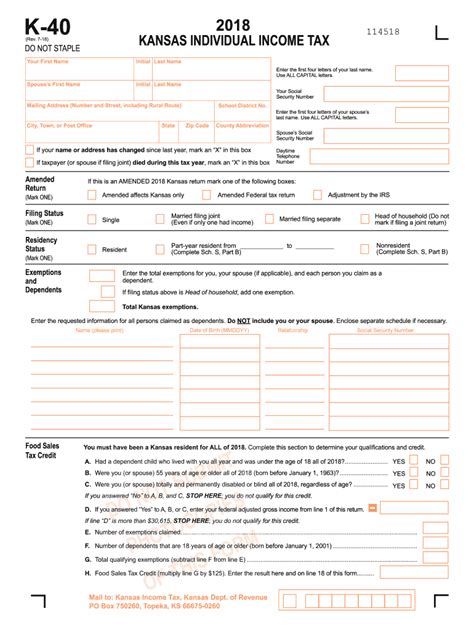

How to File Form K-40

Filing Form K-40 is a relatively straightforward process. Here are the steps you need to follow:

- Determine Your Eligibility: Before you file for a tax extension, determine if you are eligible. Check if you need to file a state income tax return and if you meet the requirements for a tax extension.

- Gather Necessary Information: You will need to provide your name, address, and social security number or ITIN. You will also need to estimate your tax liability and make a payment if you owe taxes.

- Complete Form K-40: Download and complete Form K-40 from the Kansas Department of Revenue website or use tax preparation software to file electronically.

- Submit Your Application: Mail or e-file your application by the original filing deadline.

What to Expect After Filing Form K-40

After filing Form K-40, you can expect:

- Automatic Six-Month Extension: You will receive an automatic six-month extension to file your state income tax return.

- Confirmation Letter: You will receive a confirmation letter from the Kansas Department of Revenue acknowledging your tax extension request.

- Additional Information: You may receive additional information or requests from the Kansas Department of Revenue if they need more information to process your tax extension.

Potential Consequences of Not Filing on Time

If you fail to file Form K-40 or do not file your state income tax return by the extended deadline, you may face:

- Late Filing Penalties: You may be subject to late filing penalties and interest on the amount you owe.

- Loss of Refund: If you are due a refund, you may lose it if you do not file your tax return on time.

- Collection Activities: The Kansas Department of Revenue may initiate collection activities, including sending notices, making phone calls, or even filing a tax lien.

Additional Tips and Reminders

- File Electronically: Filing electronically can speed up the processing of your tax extension request and reduce errors.

- Make a Payment: If you owe taxes, make a payment with your tax extension request to avoid additional penalties and interest.

- Keep Records: Keep a copy of your tax extension request and any supporting documentation for your records.

By following these tips and guidelines, you can file Form K-40 easily and avoid potential consequences of not filing on time. Remember to always check the Kansas Department of Revenue website for the latest information and updates on tax extensions.

Conclusion

Filing for a tax extension in Kansas can provide several benefits, including extra time to file, avoiding late filing penalties, and reducing stress and anxiety. By understanding the requirements and steps involved in filing Form K-40, you can ensure a smooth and successful tax extension process.

If you have any questions or concerns about filing Form K-40, we encourage you to comment below or share this article with others who may find it helpful.

What is the deadline for filing Form K-40?

+The deadline for filing Form K-40 is the original filing deadline for your state income tax return.

Can I file Form K-40 electronically?

+Yes, you can file Form K-40 electronically through the Kansas Department of Revenue website or using tax preparation software.

What if I owe taxes and cannot pay the full amount?

+If you owe taxes and cannot pay the full amount, you should still file Form K-40 and make a payment with your tax extension request. You can also set up a payment plan with the Kansas Department of Revenue.