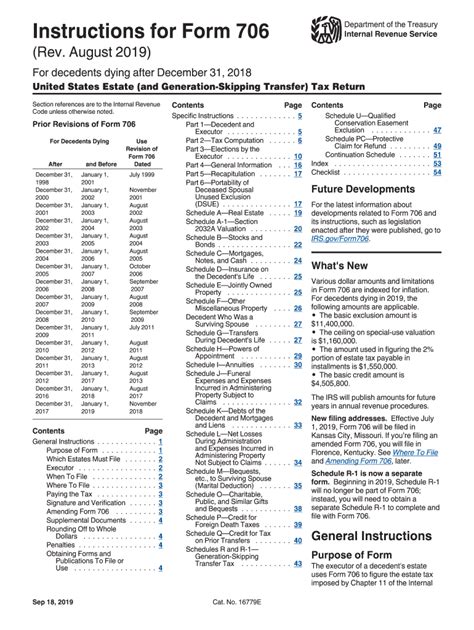

The process of filing taxes for an estate can be daunting, especially when dealing with complex forms like Form 706. The United States Estate (and Generation-Skipping Transfer) Tax Return, also known as Form 706, is a crucial document that requires meticulous attention to detail to avoid any errors or delays. In this article, we will guide you through the 7 steps to complete Form 706 with ease, ensuring that you navigate the process with confidence.

Understanding the Importance of Form 706

Before diving into the steps, it's essential to understand the significance of Form 706. This form is used to report the transfer of a deceased person's estate to their beneficiaries. The form calculates the estate tax liability, which is a significant source of revenue for the federal government. Accurate completion of Form 706 is crucial to avoid any penalties or interest on unpaid taxes.

Step 1: Gather Required Documents and Information

The first step in completing Form 706 is to gather all the necessary documents and information. This includes:

- The deceased person's will and any trust agreements

- A list of assets, including real estate, stocks, bonds, and other investments

- Appraisals of assets, such as art, collectibles, or business interests

- Records of debts, including mortgages, credit cards, and loans

- Records of funeral expenses and other administrative costs

- The deceased person's Social Security number and date of death

Step 2: Determine the Filing Deadline

The next step is to determine the filing deadline for Form 706. The deadline is typically 9 months after the date of death, but it can be extended for an additional 6 months if necessary. It's essential to file Form 706 on time to avoid any penalties or interest on unpaid taxes.

Step 3: Calculate the Estate Tax Liability

The third step is to calculate the estate tax liability using Schedule A of Form 706. This involves:

- Listing all assets and their corresponding values

- Calculating the total value of the estate

- Applying the applicable exclusion amount (AEA) to determine the taxable estate

- Calculating the estate tax liability using the tax rates provided in the instructions

Step 4: Complete Schedule B - Adjustments to Value

The fourth step is to complete Schedule B, which involves making adjustments to the value of the estate. This includes:

- Accounting for funeral expenses and other administrative costs

- Adjusting for debts and other liabilities

- Considering any charitable donations or bequests

Step 5: Complete Schedule C - Credits

The fifth step is to complete Schedule C, which involves claiming credits against the estate tax liability. This includes:

- Claiming the applicable exclusion amount (AEA)

- Claiming credits for state death taxes

- Claiming credits for foreign death taxes

Step 6: Complete Schedule D - Generation-Skipping Transfer Tax

The sixth step is to complete Schedule D, which involves calculating the generation-skipping transfer tax (GST). This tax applies to transfers of assets to beneficiaries who are two or more generations younger than the deceased person.

Step 7: Review and Sign the Return

The final step is to review and sign the return. This involves:

- Reviewing the entire return for accuracy and completeness

- Signing the return as the executor or personal representative of the estate

- Filing the return with the IRS and paying any taxes due

By following these 7 steps, you can complete Form 706 with ease and confidence. Remember to seek professional advice if you're unsure about any aspect of the process.

We encourage you to share your experiences and tips for completing Form 706 in the comments section below. Don't forget to share this article with your friends and family who may be dealing with estate taxes.

What is the deadline for filing Form 706?

+The deadline for filing Form 706 is typically 9 months after the date of death, but it can be extended for an additional 6 months if necessary.

What is the applicable exclusion amount (AEA) for estate taxes?

+The applicable exclusion amount (AEA) for estate taxes varies depending on the year of death. For 2022, the AEA is $12.06 million per person.

Do I need to file Form 706 if the estate is below the applicable exclusion amount (AEA)?

+No, you do not need to file Form 706 if the estate is below the applicable exclusion amount (AEA). However, you may still need to file other tax returns, such as Form 1041 or Form 709.