The complexities of NC extension form filing can be overwhelming, especially for those who are new to the process. Filing for an extension can provide much-needed relief, but it's essential to understand the intricacies involved. In this article, we will delve into the world of NC extension form filing, providing you with valuable insights and practical tips to ensure a smooth and successful process.

Understanding NC Extension Form Filing

Before we dive into the tips, it's crucial to understand the basics of NC extension form filing. The NC extension form is used to request an automatic six-month extension of time to file your individual income tax return. This form is typically filed by individuals who need more time to gather necessary documents or complete their tax return.

Tip 1: Determine Your Eligibility

Not everyone is eligible to file for an NC extension. To qualify, you must meet specific requirements, such as:

- You must have a valid reason for requesting an extension.

- You must be a resident of North Carolina or have a tax obligation in the state.

- You must not have any outstanding tax debts or liabilities.

Who Can File for an NC Extension?

- Individuals who need more time to gather necessary documents.

- Taxpayers who are experiencing financial difficulties.

- Those who are serving in the military or are stationed outside the United States.

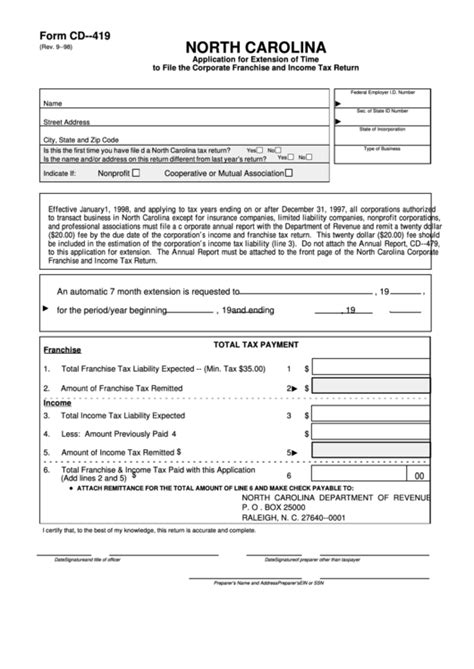

Tip 2: Choose the Correct Form

There are two types of NC extension forms: the paper form (D-410) and the electronic form (e-file). The e-file option is recommended, as it's faster and more convenient. However, if you're unable to e-file, the paper form can be used.

Tip 3: File on Time

It's essential to file your NC extension form on time to avoid penalties and interest. The deadline for filing the form is typically April 15th for individual tax returns. However, if you're filing for an extension, you can file as late as October 15th.

Key Filing Dates to Remember:

- April 15th: Deadline for individual tax returns.

- October 15th: Deadline for filing an NC extension form.

Tip 4: Pay Any Estimated Taxes

When filing for an NC extension, you're required to pay any estimated taxes owed. This will help avoid penalties and interest. You can pay online, by phone, or by mail.

Tip 5: Keep Records

After filing your NC extension form, it's essential to keep accurate records of your filing. This includes:

- A copy of the filed form.

- Payment receipts for any estimated taxes.

- Confirmation of the filing date.

Why Record Keeping is Important:

- Helps avoid disputes or audits.

- Provides proof of filing.

- Ensures you have a paper trail in case of any issues.

By following these five tips, you'll be well on your way to a successful NC extension form filing experience. Remember to stay organized, file on time, and keep accurate records to avoid any complications.

Now it's Your Turn!

We encourage you to share your experiences or ask questions about NC extension form filing in the comments below. Your feedback and insights will help others who may be facing similar challenges.

What is the deadline for filing an NC extension form?

+The deadline for filing an NC extension form is typically April 15th for individual tax returns. However, if you're filing for an extension, you can file as late as October 15th.

Can I file for an NC extension if I have outstanding tax debts or liabilities?

+No, you are not eligible to file for an NC extension if you have outstanding tax debts or liabilities.

What are the consequences of not filing an NC extension form?

+If you fail to file an NC extension form, you may face penalties and interest on any unpaid taxes.