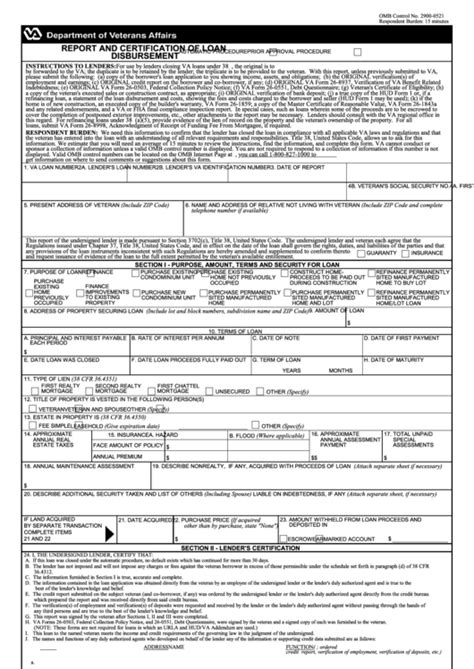

As a veteran, navigating the process of obtaining a home loan can be overwhelming. One of the most important steps in this process is filling out the VA Form 26-1820, also known as the Report of Loan Guaranty. This form is a crucial document that helps determine the level of guaranty the Department of Veterans Affairs (VA) will provide for your home loan. In this article, we will delve into the world of VA Form 26-1820, providing a comprehensive guide to help you understand its significance, benefits, and requirements.

What is VA Form 26-1820?

VA Form 26-1820 is a document that verifies the veteran's eligibility for a home loan guaranty. The form is used by lenders to determine the level of guaranty the VA will provide for the loan. The guaranty is essentially a promise by the VA to repay a portion of the loan if the borrower defaults.

Why is VA Form 26-1820 important?

The VA Form 26-1820 is essential for several reasons:

- Guaranty percentage: The form helps determine the percentage of the loan that the VA will guaranty. This percentage can range from 25% to 100%, depending on the loan amount and the veteran's eligibility.

- Loan approval: Lenders require the VA Form 26-1820 to approve the loan. Without it, the lender may not be willing to provide the loan.

- Interest rates: The guaranty percentage can affect the interest rates offered by lenders. A higher guaranty percentage can result in lower interest rates.

Benefits of VA Form 26-1820

The VA Form 26-1820 offers several benefits to veterans, including:

- No down payment: With a VA guaranty, veterans may not need to make a down payment.

- Lower interest rates: The guaranty can result in lower interest rates, making the loan more affordable.

- No private mortgage insurance (PMI): Veterans are not required to pay PMI, which can save them hundreds or even thousands of dollars per year.

How to fill out VA Form 26-1820

Filling out the VA Form 26-1820 requires careful attention to detail. Here are the steps to follow:

- Gather required documents: You will need to provide proof of service, such as a DD Form 214, and proof of income.

- Fill out the form accurately: Make sure to fill out the form accurately and completely. Incomplete or inaccurate forms may be rejected.

- Submit the form: Submit the form to the VA, either online or by mail.

Common mistakes to avoid

When filling out the VA Form 26-1820, it's essential to avoid common mistakes, such as:

- Inaccurate information: Make sure to provide accurate information, including your social security number and date of birth.

- Incomplete forms: Ensure that you fill out the entire form, including all required sections.

- Late submission: Submit the form on time to avoid delays in the loan process.

VA Form 26-1820 FAQs

Here are some frequently asked questions about the VA Form 26-1820:

- Q: What is the purpose of VA Form 26-1820? A: The purpose of VA Form 26-1820 is to verify the veteran's eligibility for a home loan guaranty.

- Q: How long does it take to process the form? A: The processing time for the VA Form 26-1820 can vary, but it typically takes a few days to a few weeks.

- Q: Can I fill out the form online? A: Yes, you can fill out the VA Form 26-1820 online through the VA's website.

What is the VA Form 26-1820 used for?

+The VA Form 26-1820 is used to verify the veteran's eligibility for a home loan guaranty.

How do I fill out the VA Form 26-1820?

+To fill out the VA Form 26-1820, you will need to provide proof of service and proof of income. You can fill out the form online or by mail.

What are the benefits of the VA Form 26-1820?

+The benefits of the VA Form 26-1820 include no down payment, lower interest rates, and no private mortgage insurance (PMI).

In conclusion, the VA Form 26-1820 is a crucial document that helps determine the level of guaranty the VA will provide for a home loan. By understanding the benefits and requirements of the form, veterans can navigate the loan process with confidence. If you have any questions or need further assistance, please don't hesitate to comment below.