Filing taxes can be a daunting task, especially when it comes to state-specific forms like the Louisiana Schedule E tax form. As a resident of Louisiana, it's essential to understand how to accurately fill out this form to ensure you're taking advantage of all the deductions and credits available to you. In this article, we'll break down the five ways to fill out the Louisiana Schedule E tax form, making it easier for you to navigate the process.

Understanding the Louisiana Schedule E Tax Form

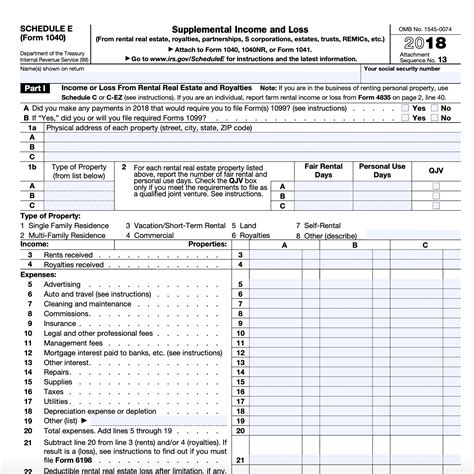

The Louisiana Schedule E tax form is used to report supplemental income and losses from various sources, such as rental properties, partnerships, S corporations, estates, and trusts. This form is required if you have income or losses from these sources that need to be reported on your Louisiana state tax return.

Method 1: Reporting Rental Income and Losses

If you own rental properties, you'll need to report the income and losses on the Louisiana Schedule E tax form. This includes reporting the gross rental income, deductions for mortgage interest, property taxes, and operating expenses, and calculating the net rental income or loss.

To report rental income and losses, you'll need to complete the following steps:

- List each rental property separately, including the address and type of property

- Report the gross rental income for each property

- Claim deductions for mortgage interest, property taxes, and operating expenses

- Calculate the net rental income or loss for each property

- Combine the net rental income or losses from all properties to determine the total net rental income or loss

Method 2: Reporting Partnership and S Corporation Income

If you're a partner in a partnership or a shareholder in an S corporation, you'll need to report your share of the income or loss on the Louisiana Schedule E tax form. This includes reporting your share of the partnership or S corporation's income or loss, as well as any deductions or credits you're eligible for.

To report partnership and S corporation income, you'll need to complete the following steps:

- List each partnership or S corporation separately, including the name and type of entity

- Report your share of the partnership or S corporation's income or loss

- Claim deductions for your share of the partnership or S corporation's expenses

- Calculate your net income or loss from the partnership or S corporation

- Combine the net income or losses from all partnerships and S corporations to determine the total net income or loss

Method 3: Reporting Estate and Trust Income

If you're the beneficiary of an estate or trust, you'll need to report the income on the Louisiana Schedule E tax form. This includes reporting the income from the estate or trust, as well as any deductions or credits you're eligible for.

To report estate and trust income, you'll need to complete the following steps:

- List the estate or trust separately, including the name and type of entity

- Report the income from the estate or trust

- Claim deductions for expenses related to the estate or trust

- Calculate the net income from the estate or trust

- Combine the net income from all estates and trusts to determine the total net income

Method 4: Reporting Royalty Income

If you receive royalty income from intellectual property, such as patents, copyrights, or trademarks, you'll need to report it on the Louisiana Schedule E tax form. This includes reporting the gross royalty income, deductions for expenses related to the intellectual property, and calculating the net royalty income.

To report royalty income, you'll need to complete the following steps:

- List each intellectual property separately, including the type of property and the royalty income

- Report the gross royalty income

- Claim deductions for expenses related to the intellectual property

- Calculate the net royalty income

- Combine the net royalty income from all intellectual properties to determine the total net royalty income

Method 5: Reporting Other Supplemental Income

If you have other supplemental income, such as prizes, awards, or other miscellaneous income, you'll need to report it on the Louisiana Schedule E tax form. This includes reporting the gross income, deductions for expenses related to the income, and calculating the net income.

To report other supplemental income, you'll need to complete the following steps:

- List each source of income separately, including the type of income and the gross amount

- Report the gross income

- Claim deductions for expenses related to the income

- Calculate the net income

- Combine the net income from all sources to determine the total net income

Tips and Reminders

When filling out the Louisiana Schedule E tax form, keep the following tips and reminders in mind:

- Make sure to report all supplemental income and losses, even if it's not reported on a separate form or schedule

- Claim all eligible deductions and credits to minimize your tax liability

- Keep accurate records of your income and expenses, including receipts, invoices, and bank statements

- Consult with a tax professional or the Louisiana Department of Revenue if you have questions or need assistance with the form

By following these five methods, you'll be able to accurately fill out the Louisiana Schedule E tax form and ensure you're taking advantage of all the deductions and credits available to you.

Common Mistakes to Avoid

When filling out the Louisiana Schedule E tax form, it's essential to avoid common mistakes that can delay your refund or result in penalties. Here are some common mistakes to avoid:

- Failing to report all supplemental income and losses

- Not claiming eligible deductions and credits

- Incorrectly calculating net income or loss

- Failing to keep accurate records of income and expenses

- Not signing and dating the form

By avoiding these common mistakes, you can ensure a smooth and hassle-free tax filing experience.

Conclusion

Filling out the Louisiana Schedule E tax form can be a complex and time-consuming process, but by following the five methods outlined in this article, you'll be able to accurately report your supplemental income and losses. Remember to avoid common mistakes, keep accurate records, and consult with a tax professional or the Louisiana Department of Revenue if you have questions or need assistance.

What is the Louisiana Schedule E tax form used for?

+The Louisiana Schedule E tax form is used to report supplemental income and losses from various sources, such as rental properties, partnerships, S corporations, estates, and trusts.

What types of income need to be reported on the Louisiana Schedule E tax form?

+The Louisiana Schedule E tax form is used to report supplemental income and losses from rental properties, partnerships, S corporations, estates, trusts, and other miscellaneous income.

What deductions and credits can I claim on the Louisiana Schedule E tax form?

+You can claim deductions for mortgage interest, property taxes, operating expenses, and other eligible expenses related to your supplemental income. You may also be eligible for credits, such as the Louisiana Earned Income Tax Credit.