Streamlining Your Finances with Truist Direct Deposit Form

In today's fast-paced world, managing finances efficiently is crucial for achieving financial stability. One way to simplify your financial life is by setting up direct deposit for your paychecks, benefits, or other regular payments. Truist, a leading financial institution, offers a convenient and secure direct deposit form that makes it easy to get started. In this article, we will delve into the benefits of using the Truist direct deposit form, how to set it up, and what you need to know to make the most of this service.

What is Direct Deposit, and How Does it Work?

Direct deposit is a payment method that allows funds to be transferred electronically from a payer's account to a recipient's account. This service is widely used by employers, government agencies, and other organizations to distribute payments efficiently. When you enroll in direct deposit, you provide your account information to the payer, who then uses this information to initiate the electronic transfer of funds.

Benefits of Using Truist Direct Deposit Form

Using the Truist direct deposit form offers numerous benefits, including:

- Convenience: Direct deposit eliminates the need to physically deposit checks, saving you time and effort.

- Security: Electronic transfers are more secure than traditional check deposits, reducing the risk of lost or stolen checks.

- Faster Access to Funds: With direct deposit, you can access your funds on the same day they are deposited, giving you greater control over your finances.

- Reduced Fees: Direct deposit can help minimize fees associated with check deposits, overdrafts, and other banking services.

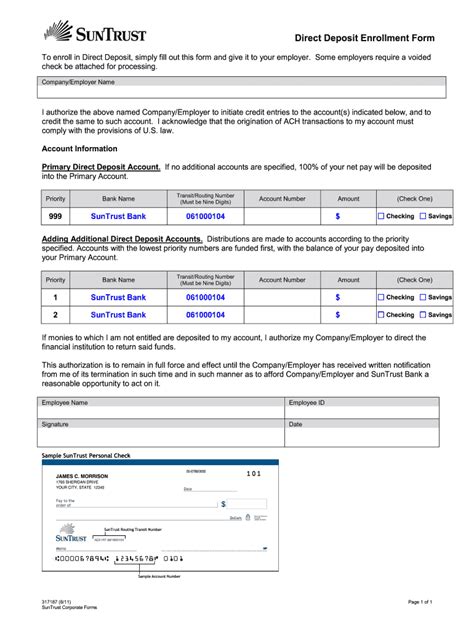

How to Set Up Truist Direct Deposit Form

To set up direct deposit with Truist, follow these steps:

- Obtain a direct deposit form from Truist's website or visit a local branch to request one.

- Complete the form with your account information, including your account number and routing number.

- Provide the completed form to your employer, benefits provider, or other payer.

- Verify your account information with Truist to ensure smooth processing of direct deposits.

Required Information for Truist Direct Deposit Form

When completing the Truist direct deposit form, you will need to provide the following information:

- Your name and address

- Your account number and routing number

- The type of account (checking or savings)

- The frequency of deposits (e.g., weekly, biweekly, monthly)

Tips for Using Truist Direct Deposit Form Effectively

To get the most out of the Truist direct deposit form, consider the following tips:

- Review your account information carefully to ensure accuracy and avoid delays.

- Set up direct deposit for all eligible payments, including paychecks, benefits, and tax refunds.

- Monitor your account activity regularly to detect any potential issues or discrepancies.

- Take advantage of Truist's online banking services to manage your accounts and track direct deposits.

Common Issues with Truist Direct Deposit Form

While the Truist direct deposit form is designed to be user-friendly, some issues may arise. Here are some common problems and their solutions:

- Incorrect account information: Double-check your account number and routing number to ensure accuracy.

- Delayed deposits: Verify with your payer that the direct deposit was initiated on time and contact Truist if issues persist.

- Failed deposits: Check your account balance and transaction history to identify the cause of the failed deposit.

Security Measures for Truist Direct Deposit Form

Truist takes the security of your financial information seriously. Here are some measures in place to protect your data:

- Encryption: Truist uses advanced encryption technology to safeguard your account information.

- Secure servers: Truist's servers are equipped with state-of-the-art security features to prevent unauthorized access.

- Monitoring: Truist continuously monitors account activity to detect and prevent potential security threats.

Conclusion: Simplifying Your Finances with Truist Direct Deposit Form

In conclusion, the Truist direct deposit form is a convenient and secure way to manage your finances. By following the steps outlined in this article, you can easily set up direct deposit and start enjoying the benefits of faster access to your funds, reduced fees, and increased security. If you have any questions or concerns, don't hesitate to reach out to Truist's customer support team.

We encourage you to share your experiences with the Truist direct deposit form in the comments section below. Your feedback will help others make informed decisions about their financial management.

What is the routing number for Truist?

+The routing number for Truist varies depending on the location. You can find the routing number on the bottom left corner of your check or by contacting Truist's customer support.

Can I set up direct deposit for multiple accounts?

+Yes, you can set up direct deposit for multiple accounts, including checking and savings accounts. Simply complete a separate direct deposit form for each account.

How long does it take for direct deposits to process?

+Direct deposits typically process on the same day they are initiated. However, processing times may vary depending on the payer and the timing of the deposit.