The Small Business Administration (SBA) is a vital institution that provides financial assistance to small businesses in the United States. One of the most popular loan programs offered by the SBA is the 7(a) loan program, which provides financing for small businesses to start, grow, and expand their operations. To apply for an SBA 7(a) loan, borrowers must complete and submit Form 1010C, also known as the SBA Loan Application. In this article, we will provide an in-depth guide to SBA Form 1010C, including its purpose, requirements, and tips for completing it successfully.

What is SBA Form 1010C?

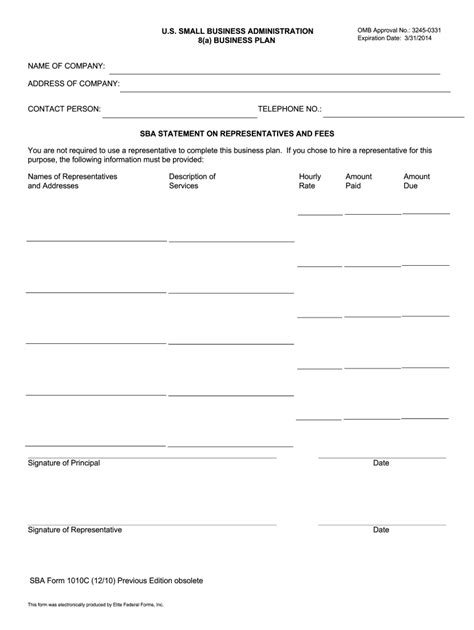

SBA Form 1010C is a loan application form used by the Small Business Administration to evaluate and process loan applications under the 7(a) loan program. The form is designed to collect information about the borrower's business, including its financial situation, management team, and loan requirements. The form is typically completed by the borrower and submitted to an SBA-approved lender, who will review and process the application.

Why is SBA Form 1010C Important?

SBA Form 1010C is a critical document in the SBA loan application process. The form provides the SBA and lenders with essential information about the borrower's business, which is used to evaluate the creditworthiness of the borrower and determine the loan's viability. The form also helps lenders to identify potential risks and determine the borrower's ability to repay the loan. By completing Form 1010C accurately and thoroughly, borrowers can increase their chances of securing an SBA loan.

Requirements for Completing SBA Form 1010C

To complete SBA Form 1010C, borrowers must provide detailed information about their business, including:

- Business profile, including name, address, and industry

- Business financial statements, including balance sheet, income statement, and cash flow statement

- Management team information, including resumes and experience

- Loan requirements, including loan amount, interest rate, and repayment terms

- Collateral information, including property and equipment values

- Personal financial statements, including personal tax returns and credit reports

Tips for Completing SBA Form 1010C

To increase their chances of securing an SBA loan, borrowers should follow these tips when completing Form 1010C:

- Provide accurate and complete information

- Use clear and concise language

- Ensure all financial statements are up-to-date and accurate

- Highlight the business's strengths and growth potential

- Be prepared to provide additional information or documentation

- Seek professional help if needed

Common Mistakes to Avoid When Completing SBA Form 1010C

When completing SBA Form 1010C, borrowers should avoid the following common mistakes:

- Incomplete or inaccurate information

- Failure to provide required documentation

- Insufficient collateral or loan repayment plan

- Poorly written or unclear loan proposal

- Failure to demonstrate business growth potential

Benefits of SBA Form 1010C

Completing SBA Form 1010C provides several benefits to borrowers, including:

- Access to SBA loan programs and financing

- Opportunity to demonstrate business creditworthiness

- Ability to showcase business growth potential

- Increased chances of securing an SBA loan

- Streamlined loan application process

Conclusion

In conclusion, SBA Form 1010C is a critical document in the SBA loan application process. By providing accurate and complete information, borrowers can increase their chances of securing an SBA loan. By following the tips and avoiding common mistakes outlined in this article, borrowers can ensure a successful loan application process.

What is SBA Form 1010C?

+SBA Form 1010C is a loan application form used by the Small Business Administration to evaluate and process loan applications under the 7(a) loan program.

Why is SBA Form 1010C important?

+SBA Form 1010C is important because it provides the SBA and lenders with essential information about the borrower's business, which is used to evaluate the creditworthiness of the borrower and determine the loan's viability.

What are the requirements for completing SBA Form 1010C?

+To complete SBA Form 1010C, borrowers must provide detailed information about their business, including business profile, financial statements, management team information, loan requirements, collateral information, and personal financial statements.