The complexities of international trade can be daunting, especially when it comes to complying with regulatory requirements. For importers, one crucial document is the Importer's Summary Declaration, also known as CBP Form 4647. In this article, we will delve into the world of CBP Form 4647, exploring its purpose, benefits, and a step-by-step guide on how to complete it accurately.

What is CBP Form 4647?

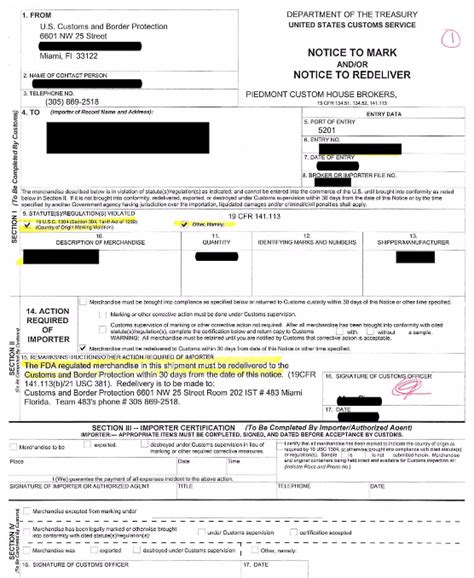

The Importer's Summary Declaration, CBP Form 4647, is a crucial document required by the U.S. Customs and Border Protection (CBP) for importers to declare the arrival of goods in the United States. The form provides a summary of the imported merchandise, including its description, quantity, value, and Harmonized System (HS) code.

Why is CBP Form 4647 important?

CBP Form 4647 is essential for several reasons:

- Compliance with regulations: The form ensures that importers comply with U.S. customs regulations and laws.

- Accurate record-keeping: It provides a record of the imported goods, which helps in tracking and verifying the merchandise.

- Streamlined processing: The form facilitates the processing of imported goods, reducing delays and increasing efficiency.

Benefits of using CBP Form 4647

The benefits of using CBP Form 4647 include:

- Simplified customs clearance: The form helps importers to clear customs quickly and efficiently.

- Reduced errors: By providing a standardized format, the form minimizes errors and discrepancies.

- Improved compliance: The form ensures that importers comply with U.S. customs regulations and laws.

Step-by-Step Guide to Completing CBP Form 4647

Completing CBP Form 4647 accurately is crucial to avoid delays and ensure compliance. Here's a step-by-step guide:

- Section 1: Importer's Information

- Provide the importer's name, address, and Employer Identification Number (EIN).

- Section 2: Broker's Information

- Provide the broker's name, address, and license number (if applicable).

- Section 3: Entry Information

- Enter the entry number, date, and time.

- Section 4: Shipment Information

- Provide the shipment details, including the bill of lading or air waybill number.

- Section 5: Commodity Information

- Describe the imported merchandise, including its quantity, value, and HS code.

Common mistakes to avoid

When completing CBP Form 4647, avoid the following common mistakes:

- Inaccurate or incomplete information: Ensure that all fields are completed accurately and thoroughly.

- Incorrect HS code: Verify the HS code to ensure that it matches the imported merchandise.

- Failure to sign and date: Sign and date the form to validate its authenticity.

Best practices for importers

To ensure a smooth and efficient import process, follow these best practices:

- Maintain accurate records: Keep detailed records of imported goods, including CBP Form 4647.

- Verify HS codes: Ensure that the HS code matches the imported merchandise.

- Consult with a broker: If unsure about the process, consult with a licensed customs broker.

Conclusion

CBP Form 4647 is a critical document for importers, ensuring compliance with U.S. customs regulations and laws. By following the step-by-step guide and avoiding common mistakes, importers can streamline the customs clearance process and reduce delays. Remember to maintain accurate records, verify HS codes, and consult with a broker if needed.

Frequently Asked Questions

What is the purpose of CBP Form 4647?

+The purpose of CBP Form 4647 is to provide a summary of the imported merchandise, including its description, quantity, value, and Harmonized System (HS) code.

Who is required to complete CBP Form 4647?

+Importers are required to complete CBP Form 4647, which may include individuals, companies, or organizations importing goods into the United States.

What are the consequences of not completing CBP Form 4647 accurately?

+Failure to complete CBP Form 4647 accurately may result in delays, penalties, and fines. In severe cases, it may also lead to the seizure of goods.

We hope this guide has provided valuable insights into CBP Form 4647 and its importance in the import process. If you have any further questions or concerns, please don't hesitate to ask.