The Qbo direct deposit form is an essential tool for businesses that use QuickBooks Online (QBO) to manage their payroll processes. As a business owner, you understand the importance of timely and accurate payment to your employees. In this article, we will explore the Qbo direct deposit form, its benefits, and how to set it up and use it to simplify your payroll process.

What is the Qbo Direct Deposit Form?

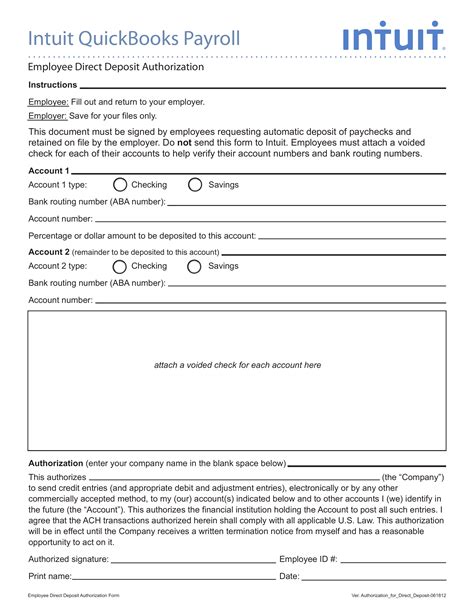

The Qbo direct deposit form is a digital form that allows you to set up and manage direct deposit payments for your employees. This form is integrated with QuickBooks Online, making it easy to manage your payroll process in one place. With the Qbo direct deposit form, you can easily add or remove employees, update payment information, and track payment history.

Benefits of Using the Qbo Direct Deposit Form

Using the Qbo direct deposit form offers several benefits to businesses, including:

- Streamlined payroll process: The Qbo direct deposit form simplifies the payroll process by allowing you to manage all payment information in one place.

- Reduced errors: The digital form reduces the risk of errors associated with manual data entry, ensuring that payments are made accurately and on time.

- Increased efficiency: The Qbo direct deposit form saves time and reduces the administrative burden associated with managing payroll.

- Improved employee satisfaction: With the Qbo direct deposit form, you can ensure that your employees receive their payments on time, improving employee satisfaction and reducing the risk of disputes.

How to Set Up the Qbo Direct Deposit Form

Setting up the Qbo direct deposit form is a straightforward process that requires the following steps:

- Log in to your QuickBooks Online account: Go to the QuickBooks Online website and log in to your account using your username and password.

- Navigate to the payroll section: Click on the "Payroll" tab and select "Direct Deposit" from the drop-down menu.

- Create a new direct deposit form: Click on the "Create a new direct deposit form" button and follow the prompts to set up the form.

- Add employee information: Add the employee's name, address, and payment information to the form.

- Save and submit: Save and submit the form to activate direct deposit for the employee.

Troubleshooting Common Issues

If you encounter any issues with the Qbo direct deposit form, the following troubleshooting tips may help:

- Incorrect employee information: Verify that the employee's information is accurate and up-to-date.

- Payment errors: Check the payment information to ensure that it is correct and complete.

- Technical issues: Contact QuickBooks Online support for assistance with technical issues.

Best Practices for Using the Qbo Direct Deposit Form

To get the most out of the Qbo direct deposit form, follow these best practices:

- Regularly review and update employee information: Ensure that employee information is accurate and up-to-date to avoid payment errors.

- Use the form to track payment history: Use the Qbo direct deposit form to track payment history and ensure that payments are made on time.

- Take advantage of automation: Use the form's automation features to streamline the payroll process and reduce administrative tasks.

Security and Compliance

The Qbo direct deposit form is designed with security and compliance in mind. The form uses encryption and secure servers to protect sensitive employee information. Additionally, the form is compliant with relevant regulations, including the Fair Labor Standards Act (FLSA) and the Gramm-Leach-Bliley Act (GLBA).

Conclusion

The Qbo direct deposit form is a powerful tool that simplifies the payroll process and reduces administrative tasks. By following the steps outlined in this article, you can set up and use the Qbo direct deposit form to improve your payroll process and increase employee satisfaction. Remember to regularly review and update employee information, use the form to track payment history, and take advantage of automation to get the most out of the Qbo direct deposit form.

We hope you found this article helpful. If you have any questions or comments, please feel free to share them below.

What is the Qbo direct deposit form?

+The Qbo direct deposit form is a digital form that allows you to set up and manage direct deposit payments for your employees.

How do I set up the Qbo direct deposit form?

+To set up the Qbo direct deposit form, log in to your QuickBooks Online account, navigate to the payroll section, create a new direct deposit form, add employee information, and save and submit the form.

What are the benefits of using the Qbo direct deposit form?

+The Qbo direct deposit form offers several benefits, including streamlined payroll process, reduced errors, increased efficiency, and improved employee satisfaction.