Depository Customer (Dep) registration is a crucial step for investors to start trading in the stock market. A Dep customer registration form is a document that contains essential information about the investor, and it is mandatory to submit this form to the depository participant (DP) to open a demat account. In this article, we will guide you through the 5 steps to complete a Dep customer registration form.

Understanding the Importance of Dep Customer Registration Form

A Dep customer registration form is a critical document that helps to establish the identity of the investor and ensures that all transactions are carried out in a secure and transparent manner. The form contains essential information such as personal details, bank account information, and tax identification numbers. By filling out this form accurately, investors can ensure that their demat account is opened smoothly and that they can start trading in the stock market without any issues.

Step 1: Gathering Required Documents

Before filling out the Dep customer registration form, it is essential to gather all the required documents. These documents typically include:

- Proof of identity (such as a passport, driving license, or Aadhaar card)

- Proof of address (such as a utility bill, bank statement, or ration card)

- Proof of income (such as a salary slip, Form 16, or income tax return)

- Bank account details (such as a cancelled cheque or bank passbook)

- Tax identification numbers (such as a PAN card or tax identification number)

Importance of Verifying Documents

Verifying documents is crucial to ensure that the information provided in the Dep customer registration form is accurate and genuine. Investors should ensure that all documents are original and not photocopies, and that they are signed and dated as required.

Step 2: Filling Out the Dep Customer Registration Form

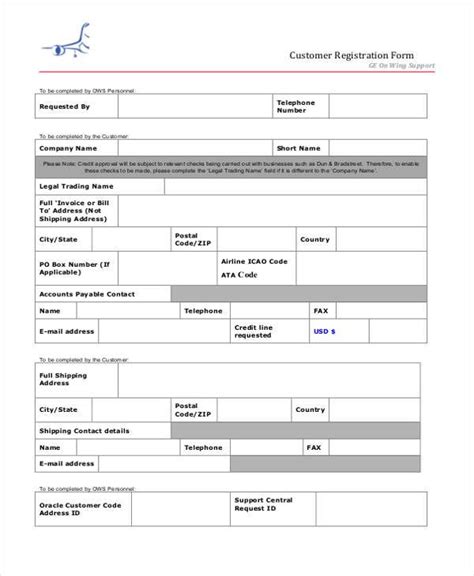

Once all the required documents are gathered, investors can start filling out the Dep customer registration form. The form typically contains several sections, including:

- Personal details (such as name, address, and date of birth)

- Bank account details (such as account number and branch name)

- Tax identification numbers (such as PAN card or tax identification number)

- Investment details (such as investment objectives and risk tolerance)

Tips for Filling Out the Form

- Investors should ensure that all information is accurate and complete.

- All sections of the form should be filled out, and no section should be left blank.

- Investors should sign and date the form as required.

Step 3: Signing and Dating the Form

Once the Dep customer registration form is filled out, investors should sign and date it as required. This is an essential step, as it confirms that the information provided in the form is accurate and genuine.

Importance of Signature and Date

The signature and date on the Dep customer registration form are crucial, as they confirm that the investor has provided accurate and genuine information. Investors should ensure that their signature matches the signature on their identification documents.

Step 4: Submitting the Form and Supporting Documents

Once the Dep customer registration form is signed and dated, investors should submit it to the depository participant (DP) along with the required supporting documents. The DP will verify the information provided in the form and the supporting documents to ensure that they are accurate and genuine.

Importance of Verifying Documents

Verifying documents is crucial to ensure that the information provided in the Dep customer registration form is accurate and genuine. The DP will verify the documents to ensure that they are original and not photocopies, and that they are signed and dated as required.

Step 5: Receiving the Demat Account Details

Once the Dep customer registration form and supporting documents are verified, the DP will provide the investor with the demat account details. This typically includes the demat account number, login ID, and password.

Importance of Demat Account Details

The demat account details are crucial, as they enable investors to access their demat account and start trading in the stock market. Investors should ensure that they keep their demat account details safe and secure to prevent unauthorized access.

Encourage Engagement:

We hope this article has provided you with a comprehensive guide on how to complete a Dep customer registration form. If you have any questions or need further clarification on any of the steps, please feel free to comment below. We would be happy to help. Additionally, if you have any friends or family members who are interested in opening a demat account, please share this article with them. Remember, investing in the stock market can be a great way to grow your wealth over time, but it's essential to do it in a secure and transparent manner.

FAQ Section:

What is a Dep customer registration form?

+A Dep customer registration form is a document that contains essential information about the investor, and it is mandatory to submit this form to the depository participant (DP) to open a demat account.

What documents are required to fill out the Dep customer registration form?

+The documents required to fill out the Dep customer registration form typically include proof of identity, proof of address, proof of income, bank account details, and tax identification numbers.

How long does it take to receive the demat account details after submitting the Dep customer registration form?

+The time it takes to receive the demat account details after submitting the Dep customer registration form typically depends on the depository participant (DP) and can range from a few days to a few weeks.