New York City is known for its unique and complex tax landscape, with various forms and requirements that can be overwhelming for even the most seasoned taxpayers. One such form that often raises questions is the NYC Form 1127, also known as the Application for Extension of Time to File for Certain City Taxes. In this article, we will delve into the essential facts about NYC Form 1127, exploring its purpose, eligibility, filing requirements, and more.

What is NYC Form 1127?

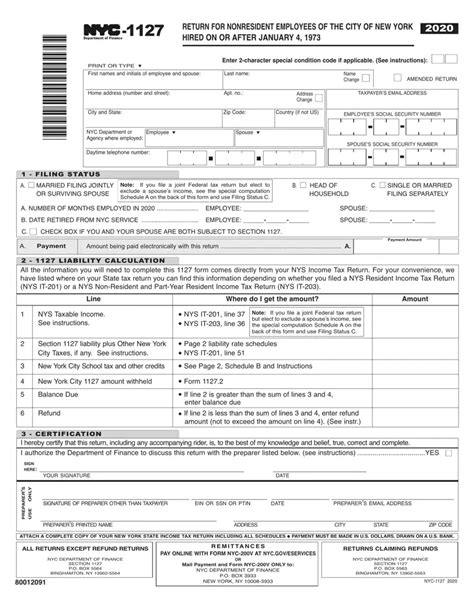

NYC Form 1127 is an application for an automatic six-month extension of time to file certain City taxes, including the General Corporation Tax (GCT), the Banking Corporation Tax (BCT), and the Unincorporated Business Tax (UBT). This form allows taxpayers to request additional time to file their tax returns, providing relief from potential penalties and interest.

Who is Eligible to File NYC Form 1127?

To be eligible to file NYC Form 1127, taxpayers must meet specific requirements. These include:

- Filing a City tax return for the tax year in question

- Being unable to file the return on or before the original due date

- Meeting the requirements for an automatic six-month extension

- Filing the application on or before the original due date of the tax return

How to File NYC Form 1127?

Filing NYC Form 1127 is a relatively straightforward process. Taxpayers can file the form electronically through the New York City Department of Finance's website or by mail. To file electronically, taxpayers will need to create an account and follow the online instructions. To file by mail, taxpayers should complete the form, sign it, and mail it to the address listed on the form.

What are the Filing Requirements for NYC Form 1127?

When filing NYC Form 1127, taxpayers must provide specific information, including:

- Their name and address

- Their tax identification number (EIN or SSN)

- The tax year for which they are requesting an extension

- The type of tax for which they are requesting an extension (GCT, BCT, or UBT)

- A statement explaining why they need an extension

What are the Benefits of Filing NYC Form 1127?

Filing NYC Form 1127 provides several benefits to taxpayers, including:

- Additional time to file their tax return

- Relief from potential penalties and interest

- More time to gather necessary documentation and information

- Reduced stress and anxiety associated with meeting the original deadline

What are the Consequences of Not Filing NYC Form 1127?

Failure to file NYC Form 1127 can result in significant consequences, including:

- Penalties and interest on the tax due

- Loss of the opportunity to request an automatic six-month extension

- Potential for audit and examination by the New York City Department of Finance

- Negative impact on credit score and financial reputation

Common Mistakes to Avoid When Filing NYC Form 1127

When filing NYC Form 1127, taxpayers should avoid common mistakes, including:

- Filing the form after the original due date

- Failing to provide required information and documentation

- Not signing the form

- Filing the form for the wrong tax year or tax type

How to Avoid Penalties and Interest When Filing NYC Form 1127?

To avoid penalties and interest when filing NYC Form 1127, taxpayers should:

- File the form on or before the original due date

- Pay any tax due by the original due date

- Respond promptly to any notices or correspondence from the New York City Department of Finance

- Keep accurate and detailed records of their tax-related activities

Conclusion and Next Steps

In conclusion, NYC Form 1127 is a valuable tool for taxpayers who need additional time to file their City tax returns. By understanding the essential facts about this form, taxpayers can avoid common mistakes and ensure a smooth filing process. If you have any questions or concerns about NYC Form 1127, we encourage you to comment below or reach out to a qualified tax professional for guidance.

We hope this article has provided you with valuable insights and information about NYC Form 1127. If you found this article helpful, please share it with others who may benefit from it. Remember to stay informed and up-to-date on the latest tax news and developments to ensure compliance and avoid potential pitfalls.

What is the purpose of NYC Form 1127?

+NYC Form 1127 is an application for an automatic six-month extension of time to file certain City taxes, including the General Corporation Tax (GCT), the Banking Corporation Tax (BCT), and the Unincorporated Business Tax (UBT).

Who is eligible to file NYC Form 1127?

+To be eligible to file NYC Form 1127, taxpayers must meet specific requirements, including filing a City tax return for the tax year in question, being unable to file the return on or before the original due date, and meeting the requirements for an automatic six-month extension.

What are the consequences of not filing NYC Form 1127?

+Failure to file NYC Form 1127 can result in significant consequences, including penalties and interest on the tax due, loss of the opportunity to request an automatic six-month extension, and potential for audit and examination by the New York City Department of Finance.