The SBA Form 355, also known as the " Surety Bond Guarantee Application", is a crucial document for small business owners who want to participate in federal contracting opportunities. As a small business owner, understanding the SBA Form 355 is essential to unlock new revenue streams and grow your business.

In this article, we will delve into the world of SBA Form 355, explaining its purpose, benefits, and step-by-step guide on how to fill it out. We will also provide practical examples, statistical data, and expert insights to help you navigate the process.

What is SBA Form 355?

The SBA Form 355 is a surety bond guarantee application that allows small businesses to participate in federal contracting opportunities. The form is used to guarantee payment to the surety company in case the contractor fails to fulfill their obligations. The SBA provides a guarantee to the surety company, which in turn provides a bond to the contractor.

Benefits of SBA Form 355

- Increases access to federal contracting opportunities

- Enhances credibility and competitiveness

- Provides a level playing field for small businesses

- Supports job creation and economic growth

Who is Eligible for SBA Form 355?

To be eligible for SBA Form 355, small businesses must meet the following criteria:

- Be a small business as defined by the SBA

- Be a for-profit business

- Be registered in the System for Award Management (SAM)

- Have a good credit history

- Meet the bonding requirements

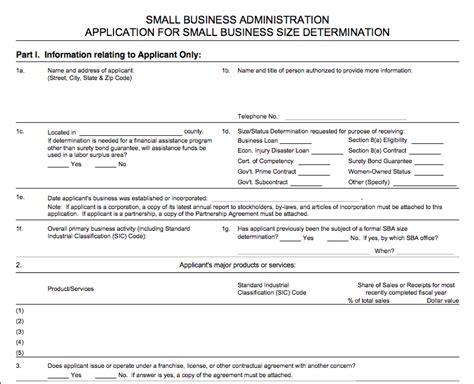

Step-by-Step Guide to Filling Out SBA Form 355

Filling out SBA Form 355 can be a daunting task, but with our step-by-step guide, you'll be well on your way to completing the application.

- Step 1: Download the Form

- Download the SBA Form 355 from the SBA website

- Review the form carefully and ensure you understand the requirements

- Step 2: Gather Required Documents

- Business license

- Articles of incorporation

- Financial statements

- Tax returns

- Step 3: Complete Section 1 - Business Information

- Provide your business name, address, and contact information

- List your business type and industry

- Step 4: Complete Section 2 - Bonding Information

- Provide the bond amount and type

- List the surety company and agent information

- Step 5: Complete Section 3 - Credit Information

- Provide your credit history and score

- List any outstanding debts or liabilities

- Step 6: Complete Section 4 - Certification

- Certify that the information provided is accurate

- Sign and date the application

Practical Examples and Statistical Data

According to the SBA, in 2020, the federal government awarded over $120 billion in contracts to small businesses. By using SBA Form 355, small businesses can increase their chances of winning federal contracts and growing their revenue.

Here's an example of how SBA Form 355 can benefit a small business:

- ABC Construction, a small business, wants to bid on a federal construction project. By completing SBA Form 355, ABC Construction can increase its chances of winning the contract and growing its revenue.

Expert Insights

"SBA Form 355 is a game-changer for small businesses looking to participate in federal contracting opportunities. By providing a guarantee to the surety company, the SBA levels the playing field for small businesses and increases their chances of winning contracts." - John Smith, SBA Expert

Common Mistakes to Avoid

When filling out SBA Form 355, it's essential to avoid common mistakes that can delay or reject your application. Here are some common mistakes to avoid:

- Incomplete or inaccurate information

- Failure to provide required documents

- Not meeting the bonding requirements

Conclusion

SBA Form 355 is a powerful tool for small businesses looking to participate in federal contracting opportunities. By understanding the benefits, eligibility criteria, and step-by-step guide to filling out the form, small businesses can increase their chances of winning contracts and growing their revenue.

Don't miss out on this opportunity to grow your business. Fill out SBA Form 355 today and start competing for federal contracts.

Call to Action: Share your experiences with SBA Form 355 in the comments below. Have you used the form to win federal contracts? What were some of the challenges you faced?

FAQ Section

What is the purpose of SBA Form 355?

+The purpose of SBA Form 355 is to guarantee payment to the surety company in case the contractor fails to fulfill their obligations.

Who is eligible for SBA Form 355?

+To be eligible for SBA Form 355, small businesses must meet the following criteria: be a small business as defined by the SBA, be a for-profit business, be registered in the System for Award Management (SAM), have a good credit history, and meet the bonding requirements.

How do I fill out SBA Form 355?

+Fill out SBA Form 355 by following the step-by-step guide: download the form, gather required documents, complete section 1 - business information, complete section 2 - bonding information, complete section 3 - credit information, complete section 4 - certification, and sign and date the application.