As a business owner, managing payroll can be a daunting task, especially when it comes to handling taxes. With numerous forms to fill out and deadlines to meet, it's easy to get overwhelmed. However, with the right tools and resources, you can simplify your payroll tax process and focus on growing your business. In this article, we'll explore the Intuit Payroll Form and how it can help you streamline your business taxes.

Business taxes can be complex, and the consequences of non-compliance can be severe. According to the IRS, the average small business spends around 40 hours per year on tax compliance. That's 40 hours that could be spent on marketing, customer service, or product development. By using the Intuit Payroll Form, you can reduce the time spent on tax compliance and minimize the risk of errors.

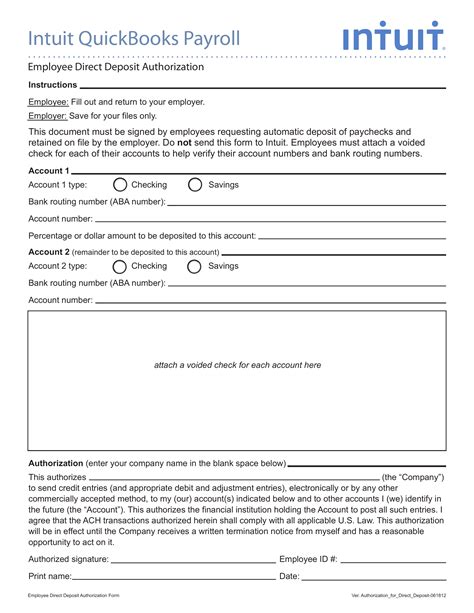

The Intuit Payroll Form is a comprehensive tool designed to help small businesses manage their payroll taxes efficiently. With this form, you can easily calculate and report payroll taxes, including federal, state, and local taxes. The form also helps you stay compliant with tax laws and regulations, reducing the risk of penalties and fines.

Benefits of Using Intuit Payroll Form

Using the Intuit Payroll Form can bring numerous benefits to your business. Here are some of the advantages of using this tool:

- Simplified Tax Compliance: The Intuit Payroll Form helps you stay compliant with tax laws and regulations, reducing the risk of penalties and fines.

- Time Savings: With the Intuit Payroll Form, you can quickly and easily calculate and report payroll taxes, saving you time and reducing the administrative burden.

- Accuracy: The form helps you avoid errors and inaccuracies, ensuring that your tax reports are accurate and complete.

- Reduced Risk: By using the Intuit Payroll Form, you can minimize the risk of tax audits and penalties, giving you peace of mind and allowing you to focus on your business.

How to Use Intuit Payroll Form

Using the Intuit Payroll Form is straightforward and easy. Here are the steps to follow:

- Download the Form: You can download the Intuit Payroll Form from the Intuit website or access it through your QuickBooks account.

- Gather Information: Collect all the necessary information, including employee data, payroll records, and tax rates.

- Fill Out the Form: Fill out the form with the required information, using the built-in calculators and tools to ensure accuracy.

- Review and Submit: Review the form for accuracy and completeness, then submit it to the relevant tax authorities.

Additional Features of Intuit Payroll Form

The Intuit Payroll Form offers several additional features that make it an indispensable tool for small businesses. Here are some of the key features:

- Automated Calculations: The form includes automated calculators that help you calculate payroll taxes, including federal, state, and local taxes.

- Error Detection: The form includes built-in error detection tools that help you identify and correct errors, ensuring that your tax reports are accurate and complete.

- Customization: The form allows you to customize your tax reports, including adding company logos and creating custom reports.

Integrating Intuit Payroll Form with QuickBooks

The Intuit Payroll Form can be integrated with QuickBooks, making it easy to manage your payroll taxes and financial records in one place. Here are the benefits of integrating the form with QuickBooks:

- Streamlined Workflow: Integrating the Intuit Payroll Form with QuickBooks streamlines your workflow, allowing you to manage payroll taxes and financial records in one place.

- Increased Efficiency: Integration reduces the administrative burden, allowing you to focus on growing your business.

- Improved Accuracy: Integration ensures that your payroll taxes and financial records are accurate and up-to-date, reducing the risk of errors and inaccuracies.

Common Mistakes to Avoid When Using Intuit Payroll Form

When using the Intuit Payroll Form, there are several common mistakes to avoid. Here are some of the most common errors:

- Inaccurate Information: Ensure that the information you enter is accurate and complete, as errors can lead to penalties and fines.

- Missed Deadlines: Ensure that you submit the form on time, as missed deadlines can result in penalties and fines.

- Incorrect Tax Rates: Ensure that you use the correct tax rates, as incorrect rates can result in errors and inaccuracies.

Tips for Getting the Most Out of Intuit Payroll Form

Here are some tips for getting the most out of the Intuit Payroll Form:

- Use the Built-in Calculators: Use the built-in calculators to ensure accuracy and reduce the risk of errors.

- Customize the Form: Customize the form to meet your business needs, including adding company logos and creating custom reports.

- Integrate with QuickBooks: Integrate the form with QuickBooks to streamline your workflow and improve efficiency.

Conclusion

The Intuit Payroll Form is a powerful tool that can help small businesses simplify their payroll tax process. By using this form, you can reduce the time spent on tax compliance, minimize the risk of errors, and focus on growing your business. Remember to use the built-in calculators, customize the form, and integrate it with QuickBooks to get the most out of this tool.

We hope this article has provided you with valuable insights into the Intuit Payroll Form and how it can benefit your business. If you have any questions or comments, please feel free to share them below.

What is the Intuit Payroll Form?

+The Intuit Payroll Form is a comprehensive tool designed to help small businesses manage their payroll taxes efficiently.

How do I use the Intuit Payroll Form?

+Download the form, gather information, fill out the form, review and submit.

Can I integrate the Intuit Payroll Form with QuickBooks?

+Yes, you can integrate the Intuit Payroll Form with QuickBooks to streamline your workflow and improve efficiency.