As a business owner or healthcare provider in California, it's essential to understand the requirements for reporting certain types of injuries or illnesses to the California Department of Public Health (CDPH). One crucial document that serves this purpose is the California 530 Form, also known as the "Report of Occupational Injury or Illness." In this article, we'll delve into the world of the California 530 Form, CDPh, and provide a step-by-step guide on how to file it accurately.

The California 530 Form is a critical document that helps the CDPH track work-related injuries and illnesses across the state. By reporting these incidents, employers and healthcare providers contribute to the development of policies and programs aimed at preventing future occurrences. Moreover, timely and accurate reporting can also help reduce workers' compensation claims and associated costs.

So, why is it crucial to file the California 530 Form correctly? Failure to report work-related injuries or illnesses can result in fines, penalties, and even legal action. Furthermore, inaccurate or incomplete reporting can lead to delays in receiving workers' compensation benefits for affected employees.

Understanding the California 530 Form

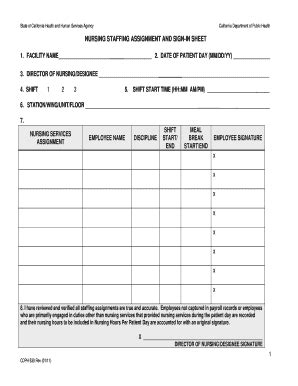

Before we dive into the step-by-step filing guide, let's take a closer look at the California 530 Form itself. The form is divided into several sections, each requiring specific information about the injured employee, the injury or illness, and the reporting employer or healthcare provider.

Who Needs to File the California 530 Form?

The California 530 Form must be filed by:

- Employers with one or more employees

- Healthcare providers who treat patients with work-related injuries or illnesses

- Insurance carriers who handle workers' compensation claims

Step-by-Step Filing Guide

Filing the California 530 Form involves several steps, which we'll outline below:

Step 1: Gather Required Information

Employee Information

- Employee's name

- Employee's address

- Employee's social security number

- Employee's date of birth

Injury or Illness Information

- Date of injury or illness

- Time of injury or illness

- Location of injury or illness

- Description of injury or illness

Employer Information

- Employer's name

- Employer's address

- Employer's workers' compensation insurance carrier

Step 2: Complete the California 530 Form

Using the gathered information, complete the California 530 Form accurately and thoroughly. Ensure that all sections are filled out, and signatures are obtained from the required parties.

Step 3: Submit the California 530 Form

The completed California 530 Form must be submitted to the CDPH within the specified timeframe (usually 5 days from the date of injury or illness). Employers and healthcare providers can submit the form:

- Electronically through the CDPH's online portal

- By mail to the CDPH's address

- By fax to the CDPH's fax number

Step 4: Maintain Records

Keep a copy of the submitted California 530 Form and supporting documentation for at least 5 years. This will help in case of audits or future reference.

Benefits of Filing the California 530 Form

Filing the California 530 Form accurately and timely provides several benefits, including:

- Reduced workers' compensation claims and associated costs

- Improved workplace safety and health

- Enhanced compliance with California regulations

- Better data collection for injury and illness prevention

Common Mistakes to Avoid

When filing the California 530 Form, avoid common mistakes such as:

- Inaccurate or incomplete information

- Late or missed submissions

- Failure to obtain required signatures

- Insufficient documentation

Conclusion

Filing the California 530 Form is a critical responsibility for employers and healthcare providers in California. By following the step-by-step guide outlined in this article, you can ensure accurate and timely reporting of work-related injuries and illnesses. Remember to maintain records and avoid common mistakes to reap the benefits of compliance.

Take Action

If you're an employer or healthcare provider in California, take the following actions:

- Familiarize yourself with the California 530 Form and filing requirements

- Develop a system for tracking and reporting work-related injuries and illnesses

- Train employees and staff on the importance of accurate reporting

- Review and update your reporting procedures regularly

By working together, we can create a safer and healthier work environment for all Californians.

FAQ Section

Who is responsible for filing the California 530 Form?

+The California 530 Form must be filed by employers with one or more employees, healthcare providers who treat patients with work-related injuries or illnesses, and insurance carriers who handle workers' compensation claims.

What is the deadline for submitting the California 530 Form?

+The completed California 530 Form must be submitted to the CDPH within 5 days from the date of injury or illness.

Can I submit the California 530 Form electronically?

+Yes, employers and healthcare providers can submit the California 530 Form electronically through the CDPH's online portal.