Updating your Social Security direct deposit information can be a hassle, especially when dealing with paperwork. However, with Form 1199A, the process becomes much simpler. In this article, we will guide you through the steps to update your Social Security direct deposit information using Form 1199A.

Understanding Form 1199A

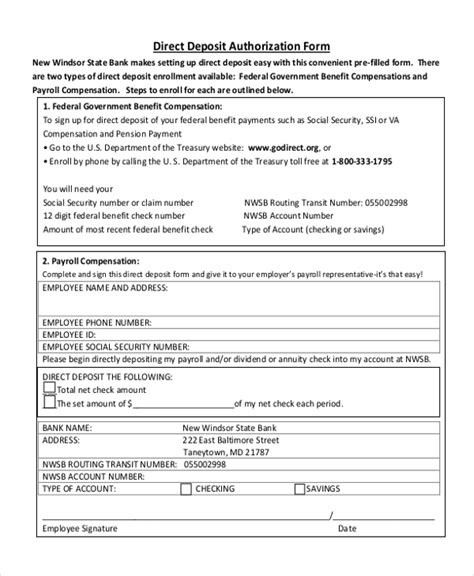

Form 1199A is a document used by the Social Security Administration (SSA) to update direct deposit information for Social Security benefits. This form allows beneficiaries to change their bank account or routing number, ensuring that their benefits are deposited correctly.

Why Update Your Direct Deposit Information?

There are several reasons why you may need to update your direct deposit information:

- You changed banks or bank accounts

- You moved to a new address

- You want to switch to a different type of bank account (e.g., from checking to savings)

- You need to update your account number or routing number

How to Update Your Direct Deposit Information with Form 1199A

Updating your direct deposit information with Form 1199A is a straightforward process. Here are the steps to follow:

- Obtain Form 1199A: You can download Form 1199A from the SSA website or pick one up at your local SSA office.

- Fill out the form: Complete the form with your updated direct deposit information, including your new bank account number and routing number.

- Sign the form: Sign the form to authorize the SSA to update your direct deposit information.

- Submit the form: Mail the completed form to the SSA address listed on the form or take it to your local SSA office.

Tips for Filling Out Form 1199A

- Make sure to use black ink and print clearly

- Use your full name as it appears on your Social Security card

- Double-check your bank account number and routing number for accuracy

- Sign the form in the presence of an SSA representative if you're submitting it in person

Alternative Methods for Updating Direct Deposit Information

While Form 1199A is a convenient way to update your direct deposit information, there are alternative methods available:

- Online account: If you have a My Social Security account, you can update your direct deposit information online.

- Phone: You can call the SSA's toll-free number (1-800-772-1213) to update your direct deposit information over the phone.

- In-person: You can visit your local SSA office and update your direct deposit information in person.

Benefits of Updating Your Direct Deposit Information

- Ensures timely payment of benefits

- Reduces the risk of payment errors

- Allows for faster access to benefits

Common Errors to Avoid When Updating Direct Deposit Information

When updating your direct deposit information, it's essential to avoid common errors that can delay or prevent payment of benefits:

- Inaccurate bank account number or routing number

- Missing or incomplete information

- Unsigned form

Conclusion

Updating your Social Security direct deposit information with Form 1199A is a simple and efficient process. By following the steps outlined in this article, you can ensure that your benefits are deposited correctly and on time. Remember to double-check your information and avoid common errors to prevent delays or payment issues.

What is Form 1199A used for?

+Form 1199A is used to update direct deposit information for Social Security benefits.

How do I obtain Form 1199A?

+You can download Form 1199A from the SSA website or pick one up at your local SSA office.

Can I update my direct deposit information online?

+Yes, if you have a My Social Security account, you can update your direct deposit information online.