Florida is known for its beautiful beaches, pleasant climate, and numerous tourist attractions. However, to enjoy the state's many benefits, including lower taxes and easier access to public services, it's essential to establish residency. The Florida Form DR-0100, also known as the Declaration of Florida Residency, is a crucial document for individuals looking to establish or confirm their residency in the state.

Establishing residency in Florida can have numerous benefits, including lower tuition fees for students, access to state-funded healthcare, and eligibility for state-specific tax exemptions. However, the process can be complex, and it's essential to understand the requirements and procedures involved. In this article, we'll delve into the details of the Florida Form DR-0100, its importance, and the steps involved in establishing residency in Florida.

What is the Florida Form DR-0100?

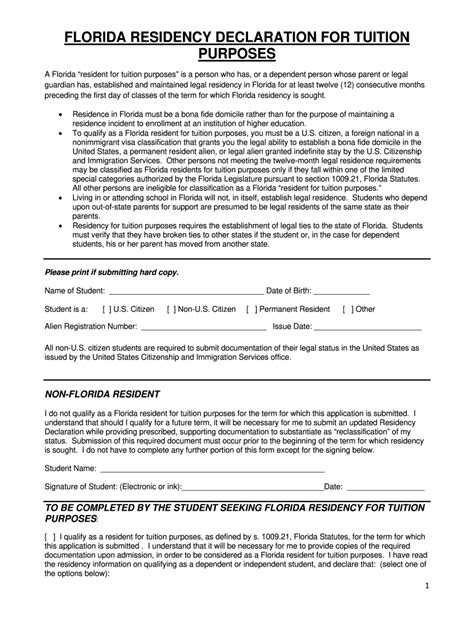

The Florida Form DR-0100 is a document used to declare an individual's residency status in Florida. It's a sworn statement that confirms the individual's intention to establish or maintain residency in the state. The form is typically submitted to the local county tax collector's office or other relevant authorities.

Why is the Florida Form DR-0100 important?

The Florida Form DR-0100 serves several purposes:

- Establishes residency: By submitting the form, individuals can establish or confirm their residency in Florida, which can have numerous benefits, including lower taxes and access to public services.

- Confirms intent: The form confirms the individual's intention to establish or maintain residency in Florida, which can help resolve any disputes or questions regarding their residency status.

- Required for certain benefits: In some cases, the Florida Form DR-0100 may be required to access certain state-funded benefits, such as healthcare or education programs.

Who needs to file the Florida Form DR-0100?

The following individuals may need to file the Florida Form DR-0100:

- New residents: Individuals who have recently moved to Florida and want to establish residency in the state.

- Students: Students who want to access in-state tuition fees or other education benefits may need to submit the form.

- Homeowners: Homeowners who want to take advantage of homestead exemptions or other property tax benefits may need to file the form.

- Businesses: Businesses that want to establish a presence in Florida or access state-funded benefits may need to submit the form.

What are the requirements for filing the Florida Form DR-0100?

To file the Florida Form DR-0100, individuals must meet certain requirements, including:

- Age: Individuals must be at least 18 years old to file the form.

- Residency: Individuals must have established or intend to establish residency in Florida.

- Documentation: Individuals must provide documentation to support their residency claim, such as a driver's license, passport, or utility bills.

How to file the Florida Form DR-0100?

To file the Florida Form DR-0100, individuals can follow these steps:

- Download the form: The form can be downloaded from the Florida Department of Revenue's website or obtained from the local county tax collector's office.

- Complete the form: Individuals must complete the form accurately and truthfully, providing all required information and documentation.

- Sign the form: The form must be signed in the presence of a notary public.

- Submit the form: The form can be submitted to the local county tax collector's office or other relevant authorities.

What are the benefits of filing the Florida Form DR-0100?

Filing the Florida Form DR-0100 can have numerous benefits, including:

- Lower taxes: Establishing residency in Florida can result in lower taxes, including lower property taxes and sales taxes.

- Access to public services: Residents of Florida may have access to public services, such as healthcare and education programs.

- In-state tuition fees: Students who establish residency in Florida may be eligible for in-state tuition fees, which can result in significant cost savings.

- Homestead exemptions: Homeowners who establish residency in Florida may be eligible for homestead exemptions, which can result in lower property taxes.

Common mistakes to avoid when filing the Florida Form DR-0100

When filing the Florida Form DR-0100, individuals should avoid the following common mistakes:

- Incomplete information: Failing to provide complete and accurate information can result in delays or rejection of the application.

- Lack of documentation: Failing to provide required documentation can result in delays or rejection of the application.

- Unsigned form: Failing to sign the form in the presence of a notary public can result in delays or rejection of the application.

Conclusion

Establishing residency in Florida can have numerous benefits, including lower taxes and access to public services. The Florida Form DR-0100 is a crucial document for individuals looking to establish or confirm their residency in the state. By understanding the requirements and procedures involved, individuals can ensure a smooth and successful application process. If you have any questions or concerns about the Florida Form DR-0100 or the residency application process, don't hesitate to comment below or share this article with others who may find it helpful.

What is the Florida Form DR-0100?

+The Florida Form DR-0100 is a document used to declare an individual's residency status in Florida. It's a sworn statement that confirms the individual's intention to establish or maintain residency in the state.

Who needs to file the Florida Form DR-0100?

+The following individuals may need to file the Florida Form DR-0100: new residents, students, homeowners, and businesses.

What are the requirements for filing the Florida Form DR-0100?

+To file the Florida Form DR-0100, individuals must meet certain requirements, including age, residency, and documentation.