Direct deposit has become an essential feature for many financial institutions, allowing users to receive their paychecks, benefits, and other payments directly into their accounts. UCFCU, or University Credit Union, offers a direct deposit service that enables members to easily set up and manage their deposits. In this article, we will delve into the world of UCFCU direct deposit, exploring its benefits, setup process, and providing answers to frequently asked questions.

What is UCFCU Direct Deposit?

UCFCU direct deposit is a service provided by University Credit Union that allows members to receive their payments directly into their accounts. This service is designed to provide a convenient, secure, and efficient way to manage your finances. With UCFCU direct deposit, you can receive your paychecks, government benefits, and other payments without the need for physical checks or visits to the bank.

Benefits of UCFCU Direct Deposit

The benefits of using UCFCU direct deposit are numerous. Some of the most significant advantages include:

- Convenience: With UCFCU direct deposit, you can receive your payments from anywhere, at any time, as long as you have access to your account.

- Security: Direct deposit eliminates the risk of lost or stolen checks, reducing the likelihood of identity theft and financial fraud.

- Efficiency: UCFCU direct deposit saves you time and effort, as you don't need to visit the bank or wait for physical checks to clear.

- Cost-effective: Direct deposit reduces the need for paper checks, envelopes, and postage, making it an environmentally friendly option.

- Faster access to funds: With UCFCU direct deposit, you can access your funds on the same day they are deposited, allowing you to manage your finances more effectively.

How to Set Up UCFCU Direct Deposit

Setting up UCFCU direct deposit is a straightforward process that can be completed in a few simple steps. Here's a step-by-step guide to help you get started:

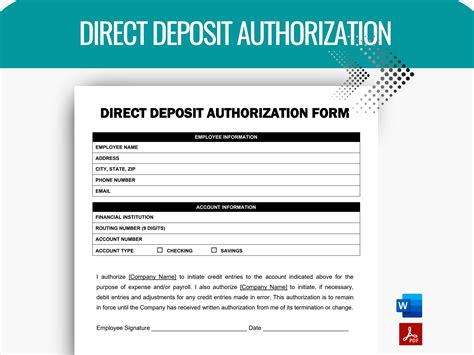

- Obtain a direct deposit form: You can download the UCFCU direct deposit form from the University Credit Union website or pick one up at a local branch.

- Fill out the form: Complete the form by providing your account information, including your account number, routing number, and type of account.

- Provide employer or payer information: You will need to provide your employer or payer with the completed direct deposit form, as well as your account information.

- Verify your account: Once your employer or payer receives your direct deposit form, they will verify your account information with UCFCU.

- Start receiving direct deposits: After your account has been verified, you can start receiving direct deposits into your UCFCU account.

UCFCU Direct Deposit Form Requirements

To set up UCFCU direct deposit, you will need to provide the following information:

- Your UCFCU account number

- Your UCFCU routing number (also known as the ABA number)

- The type of account you want to use for direct deposit (e.g., checking or savings)

- Your employer or payer's name and address

- The frequency of your direct deposits (e.g., weekly, biweekly, or monthly)

Common UCFCU Direct Deposit Questions

Here are some frequently asked questions about UCFCU direct deposit:

Q: Is UCFCU direct deposit secure? A: Yes, UCFCU direct deposit is a secure way to receive your payments. Your account information is protected by advanced security measures, including encryption and secure servers.

Q: Can I set up UCFCU direct deposit online? A: Yes, you can set up UCFCU direct deposit online by logging into your UCFCU account and completing the direct deposit form.

Q: How long does it take to set up UCFCU direct deposit? A: Setting up UCFCU direct deposit typically takes a few days to a week, depending on the processing time of your employer or payer.

Q: Can I receive multiple direct deposits into my UCFCU account? A: Yes, you can receive multiple direct deposits into your UCFCU account. Simply provide your account information to each employer or payer, and they will set up separate direct deposits.

Conclusion: UCFCU Direct Deposit Made Easy

UCFCU direct deposit is a convenient, secure, and efficient way to manage your finances. With its easy setup process and numerous benefits, it's no wonder why many UCFCU members are switching to direct deposit. By following the steps outlined in this article, you can set up UCFCU direct deposit and start enjoying the benefits of faster, more secure payments.

What is the UCFCU routing number?

+The UCFCU routing number is 313082805.

Can I cancel UCFCU direct deposit?

+Yes, you can cancel UCFCU direct deposit by contacting your employer or payer and providing them with a written request to cancel your direct deposit.

How do I check the status of my UCFCU direct deposit?

+You can check the status of your UCFCU direct deposit by logging into your UCFCU account or contacting your employer or payer.