Understanding the Importance of IRS Form 1040 for 2019

As the 2019 tax season approached, individuals and businesses alike prepared to file their annual tax returns with the Internal Revenue Service (IRS). The IRS Form 1040 is the standard form used by taxpayers to report their income, claim deductions and credits, and calculate their tax liability. In this comprehensive guide, we will walk you through the IRS Form 1040 for 2019, highlighting the changes, requirements, and essential information you need to know.

The IRS Form 1040 is a critical document that helps the IRS determine the amount of taxes owed or refunded to taxpayers. It's essential to accurately complete this form to avoid any delays or issues with your tax return. In the following sections, we will delve into the details of the IRS Form 1040 for 2019, covering topics such as who needs to file, what information is required, and how to navigate the form.

Who Needs to File IRS Form 1040 for 2019?

Not everyone is required to file a tax return, but most individuals and businesses are. The following individuals are typically required to file IRS Form 1040 for 2019:

- U.S. citizens and resident aliens who have gross income above a certain threshold

- Nonresident aliens who have U.S. source income

- Self-employed individuals who have net earnings from self-employment of $400 or more

- Individuals who have taxes withheld from any of the following:

- Wages, salaries, and tips

- Interest, dividends, and capital gains distributions

- Taxable distributions from retirement accounts

- Unemployment compensation

It's essential to review the IRS's filing requirements to determine if you need to file a tax return for 2019.

What Information Do You Need to File IRS Form 1040 for 2019?

To accurately complete IRS Form 1040 for 2019, you will need to gather various documents and information, including:

- W-2 forms from your employer(s)

- 1099 forms for freelance work, interest, dividends, and capital gains

- Receipts for deductions and credits, such as charitable donations and mortgage interest

- Information about your dependents, including their Social Security numbers and dates of birth

- Records of any estimated tax payments made during the year

Having all the necessary information and documents ready will help you navigate the form more efficiently and ensure accuracy.

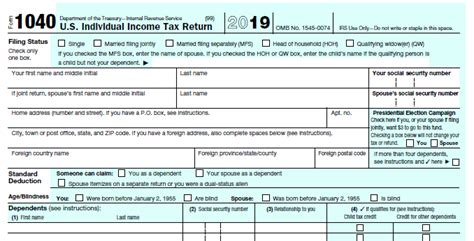

Navigating IRS Form 1040 for 2019

The IRS Form 1040 for 2019 consists of several sections and schedules. Here's an overview of the main sections:

- Personal and dependent information: Enter your name, address, Social Security number, and information about your dependents.

- Income: Report your income from various sources, including wages, salaries, tips, interest, dividends, and capital gains.

- Adjustments to income: Claim adjustments to your income, such as student loan interest deductions and educator expenses.

- Deductions and exemptions: Itemize your deductions, including mortgage interest, charitable donations, and medical expenses, or claim the standard deduction.

- Tax credits: Claim tax credits, such as the earned income tax credit (EITC) and the child tax credit.

- Tax: Calculate your total tax liability and apply any payments, credits, or overpayments.

Take your time when completing the form, and consider seeking professional help if you're unsure about any section.

Changes to IRS Form 1040 for 2019

The IRS introduced several changes to Form 1040 for 2019, including:

- New layout: The form has a new layout, with separate schedules for different types of income and deductions.

- Additional schedules: There are new schedules for reporting cryptocurrency transactions, alimony payments, and qualified business income (QBI) deductions.

- Updated instructions: The instructions for completing the form have been updated to reflect changes in tax laws and regulations.

It's essential to review the changes to ensure you accurately complete the form.

Tips for Filing IRS Form 1040 for 2019

Here are some tips to keep in mind when filing IRS Form 1040 for 2019:

- File electronically: Filing electronically can help reduce errors and speed up the processing of your return.

- Use tax software: Tax software can guide you through the filing process and help you claim deductions and credits.

- Seek professional help: If you're unsure about any part of the form, consider seeking help from a tax professional.

- Keep records: Keep accurate records of your income, deductions, and credits, in case of an audit.

By following these tips, you can ensure a smooth and accurate filing process.

Common Mistakes to Avoid When Filing IRS Form 1040 for 2019

Here are some common mistakes to avoid when filing IRS Form 1040 for 2019:

- Math errors: Double-check your math to avoid errors in calculating your tax liability.

- Missing or incorrect information: Ensure you provide accurate and complete information, including Social Security numbers and addresses.

- Forgotten deductions and credits: Review the form carefully to ensure you claim all eligible deductions and credits.

- Late filing: File your return on time to avoid penalties and interest.

By avoiding these common mistakes, you can reduce the risk of delays or issues with your tax return.

Now that you've reached the end of this comprehensive guide to IRS Form 1040 for 2019, you're better equipped to navigate the tax filing process. Take a moment to review the key takeaways and share your thoughts or questions in the comments section below.