Life insurance policies are an essential part of financial planning, providing a safety net for loved ones in the event of the policyholder's passing. One of the most critical components of a life insurance policy is the beneficiary designation. A beneficiary is the person or entity that will receive the death benefit payout in the event of the policyholder's death. It's crucial to ensure that the beneficiary designation is accurate and up-to-date to avoid any potential disputes or issues.

Why Update Your Beneficiary Designation?

Life is full of changes, and circumstances can shift over time. For example, you may have gotten married, had children, or experienced a divorce. These changes can impact your beneficiary designation. If you don't update your beneficiary designation, the wrong person may receive the death benefit payout, which could lead to financial hardship for your intended beneficiaries. Updating your beneficiary designation ensures that your loved ones are protected and that your wishes are respected.

Prudential Life Change Of Beneficiary Form: What You Need To Know

The Prudential Life Change of Beneficiary Form is a document used to update the beneficiary designation on a Prudential life insurance policy. The form is typically used when a policyholder wants to change the beneficiary designation due to a change in circumstances, such as a divorce or the birth of a child. The form must be completed accurately and submitted to Prudential to ensure that the change is processed correctly.

Who Can Update The Beneficiary Designation?

Only the policyholder can update the beneficiary designation. If the policyholder is deceased, the beneficiary designation cannot be changed. However, if the policyholder is incapacitated, a court-appointed guardian or conservator may be able to update the beneficiary designation on their behalf.

How To Complete The Prudential Life Change Of Beneficiary Form

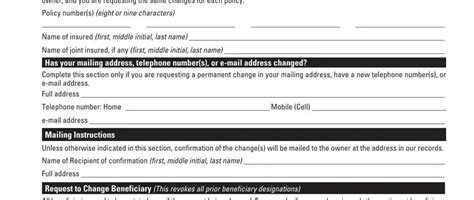

Completing the Prudential Life Change of Beneficiary Form requires careful attention to detail. Here's a step-by-step guide to help you through the process:

- Obtain the form: You can download the form from the Prudential website or contact a Prudential representative to request a copy.

- Read the instructions: Carefully read the instructions on the form to ensure you understand what information is required.

- Provide policy information: Enter the policy number and policy type (e.g., term life, whole life, universal life).

- Identify the current beneficiary: Provide the name and relationship of the current beneficiary.

- Designate the new beneficiary: Enter the name, address, and social security number (or tax identification number) of the new beneficiary.

- Specify the beneficiary percentage: Indicate the percentage of the death benefit that the new beneficiary will receive.

- Sign and date the form: Sign and date the form in the presence of a notary public (if required).

What To Do After Completing The Form

Once you've completed the form, you'll need to submit it to Prudential for processing. Here's what to do next:

- Submit the form: Mail or fax the completed form to Prudential at the address or fax number provided on the form.

- Wait for confirmation: Prudential will review and process the form. You'll receive a confirmation letter or email once the change has been processed.

- Verify the change: Review your policy documents to ensure that the beneficiary designation has been updated correctly.

Tips And Considerations

Here are some tips and considerations to keep in mind when updating your beneficiary designation:

- Review your policy regularly: Regularly review your policy to ensure that the beneficiary designation is accurate and up-to-date.

- Use a beneficiary designation form: Use a beneficiary designation form to update the beneficiary designation, rather than relying on a will or trust.

- Consider multiple beneficiaries: Consider designating multiple beneficiaries to ensure that the death benefit is distributed according to your wishes.

- Seek professional advice: If you're unsure about how to update your beneficiary designation or have complex estate planning needs, seek professional advice from an attorney or financial advisor.

Conclusion

Updating your beneficiary designation is a critical step in ensuring that your life insurance policy reflects your current wishes. The Prudential Life Change of Beneficiary Form is a straightforward document that can be completed with ease. By following the steps outlined in this guide, you can ensure that your loved ones are protected and that your wishes are respected.

What is the purpose of the Prudential Life Change of Beneficiary Form?

+The Prudential Life Change of Beneficiary Form is used to update the beneficiary designation on a Prudential life insurance policy.

Who can update the beneficiary designation on a Prudential life insurance policy?

+Only the policyholder can update the beneficiary designation. If the policyholder is deceased, the beneficiary designation cannot be changed.

What information is required on the Prudential Life Change of Beneficiary Form?

+The form requires policy information, current beneficiary information, new beneficiary information, and signature and date.