The Internal Revenue Service (IRS) requires individuals and businesses to make timely and accurate estimated tax payments throughout the year. Failure to do so can result in penalties and interest. Form 2210 is used to calculate and report unpaid estimated tax penalties, as well as to request relief from these penalties. In this article, we will delve into the instructions for Form 2210 and provide guidance on how to complete it accurately.

Understanding Form 2210

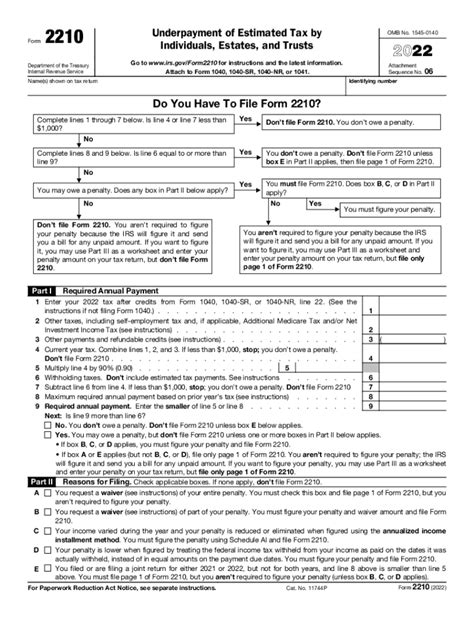

Form 2210 is used to calculate the unpaid estimated tax penalty, which is imposed when individuals and businesses fail to make sufficient estimated tax payments. The form is typically filed along with the taxpayer's annual tax return (Form 1040 or Form 1120). The IRS may waive the penalty if the taxpayer can demonstrate reasonable cause for not making the required estimated tax payments.

Who Needs to File Form 2210?

Individuals and businesses that are required to make estimated tax payments must file Form 2210 if they fail to make these payments or underpay their estimated taxes. This includes:

- Self-employed individuals

- Small business owners

- Corporations

- Partnerships

- S corporations

How to Complete Form 2210

To complete Form 2210, follow these steps:

- Determine the estimated tax liability: Calculate the estimated tax liability for each quarter using Form 2210, Part I.

- Calculate the penalty: Calculate the penalty for each quarter using Form 2210, Part II.

- Request penalty relief: If eligible, request penalty relief by completing Form 2210, Part III.

- Attach supporting documentation: Attach supporting documentation, such as a statement explaining the reason for not making estimated tax payments.

Part I: Estimated Tax Liability

In Part I, calculate the estimated tax liability for each quarter. This is done by multiplying the taxable income for the quarter by the applicable tax rate.

- Line 1: Enter the taxable income for the quarter.

- Line 2: Enter the applicable tax rate.

- Line 3: Calculate the estimated tax liability by multiplying the taxable income by the tax rate.

Part II: Penalty Calculation

In Part II, calculate the penalty for each quarter. This is done by multiplying the unpaid estimated tax liability by the applicable penalty rate.

- Line 4: Enter the unpaid estimated tax liability.

- Line 5: Enter the applicable penalty rate.

- Line 6: Calculate the penalty by multiplying the unpaid estimated tax liability by the penalty rate.

Part III: Penalty Relief

In Part III, request penalty relief if eligible. This is done by completing the following steps:

- Line 7: Check the box to request penalty relief.

- Line 8: Enter the reason for not making estimated tax payments.

- Line 9: Attach supporting documentation.

Requesting Penalty Relief

To request penalty relief, taxpayers must demonstrate reasonable cause for not making estimated tax payments. Reasonable cause may include:

- Serious illness or death of a family member

- Natural disasters or other unforeseen circumstances

- Lack of funds due to unforeseen business expenses

Taxpayers must attach supporting documentation, such as a statement explaining the reason for not making estimated tax payments, to Form 2210.

Conclusion

Form 2210 is used to calculate and report unpaid estimated tax penalties, as well as to request relief from these penalties. By following the instructions outlined in this article, taxpayers can accurately complete Form 2210 and request penalty relief if eligible. Remember to attach supporting documentation and to file Form 2210 along with the annual tax return.

We hope this article has been informative and helpful. If you have any questions or need further guidance, please don't hesitate to comment below. Additionally, if you found this article helpful, please share it with others who may benefit from this information.

Who needs to file Form 2210?

+Individuals and businesses that are required to make estimated tax payments must file Form 2210 if they fail to make these payments or underpay their estimated taxes.

How do I calculate the estimated tax liability?

+Calculate the estimated tax liability for each quarter by multiplying the taxable income for the quarter by the applicable tax rate.

Can I request penalty relief?

+Yes, taxpayers can request penalty relief if they can demonstrate reasonable cause for not making estimated tax payments.