The IRS Whistleblower Program was established to encourage individuals to report tax evasion and other tax-related crimes, with the goal of collecting unpaid taxes and reducing the tax gap. If you have information about tax noncompliance, you can submit a claim using Form 3949-A, also known as the Information Referral form. In this article, we will provide a comprehensive guide on how to complete Form 3949-A and submit a successful IRS whistleblower claim.

What is Form 3949-A?

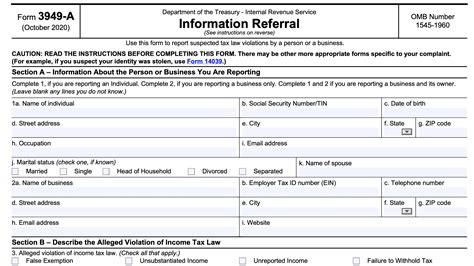

Form 3949-A is a four-page form used to report suspected tax fraud or other tax-related crimes to the IRS. The form is designed to provide the IRS with the information needed to investigate and potentially take enforcement action against individuals or businesses that have failed to comply with tax laws.

Who Can File Form 3949-A?

Anyone with information about tax noncompliance can file Form 3949-A, including:

- Current or former employees of a business

- Customers or clients of a business

- Competitors of a business

- Family members or friends of an individual who has committed tax noncompliance

What Information is Required on Form 3949-A?

To complete Form 3949-A, you will need to provide the following information:

- Your name and contact information (although you can request confidentiality)

- The name and address of the individual or business you are reporting

- A detailed description of the tax noncompliance, including the type of tax involved (e.g., income tax, payroll tax, etc.) and the approximate amount of tax owed

- Any supporting documentation, such as financial records or witness statements

How to Complete Form 3949-A

Here are the steps to complete Form 3949-A:

- Download and print Form 3949-A from the IRS website or pick one up at your local IRS office.

- Fill out the form legibly and completely, using black ink.

- Attach any supporting documentation, such as financial records or witness statements.

- Sign and date the form.

- Mail the completed form to the IRS Whistleblower Office at the address listed on the form.

What Happens After You File Form 3949-A?

After you file Form 3949-A, the IRS Whistleblower Office will review your claim to determine whether it meets the requirements for an award. If your claim is accepted, the IRS will conduct an investigation and take enforcement action against the individual or business if necessary.

Whistleblower Awards

If the IRS collects taxes, penalties, or interest as a result of your whistleblower claim, you may be eligible for an award. The amount of the award depends on the amount of taxes, penalties, and interest collected, as well as the level of your involvement in the case. Awards can range from 15% to 30% of the total amount collected.

Tips for Submitting a Successful Whistleblower Claim

Here are some tips for submitting a successful whistleblower claim:

- Provide detailed and specific information about the tax noncompliance.

- Attach supporting documentation, such as financial records or witness statements.

- Keep your claim confidential to avoid retaliation.

- Follow up with the IRS Whistleblower Office to ensure your claim is being processed.

Conclusion

Submitting a whistleblower claim using Form 3949-A can be a complex process, but it can also be a valuable way to report tax noncompliance and potentially receive an award. By following the instructions and tips outlined in this article, you can increase your chances of submitting a successful whistleblower claim.

We encourage you to share your thoughts and experiences with the IRS Whistleblower Program in the comments below. If you have any questions or need further guidance, please don't hesitate to ask.

What is the deadline for submitting a whistleblower claim?

+There is no specific deadline for submitting a whistleblower claim, but it is recommended that you submit your claim as soon as possible to ensure timely processing.

Can I submit a whistleblower claim anonymously?

+Yes, you can submit a whistleblower claim anonymously, but you will need to provide contact information if you want to receive an award.

How long does it take to process a whistleblower claim?

+The processing time for a whistleblower claim can vary depending on the complexity of the case, but it typically takes several months to several years.