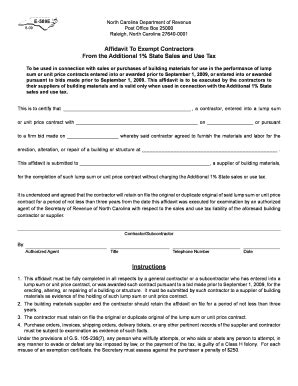

As a business owner in North Carolina, you're likely familiar with the process of obtaining necessary licenses and permits to operate your company. One crucial document you may need to obtain is the NC Certificate of Resale form E-590. In this article, we'll delve into the details of this form, its importance, and provide a comprehensive guide on how to complete it.

What is the NC Certificate of Resale Form E-590?

The NC Certificate of Resale form E-590 is a document issued by the North Carolina Department of Revenue that certifies a business is registered to collect and remit sales tax in the state. This certificate is required for any business that sells tangible personal property or services subject to sales tax in North Carolina. The form serves as proof that a business has obtained the necessary sales tax permit and is authorized to collect sales tax from customers.

Why Do I Need a NC Certificate of Resale Form E-590?

Obtaining a NC Certificate of Resale form E-590 is crucial for several reasons:

- Compliance with State Law: Failure to obtain this certificate can result in penalties and fines. By obtaining the certificate, you ensure your business is compliant with North Carolina state law.

- Sales Tax Collection: The certificate is required to collect sales tax from customers. Without it, you may be liable for unpaid sales tax.

- Vendor Verification: The certificate serves as proof of your business's sales tax registration, allowing vendors to verify your status.

How to Complete the NC Certificate of Resale Form E-590

To complete the NC Certificate of Resale form E-590, follow these steps:

- Obtain the Form: Download the NC Certificate of Resale form E-590 from the North Carolina Department of Revenue website or obtain it from your local tax office.

- Fill Out the Form: Complete the form by providing your business's information, including your name, address, and sales tax account number.

- Sign and Date the Form: Sign and date the form, certifying that the information provided is accurate.

- Submit the Form: Submit the completed form to the North Carolina Department of Revenue or your local tax office.

Additional Requirements for Completing the NC Certificate of Resale Form E-590

In addition to completing the form, you may need to provide additional documentation, such as:

- Sales Tax Permit: A copy of your sales tax permit, which can be obtained from the North Carolina Department of Revenue.

- Business License: A copy of your business license, which can be obtained from your local government.

- Identification: Proof of identification, such as a driver's license or passport.

Renewing Your NC Certificate of Resale Form E-590

The NC Certificate of Resale form E-590 is valid for a specific period, typically one year. To renew your certificate, follow these steps:

- Obtain a New Form: Download a new NC Certificate of Resale form E-590 or obtain it from your local tax office.

- Update Your Information: Update your business's information on the form, if necessary.

- Resubmit the Form: Resubmit the completed form to the North Carolina Department of Revenue or your local tax office.

Conclusion

In conclusion, the NC Certificate of Resale form E-590 is a crucial document for any business operating in North Carolina. By understanding the importance of this form and following the steps outlined in this guide, you can ensure your business is compliant with state law and avoid any potential penalties or fines.

What's Next?

If you have any questions or concerns about the NC Certificate of Resale form E-590, please don't hesitate to reach out to the North Carolina Department of Revenue or your local tax office. Additionally, share this article with fellow business owners to help them navigate the process of obtaining this essential document.

FAQ Section

What is the purpose of the NC Certificate of Resale form E-590?

+The NC Certificate of Resale form E-590 certifies that a business is registered to collect and remit sales tax in North Carolina.

Who needs to obtain a NC Certificate of Resale form E-590?

+Any business that sells tangible personal property or services subject to sales tax in North Carolina needs to obtain a NC Certificate of Resale form E-590.

How do I renew my NC Certificate of Resale form E-590?

+To renew your NC Certificate of Resale form E-590, obtain a new form, update your information if necessary, and resubmit the completed form to the North Carolina Department of Revenue or your local tax office.