Filing tax extensions can be a stressful and overwhelming experience, especially when dealing with state tax authorities. However, the North Carolina Department of Revenue provides an option to request an automatic six-month extension to file individual income tax returns. In this article, we will guide you through the process of filing the NC tax extension form D-410 in 5 easy steps.

The importance of filing tax extensions cannot be overstated. It provides taxpayers with extra time to gather necessary documents, consult with tax professionals, and ensure accuracy in their tax returns. By filing form D-410, individuals can avoid penalties and interest associated with late filing. Moreover, it allows taxpayers to take advantage of the available six-month extension, which can be beneficial for those who need more time to settle their tax obligations.

Before we dive into the steps, it is essential to understand the eligibility criteria and requirements for filing form D-410. The North Carolina Department of Revenue requires taxpayers to meet specific conditions, including filing the extension request on or before the original tax filing deadline. Additionally, taxpayers must pay any estimated tax due by the original deadline to avoid penalties and interest.

Filing NC Tax Extension Form D-410: Step-by-Step Guide

Step 1: Gather Required Information

To file form D-410, you will need to gather specific information, including:

- Your name and social security number

- Your spouse's name and social security number (if filing jointly)

- Your North Carolina tax account number (if you have filed previously)

- An estimate of your total tax liability for the year

- Payment information (check, money order, or electronic payment)

Step 2: Choose Filing Method

You can file form D-410 electronically or by mail. The North Carolina Department of Revenue recommends electronic filing, as it is faster and more secure. If you choose to file by mail, make sure to use the correct address and include the required payment.

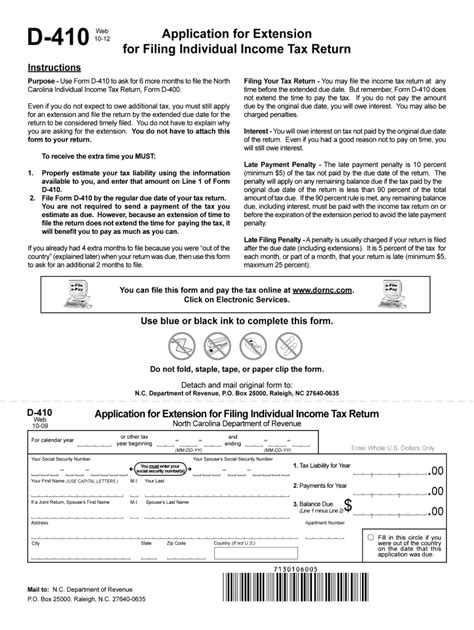

Step 3: Complete Form D-410

Form D-410 is a simple, one-page document that requires basic information. You can download the form from the North Carolina Department of Revenue's website or obtain it from a local tax office. Complete the form carefully, ensuring accuracy in your name, social security number, and estimated tax liability.

Step 4: Make Payment

You must pay any estimated tax due by the original deadline to avoid penalties and interest. You can make payment by check, money order, or electronic payment. If you are filing electronically, you can pay online using a credit or debit card.

Step 5: Submit Form D-410

Once you have completed form D-410 and made payment, submit the form to the North Carolina Department of Revenue. If filing electronically, follow the online prompts to upload the form and make payment. If filing by mail, send the form and payment to the address listed on the form.

Benefits of Filing NC Tax Extension Form D-410

Filing form D-410 provides several benefits, including:

- Avoidance of penalties and interest associated with late filing

- Extra time to gather necessary documents and consult with tax professionals

- Ability to take advantage of the available six-month extension

- Opportunity to ensure accuracy in tax returns

Common Mistakes to Avoid When Filing NC Tax Extension Form D-410

When filing form D-410, it is essential to avoid common mistakes, including:

- Failing to pay estimated tax due by the original deadline

- Inaccurate or incomplete information on the form

- Missing the filing deadline

- Failing to keep records of payment and form submission

Tax Planning Strategies for NC Taxpayers

In addition to filing form D-410, NC taxpayers can benefit from various tax planning strategies, including:

- Keeping accurate records of income and expenses

- Taking advantage of available tax credits and deductions

- Consulting with tax professionals to ensure accuracy and compliance

- Planning for estimated tax payments throughout the year

By following these steps and avoiding common mistakes, NC taxpayers can ensure a smooth and stress-free tax filing experience. Remember to take advantage of the available six-month extension and plan accordingly to meet your tax obligations.

Conclusion

Filing NC tax extension form D-410 is a straightforward process that can provide taxpayers with extra time to settle their tax obligations. By following the steps outlined in this article and avoiding common mistakes, NC taxpayers can ensure a successful tax filing experience. Remember to take advantage of available tax planning strategies and plan accordingly to meet your tax obligations.

We encourage you to share your experiences and tips for filing NC tax extension form D-410 in the comments section below. Don't forget to share this article with friends and family who may benefit from this information.

What is the deadline for filing NC tax extension form D-410?

+The deadline for filing NC tax extension form D-410 is the original tax filing deadline, which is typically April 15th for individual income tax returns.

How do I make payment for the estimated tax due?

+You can make payment by check, money order, or electronic payment. If filing electronically, you can pay online using a credit or debit card.

What are the benefits of filing NC tax extension form D-410?

+The benefits of filing NC tax extension form D-410 include avoidance of penalties and interest associated with late filing, extra time to gather necessary documents and consult with tax professionals, and the ability to take advantage of the available six-month extension.