Understanding the Importance of a Quitclaim Deed in Property Transfers

When it comes to transferring property, it's essential to have the right documents in place to ensure a smooth and hassle-free process. One such document is the quitclaim deed form, which is used to transfer ownership of a property from one person to another. In this article, we will delve into the world of quitclaim deeds, specifically focusing on the Adams quitclaim deed form, and provide a comprehensive guide on how to use it to transfer property.

What is a Quitclaim Deed?

A quitclaim deed is a type of deed that transfers the grantor's (seller's) interest in a property to the grantee (buyer). It is a simple and straightforward way to transfer ownership, but it does not guarantee that the grantor has clear title to the property. Quitclaim deeds are often used in situations where the grantor is not sure if they have a valid claim to the property or if there are any outstanding liens or encumbrances.

What is an Adams Quitclaim Deed Form?

An Adams quitclaim deed form is a specific type of quitclaim deed form that is designed to be used in the state of Massachusetts. It is named after the county of Adams, where it originated. This form is tailored to meet the specific requirements of Massachusetts law and is commonly used in real estate transactions throughout the state.

Benefits of Using an Adams Quitclaim Deed Form

Using an Adams quitclaim deed form offers several benefits, including:

- Simplified process: The form provides a straightforward and easy-to-follow template for transferring property ownership.

- Compliance with Massachusetts law: The form is designed to meet the specific requirements of Massachusetts law, ensuring that the transfer is valid and enforceable.

- Flexibility: Quitclaim deeds can be used in a variety of situations, including transfers between family members, divorce settlements, and estate planning.

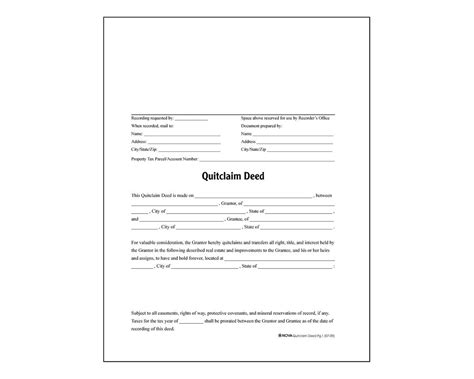

How to Fill Out an Adams Quitclaim Deed Form

Filling out an Adams quitclaim deed form requires careful attention to detail to ensure that the transfer is valid and enforceable. Here's a step-by-step guide to help you get started:

- Grantor's information: Enter the grantor's (seller's) name, address, and marital status.

- Grantee's information: Enter the grantee's (buyer's) name, address, and marital status.

- Property description: Provide a detailed description of the property being transferred, including the address, parcel number, and any other relevant details.

- Consideration: State the consideration (payment) being made for the transfer, if any.

- Signatures: Both the grantor and grantee must sign the deed in the presence of a notary public.

Types of Adams Quitclaim Deed Forms

There are several types of Adams quitclaim deed forms available, including:

- Individual grantor: Used when one individual is transferring property to another individual.

- Joint grantors: Used when two or more individuals are transferring property to another individual or entity.

- Entity grantor: Used when a corporation, LLC, or other entity is transferring property.

Common Uses of Adams Quitclaim Deed Forms

Adams quitclaim deed forms are commonly used in a variety of situations, including:

- Divorce settlements: To transfer property from one spouse to another as part of a divorce settlement.

- Estate planning: To transfer property to heirs or beneficiaries as part of an estate plan.

- Family transfers: To transfer property between family members, such as from parent to child.

Risks and Limitations of Using an Adams Quitclaim Deed Form

While Adams quitclaim deed forms can be a useful tool for transferring property, there are some risks and limitations to be aware of:

- No guarantee of clear title: A quitclaim deed does not guarantee that the grantor has clear title to the property.

- No warranty: A quitclaim deed does not provide any warranty or assurance that the property is free from liens or encumbrances.

- Tax implications: Transferring property can have tax implications, and it's essential to consult with a tax professional to understand the potential consequences.

Alternatives to Adams Quitclaim Deed Forms

While Adams quitclaim deed forms can be a useful tool for transferring property, there are alternative options available, including:

- Warranty deed: A warranty deed provides a guarantee that the grantor has clear title to the property and is often used in real estate transactions.

- Special warranty deed: A special warranty deed provides a limited guarantee that the grantor has clear title to the property and is often used in situations where the grantor is unsure of their title.

- Transfer on death (TOD) deed: A TOD deed allows the grantor to transfer property to a beneficiary at the time of their death, without the need for probate.

Conclusion: Making the Most of an Adams Quitclaim Deed Form

In conclusion, an Adams quitclaim deed form can be a valuable tool for transferring property in Massachusetts. By understanding the benefits, risks, and limitations of using this form, you can make informed decisions about your real estate transactions. Always consult with an attorney or real estate professional to ensure that you are using the correct form and following the proper procedures.

What is the difference between a quitclaim deed and a warranty deed?

+A quitclaim deed transfers the grantor's interest in a property, but does not guarantee clear title. A warranty deed, on the other hand, provides a guarantee that the grantor has clear title to the property.

Can I use an Adams quitclaim deed form for any type of property transfer?

+No, an Adams quitclaim deed form is specifically designed for use in Massachusetts and may not be suitable for all types of property transfers. Always consult with an attorney or real estate professional to ensure you are using the correct form.

What are the tax implications of transferring property using an Adams quitclaim deed form?

+Transferring property can have tax implications, and it's essential to consult with a tax professional to understand the potential consequences.