As an employer in North Carolina, it's essential to understand the state's withholding tax requirements to ensure compliance and avoid penalties. The NC State Withholding Form, also known as the NC-4, is a crucial document that employers must use to report and remit state income tax withheld from their employees' wages. In this article, we'll delve into the details of the NC State Withholding Form, its importance, and provide a step-by-step guide on how to complete and submit it.

Understanding the NC State Withholding Form

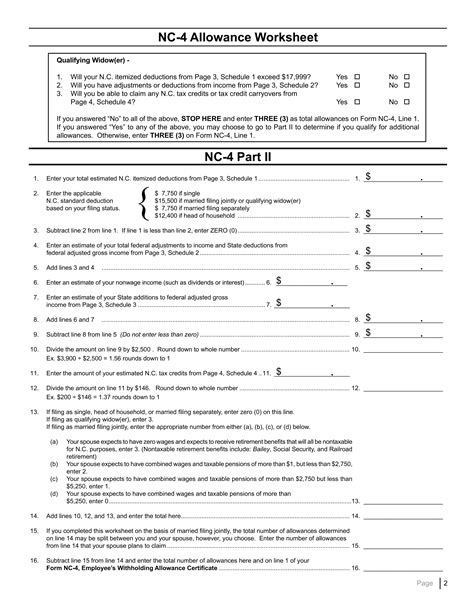

The NC State Withholding Form, or NC-4, is used to report and remit state income tax withheld from employees' wages. Employers are required to withhold state income tax from their employees' wages and remit it to the North Carolina Department of Revenue (NCDOR) on a quarterly basis. The NC-4 form is used to report the total amount of state income tax withheld from employees' wages during the quarter.

Why is the NC State Withholding Form Important?

The NC State Withholding Form is crucial for several reasons:

- It ensures compliance with state tax laws and regulations.

- It allows employers to report and remit state income tax withheld from employees' wages.

- It helps the NCDOR track and record state income tax withholding and remittances.

Completing the NC State Withholding Form

To complete the NC State Withholding Form, employers will need to provide the following information:

- Employer's name, address, and federal employer identification number (FEIN)

- Quarter and year for which the report is being filed

- Total amount of state income tax withheld from employees' wages during the quarter

- Total amount of wages subject to state income tax withholding

Step-by-Step Guide to Completing the NC State Withholding Form

Here's a step-by-step guide to completing the NC State Withholding Form:

- Download and print the NC-4 form from the NCDOR website or obtain a copy from the NCDOR office.

- Complete the employer information section, including name, address, and FEIN.

- Enter the quarter and year for which the report is being filed.

- Calculate the total amount of state income tax withheld from employees' wages during the quarter.

- Enter the total amount of wages subject to state income tax withholding.

- Sign and date the form.

Submitting the NC State Withholding Form

The NC State Withholding Form must be submitted to the NCDOR on a quarterly basis, along with the required payment. The due dates for submitting the form are:

- April 30th for the first quarter (January 1 - March 31)

- July 31st for the second quarter (April 1 - June 30)

- October 31st for the third quarter (July 1 - September 30)

- January 31st for the fourth quarter (October 1 - December 31)

Payment Options

Employers can submit payment for the NC State Withholding Form using the following options:

- Electronic Funds Transfer (EFT)

- Check or money order

- Credit card (online only)

Penalties for Non-Compliance

Employers who fail to submit the NC State Withholding Form or make payments on time may be subject to penalties and interest. The NCDOR may impose the following penalties:

- Late payment penalty: 5% of the unpaid tax

- Late filing penalty: 5% of the unpaid tax

- Interest: accrues at the rate of 1% per month or fraction of a month

Avoiding Penalties

To avoid penalties, employers should:

- File the NC State Withholding Form on time

- Make payments on time

- Keep accurate records of state income tax withholding and remittances

Conclusion

The NC State Withholding Form is an essential document for employers in North Carolina. By understanding the form's purpose, completing it accurately, and submitting it on time, employers can avoid penalties and ensure compliance with state tax laws and regulations. Employers should also be aware of the payment options and penalties for non-compliance to avoid any issues.

We hope this guide has been helpful in understanding the NC State Withholding Form. If you have any further questions or concerns, please don't hesitate to reach out. Share your thoughts and experiences with us in the comments below.

What is the NC State Withholding Form?

+The NC State Withholding Form, also known as the NC-4, is a document used to report and remit state income tax withheld from employees' wages.

Who needs to file the NC State Withholding Form?

+Employers in North Carolina who withhold state income tax from their employees' wages need to file the NC State Withholding Form.

What is the deadline for submitting the NC State Withholding Form?

+The deadline for submitting the NC State Withholding Form is the last day of the month following the end of the quarter.