As a business owner in Connecticut, you're likely familiar with the importance of filing accurate and timely tax returns. Two crucial forms for Connecticut businesses are the CT-1065 and CT-1120SI. Mastering these forms can help you avoid penalties, ensure compliance, and even identify potential tax savings. In this article, we'll delve into the world of Connecticut business taxes, exploring the intricacies of these forms and providing you with actionable tips to master them.

Understanding the CT-1065 Form

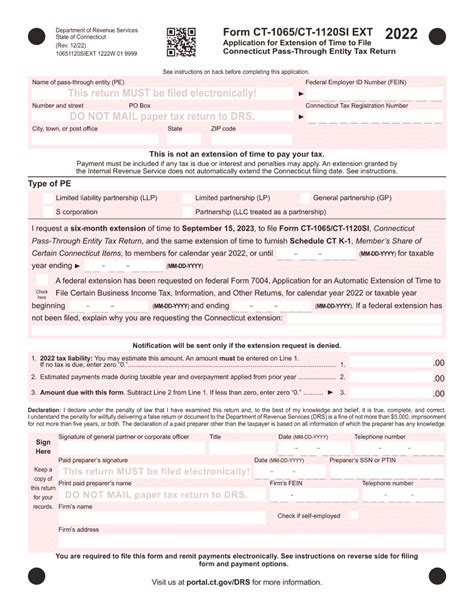

The CT-1065 form is used by partnerships and S corporations to report their income, deductions, and credits to the state of Connecticut. This form is typically due on April 15th of each year, with an automatic six-month extension available. To master the CT-1065 form, you'll need to understand the following key components:

- Business income: Report all business income, including income from sales, services, and investments.

- Deductions: Claim deductions for business expenses, such as rent, utilities, and employee salaries.

- Credits: Identify and claim available credits, like the Connecticut Research and Development Tax Credit.

5 Ways to Master the CT-1065 Form

- Keep accurate records: Maintain detailed records of your business income, expenses, and credits to ensure accurate reporting.

- Understand Connecticut tax laws: Stay up-to-date on Connecticut tax laws and regulations to ensure compliance and identify potential tax savings.

- Consult with a tax professional: Work with a qualified tax professional to ensure your CT-1065 form is accurate and complete.

- Use tax preparation software: Utilize tax preparation software, such as QuickBooks or TurboTax, to streamline the filing process and reduce errors.

- Take advantage of available credits: Identify and claim available credits, such as the Connecticut Research and Development Tax Credit, to minimize your tax liability.

Understanding the CT-1120SI Form

The CT-1120SI form is used by S corporations to report their income, deductions, and credits to the state of Connecticut. This form is typically due on April 15th of each year, with an automatic six-month extension available. To master the CT-1120SI form, you'll need to understand the following key components:

- Business income: Report all business income, including income from sales, services, and investments.

- Deductions: Claim deductions for business expenses, such as rent, utilities, and employee salaries.

- Credits: Identify and claim available credits, like the Connecticut Research and Development Tax Credit.

5 Ways to Master the CT-1120SI Form

- Understand S corporation taxation: Familiarize yourself with the unique taxation rules applicable to S corporations.

- Keep accurate records: Maintain detailed records of your business income, expenses, and credits to ensure accurate reporting.

- Consult with a tax professional: Work with a qualified tax professional to ensure your CT-1120SI form is accurate and complete.

- Use tax preparation software: Utilize tax preparation software, such as QuickBooks or TurboTax, to streamline the filing process and reduce errors.

- Take advantage of available credits: Identify and claim available credits, such as the Connecticut Research and Development Tax Credit, to minimize your tax liability.

Common Mistakes to Avoid

When filing the CT-1065 and CT-1120SI forms, it's essential to avoid common mistakes that can lead to penalties and delayed refunds. Some common mistakes to avoid include:

- Inaccurate reporting: Ensure all income, deductions, and credits are accurately reported.

- Missing signatures: Ensure all required signatures are included.

- Late filing: File your return on time to avoid penalties and interest.

Conclusion

Mastering the CT-1065 and CT-1120SI forms requires a deep understanding of Connecticut tax laws, accurate record-keeping, and attention to detail. By following the tips outlined in this article, you'll be well on your way to ensuring compliance and identifying potential tax savings. Remember to consult with a qualified tax professional and take advantage of available credits to minimize your tax liability.

We encourage you to share your experiences with filing the CT-1065 and CT-1120SI forms in the comments below. Have you encountered any challenges or successes? Share your insights to help others master these forms.

What is the deadline for filing the CT-1065 and CT-1120SI forms?

+The CT-1065 and CT-1120SI forms are typically due on April 15th of each year, with an automatic six-month extension available.

What are some common mistakes to avoid when filing the CT-1065 and CT-1120SI forms?

+Common mistakes to avoid include inaccurate reporting, missing signatures, and late filing.

Can I file the CT-1065 and CT-1120SI forms electronically?

+Yes, you can file the CT-1065 and CT-1120SI forms electronically through the Connecticut Department of Revenue Services website.