In today's digital age, managing paperwork and forms can be a daunting task for businesses and individuals alike. One such form that requires careful handling is the W-9 form, also known as the Request for Taxpayer Identification Number and Certification. The W-9 form is a crucial document that provides the Internal Revenue Service (IRS) with the necessary information to process tax payments and returns. However, manually signing and managing W-9 forms can be time-consuming and prone to errors.

Introduction to W-9 Forms

A W-9 form is a standardized document used by the IRS to collect taxpayer identification information from individuals and businesses. The form requires the taxpayer to provide their name, business name, address, and taxpayer identification number (TIN), which can be either a Social Security number (SSN) or an Employer Identification Number (EIN). The W-9 form is typically used by payers to report income paid to freelancers, independent contractors, and other non-employees.

The Importance of Accurate W-9 Forms

Accurate and complete W-9 forms are essential for ensuring that tax payments and returns are processed correctly. Inaccurate or incomplete forms can lead to delays, penalties, and even audits. Moreover, businesses that fail to obtain a valid W-9 form from their contractors and freelancers may be subject to backup withholding, which can result in significant financial losses.

Challenges of Manual W-9 Form Management

Manual W-9 form management can be a tedious and error-prone process. Paper-based forms can get lost, damaged, or misplaced, leading to delays and inaccuracies. Additionally, manual data entry can result in typos and incorrect information, which can further complicate the tax filing process.

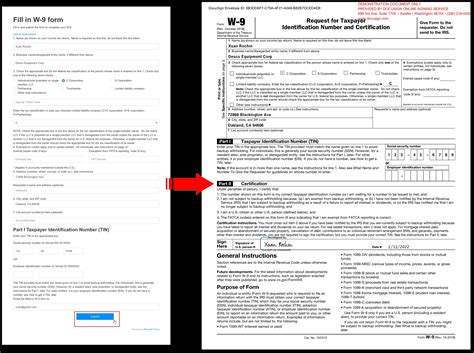

Introducing DocuSign: A Digital Solution for W-9 Forms

DocuSign is a digital signature platform that enables businesses and individuals to electronically sign and manage W-9 forms. With DocuSign, users can upload their W-9 forms, add fields and tags, and send them to recipients for electronic signature. The platform ensures that all forms are complete, accurate, and securely stored, reducing the risk of errors and lost documents.

Benefits of Using DocuSign for W-9 Forms

Using DocuSign for W-9 forms offers numerous benefits, including:

- Increased efficiency: Electronic signatures and automated workflows streamline the W-9 form management process, reducing administrative burdens and saving time.

- Improved accuracy: DocuSign's electronic forms and automated data validation ensure that all information is complete and accurate, reducing the risk of errors and inaccuracies.

- Enhanced security: DocuSign's secure platform and data encryption ensure that sensitive taxpayer information is protected and compliant with IRS regulations.

- Scalability: DocuSign's cloud-based platform can handle large volumes of W-9 forms, making it an ideal solution for businesses with multiple contractors and freelancers.

How to Sign and Manage W-9 Forms with DocuSign

Signing and managing W-9 forms with DocuSign is a straightforward process:

- Upload your W-9 form: Upload your W-9 form to the DocuSign platform and add fields and tags as needed.

- Send for signature: Send the W-9 form to recipients for electronic signature, either individually or in bulk.

- Track and manage: Track the status of your W-9 forms and manage them securely in your DocuSign account.

- Store and retrieve: Store completed W-9 forms securely in your DocuSign account and retrieve them as needed.

Conclusion

Managing W-9 forms can be a complex and time-consuming process, but with DocuSign, businesses and individuals can streamline their workflow and ensure compliance with IRS regulations. By electronically signing and managing W-9 forms, users can reduce errors, increase efficiency, and enhance security. Whether you're a freelancer, contractor, or business owner, DocuSign's digital solution for W-9 forms is an essential tool for simplifying your tax management process.

FAQs

What is a W-9 form?

+A W-9 form is a standardized document used by the IRS to collect taxpayer identification information from individuals and businesses.

Why do I need to sign a W-9 form?

+You need to sign a W-9 form to provide the IRS with your taxpayer identification information, which is required for tax filing and payment purposes.