Many Walmart employees take advantage of the company's 401(k) plan to save for retirement. However, life can be unpredictable, and sometimes, unexpected expenses or financial difficulties may arise. In such situations, employees may need to access their retirement savings earlier than planned. This is where the Walmart 401(k) hardship withdrawal comes into play. In this article, we will guide you through the process of filling out the Walmart 401(k) hardship withdrawal form.

Filling out the Walmart 401(k) hardship withdrawal form can be a daunting task, especially if you're not familiar with the process. To help you navigate this process, we've broken down the steps into a comprehensive guide. Please note that the information provided is for general purposes only and may not be applicable to your specific situation. It's always best to consult with a financial advisor or HR representative for personalized guidance.

Understanding Walmart 401(k) Hardship Withdrawal

Before we dive into the steps, let's quickly understand what a hardship withdrawal is. A hardship withdrawal is a type of withdrawal that allows employees to access their 401(k) funds before age 59 1/2, without incurring the 10% early withdrawal penalty. However, keep in mind that hardship withdrawals are subject to income tax and may impact your retirement savings.

Step 1: Determine Your Eligibility

To be eligible for a hardship withdrawal, you must meet specific criteria set by the IRS and Walmart. These criteria include:

- Unforeseen medical expenses

- Tuition and fees for higher education

- Purchase of a primary residence

- Prevention of foreclosure or eviction

- Burial expenses

- Repairs to a primary residence

You must provide documentation to support your request, and your situation must meet the IRS's definition of "immediate and heavy financial need."

Step 2: Gather Required Documents

Documentation Requirements

To fill out the Walmart 401(k) hardship withdrawal form, you'll need to gather the following documents:

- Proof of your income and expenses

- Documentation of your financial need (e.g., medical bills, tuition statements, or eviction notices)

- Your most recent account statement

- A letter explaining your financial situation and the reason for your request

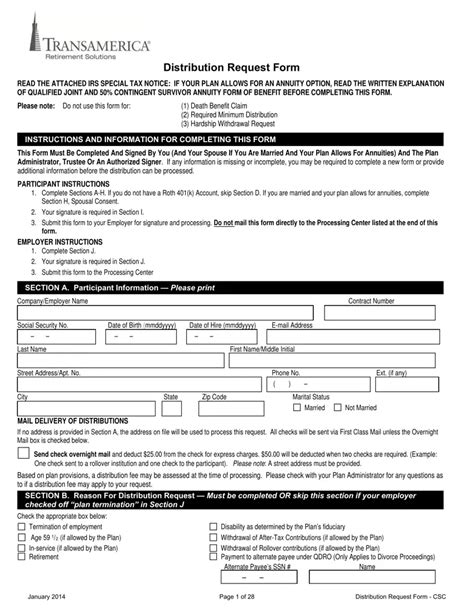

Step 3: Complete the Hardship Withdrawal Form

The hardship withdrawal form is typically available on the Walmart Benefits website or through your HR representative. The form will require you to provide:

- Your personal and account information

- The reason for your hardship withdrawal

- The amount you're requesting to withdraw

- Your signature and date

Make sure to carefully review the form and attach all required documentation.

Step 4: Submit Your Request

Submission Guidelines

Once you've completed the form and gathered all necessary documents, submit your request to the address or fax number provided on the form. You can also submit your request online through the Walmart Benefits website.

Step 5: Review and Follow Up

After submitting your request, review your account statement to ensure the withdrawal has been processed correctly. If you have any questions or concerns, contact the Walmart Benefits center or your HR representative for assistance.

By following these steps, you'll be able to successfully fill out the Walmart 401(k) hardship withdrawal form and access your retirement savings when you need it most. Remember to carefully review the form and attached documentation to ensure a smooth process.

Invitation to Engage

We hope this guide has helped you navigate the process of filling out the Walmart 401(k) hardship withdrawal form. If you have any questions or comments, please feel free to share them below. We encourage you to share this article with your colleagues or friends who may be facing similar situations.

FAQ Section

What is the maximum amount I can withdraw from my Walmart 401(k) account?

+The maximum amount you can withdraw from your Walmart 401(k) account is 50% of your account balance or $50,000, whichever is less.

Will I be taxed on my hardship withdrawal?

+Yes, you will be taxed on your hardship withdrawal. The withdrawal will be considered ordinary income and will be subject to federal and state income tax.

Can I repay my hardship withdrawal?

+No, you cannot repay a hardship withdrawal. However, you can contribute to your Walmart 401(k) account again in the future.