Form 990 is a crucial document that tax-exempt organizations in the United States must file annually with the Internal Revenue Service (IRS). The form provides information about the organization's financial activities, governance, and compliance with tax laws. One of the key components of Form 990 is Schedule A, which is used to report an organization's public charity status and the calculation of its public support percentage. In this article, we will walk you through the 7 essential steps for completing Form 990 Schedule A accurately and efficiently.

Understanding Form 990 Schedule A

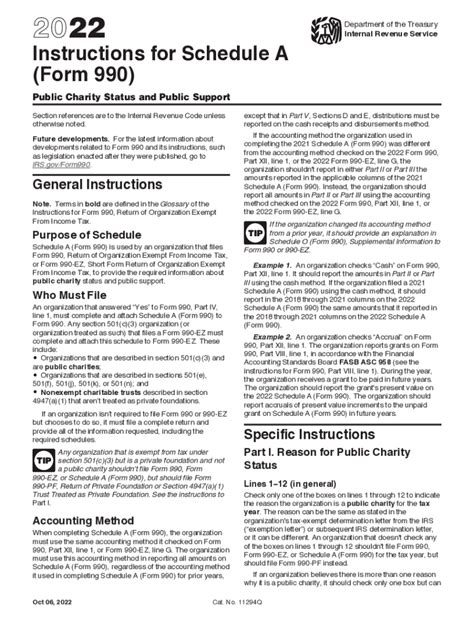

Before we dive into the steps, it's essential to understand the purpose and scope of Schedule A. This schedule is used by organizations that are classified as public charities under Section 501(c)(3) of the Internal Revenue Code. The primary goal of Schedule A is to report the organization's public charity status and to calculate its public support percentage.

Why is Public Support Percentage Important?

The public support percentage is crucial because it determines an organization's eligibility for certain tax benefits and its classification as a public charity. Organizations that fail to meet the public support test may be reclassified as private foundations, which can result in significant tax implications and restrictions on their activities.

Step 1: Determine Your Organization's Public Charity Status

The first step is to determine whether your organization is classified as a public charity. To qualify as a public charity, an organization must meet one of the following tests:

- The organization must receive at least 33.33% of its total support from the general public (this is known as the "33.33% test")

- The organization must receive at least 10% of its total support from the general public and have a facts-and-circumstances test that demonstrates it is a publicly supported organization

Step 2: Gather Financial Data

To complete Schedule A, you will need to gather financial data from your organization's records. This includes:

- Total support received from the general public

- Total support received from other sources (such as grants, contributions, and investment income)

- Total expenses for the tax year

Tips for Gathering Financial Data

- Make sure to use the same financial data that you reported on Form 990, Part I, lines 1-12.

- If your organization has a fiscal year that does not match the calendar year, make sure to adjust the financial data accordingly.

Step 3: Calculate Public Support Percentage

Using the financial data gathered in Step 2, calculate the public support percentage by dividing the total support received from the general public by the total support received from all sources.

Step 4: Complete Schedule A, Part I

Using the calculated public support percentage, complete Schedule A, Part I. This section requires you to report the organization's public charity status and the calculation of its public support percentage.

Important Notes for Schedule A, Part I

- Make sure to check the correct box to indicate whether your organization is a publicly supported organization or a private foundation.

- If your organization is a publicly supported organization, you will need to complete the calculation of the public support percentage and report it in Part I.

Step 5: Complete Schedule A, Part II

If your organization is a publicly supported organization, you will need to complete Schedule A, Part II. This section requires you to report additional information about your organization's public support and revenue.

Step 6: Review and Edit Schedule A

Once you have completed Schedule A, review it carefully for accuracy and completeness. Make any necessary edits or corrections before submitting the form to the IRS.

Tips for Reviewing Schedule A

- Make sure to check the math calculations and ensure that the public support percentage is accurate.

- Review the form for completeness and ensure that all required information is reported.

Step 7: Submit Schedule A with Form 990

Finally, submit Schedule A with Form 990 to the IRS by the required deadline. Make sure to follow the IRS instructions for filing and submitting the form.

By following these 7 essential steps, you can accurately and efficiently complete Form 990 Schedule A and ensure that your organization remains in compliance with tax laws and regulations.

We hope this article has been informative and helpful. If you have any questions or need further clarification on any of the steps, please feel free to comment below. Additionally, if you found this article helpful, please share it with others who may benefit from it.

What is the purpose of Form 990 Schedule A?

+The purpose of Form 990 Schedule A is to report an organization's public charity status and the calculation of its public support percentage.

What is the public support test?

+The public support test is a test that determines an organization's eligibility for certain tax benefits and its classification as a public charity. To qualify as a public charity, an organization must meet one of the following tests: (1) receive at least 33.33% of its total support from the general public, or (2) receive at least 10% of its total support from the general public and have a facts-and-circumstances test that demonstrates it is a publicly supported organization.

What is the deadline for submitting Form 990 and Schedule A?

+The deadline for submitting Form 990 and Schedule A is typically May 15th of each year, although this deadline may be extended in certain circumstances.