Understanding the intricacies of tax forms can be daunting, but with the right guidance, individuals can navigate the process with ease. One such crucial form is the Form 4835, which is specifically designed for farmers and ranchers to report their farm-related income and expenses. In this article, we will delve into the world of Form 4835, providing a comprehensive, step-by-step guide to help farmers and ranchers accurately complete this form and ensure compliance with tax regulations.

The importance of accurately completing Form 4835 cannot be overstated. Not only does it enable farmers and ranchers to report their farm income and expenses, but it also plays a critical role in determining their overall tax liability. With the ever-changing landscape of tax laws and regulations, it is essential for individuals involved in agricultural activities to stay informed and up-to-date on the latest requirements. In the following sections, we will break down the process of completing Form 4835, highlighting key sections, and providing practical examples to illustrate the concepts.

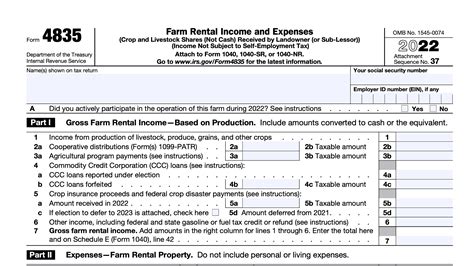

Understanding Form 4835: An Overview

Form 4835, also known as the Farm Rental Income and Expenses form, is a crucial document for farmers and ranchers who derive income from farm rentals. This form is used to report farm rental income, as well as expenses related to the rental of farmland, livestock, or equipment. The information reported on Form 4835 is used to calculate the taxpayer's net farm income, which is then reported on Schedule F (Form 1040).

Who Needs to File Form 4835?

Form 4835 is required for individuals who receive rental income from farm properties, including:

- Farmers who rent out their land to other farmers

- Ranchers who rent out their livestock or equipment

- Landowners who rent out their property to farmers or ranchers

- Taxpayers who receive crop shares or livestock shares as rent

Step-by-Step Instructions for Completing Form 4835

Completing Form 4835 requires careful attention to detail and a thorough understanding of the form's various sections. Here is a step-by-step guide to help taxpayers navigate the process:

Step 1: Identify Your Farm Rental Income

Report all farm rental income received during the tax year, including cash, crop shares, and livestock shares. This information should be reported on Line 1 of Form 4835.

Step 2: Calculate Your Farm Rental Expenses

Report all expenses related to the rental of farmland, livestock, or equipment on Lines 2-15 of Form 4835. These expenses may include:

- Rent paid to others

- Property taxes

- Insurance premiums

- Repairs and maintenance

- Interest on loans

Step 3: Calculate Your Net Farm Rental Income

Subtract your total farm rental expenses from your total farm rental income to calculate your net farm rental income. This amount should be reported on Line 16 of Form 4835.

Step 4: Complete Schedule F (Form 1040)

Report your net farm rental income on Schedule F (Form 1040), which is used to calculate your overall net farm income.

Additional Tips and Considerations

When completing Form 4835, it is essential to keep the following tips and considerations in mind:

- Accurately report all farm rental income and expenses to avoid errors or omissions.

- Maintain detailed records of farm rental income and expenses, including receipts, invoices, and bank statements.

- Consult with a tax professional or accountant if you are unsure about any aspect of the form.

- Take advantage of available tax credits and deductions, such as the depreciation of farm equipment or the mortgage interest deduction.

Common Mistakes to Avoid When Completing Form 4835

When completing Form 4835, it is essential to avoid common mistakes that can lead to errors or omissions. Some common mistakes to avoid include:

- Failing to report all farm rental income

- Incorrectly calculating farm rental expenses

- Failing to maintain accurate records of farm rental income and expenses

- Failing to consult with a tax professional or accountant when needed

Conclusion

Completing Form 4835 requires careful attention to detail and a thorough understanding of the form's various sections. By following the step-by-step guide outlined in this article, farmers and ranchers can ensure accurate reporting of their farm rental income and expenses, minimizing the risk of errors or omissions. Remember to maintain detailed records, consult with a tax professional or accountant when needed, and take advantage of available tax credits and deductions.

What is Form 4835 used for?

+Form 4835 is used to report farm rental income and expenses, as well as to calculate net farm rental income.

Who needs to file Form 4835?

+Form 4835 is required for individuals who receive rental income from farm properties, including farmers, ranchers, landowners, and taxpayers who receive crop shares or livestock shares as rent.

What is the deadline for filing Form 4835?

+The deadline for filing Form 4835 is the same as the deadline for filing Form 1040, which is typically April 15th of each year.