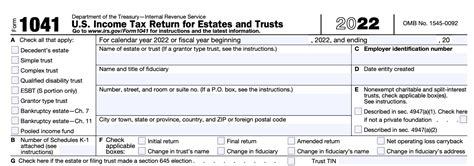

Filing taxes can be a daunting task, especially for those who are responsible for managing the financial affairs of an estate or trust. Form 1041, also known as the U.S. Income Tax Return for Estates and Trusts, is a crucial document that must be filed annually with the Internal Revenue Service (IRS). In this article, we will guide you through the essential steps for filing Form 1041, helping you navigate the complexities of estate and trust taxation.

Understanding the Importance of Form 1041

Before diving into the filing process, it's essential to understand the significance of Form 1041. This form is used to report the income, deductions, and credits of an estate or trust, and it's a critical component of the tax compliance process. Failure to file Form 1041 can result in penalties, fines, and even audits, which can be costly and time-consuming.

Step 1: Gather Necessary Documents and Information

The first step in filing Form 1041 is to gather all necessary documents and information. This includes:

- The estate's or trust's income statements, such as dividend statements, interest statements, and capital gains statements

- Records of all expenses, including funeral expenses, administration fees, and charitable donations

- Information about the beneficiaries, including their names, addresses, and social security numbers

- A copy of the estate's or trust's governing document, such as the will or trust agreement

Step 2: Determine the Filing Status

Determining the Filing Status

The next step is to determine the filing status of the estate or trust. This will depend on the type of entity and its taxable income. The most common filing statuses for estates and trusts are:

- Single: This is the most common filing status for estates and trusts, which are considered separate taxable entities.

- Married Filing Jointly: This filing status is used when the estate or trust is filing jointly with its spouse or beneficiary.

- Qualified Widow(er): This filing status is used when the estate or trust is filing as a qualified widow(er) with dependent children.

Step 3: Calculate Income and Deductions

Calculating Income and Deductions

The next step is to calculate the income and deductions of the estate or trust. This includes:

- Calculating the total income from all sources, including interest, dividends, and capital gains

- Deducting all qualified expenses, such as administration fees, funeral expenses, and charitable donations

- Claiming all eligible credits, such as the foreign tax credit or the education credit

Step 4: Complete and Sign the Form

Completing and Signing the Form

Once all the necessary calculations have been made, the next step is to complete and sign the Form 1041. This includes:

- Filling out all required fields and schedules, including the income statement, deduction schedule, and credit schedule

- Signing the form as the executor, trustee, or authorized representative

- Including all required documentation and attachments, such as the estate's or trust's governing document and supporting schedules

Step 5: File the Form and Pay Any Taxes Due

Filing the Form and Paying Taxes Due

The final step is to file the completed Form 1041 with the IRS and pay any taxes due. This includes:

- Filing the form electronically or by mail, depending on the estate's or trust's tax obligations

- Paying any taxes due by the deadline to avoid penalties and interest

- Keeping a copy of the filed form and supporting documentation for record-keeping purposes

Conclusion: Simplifying the Form 1041 Filing Process

Filing Form 1041 can be a complex and time-consuming process, but by following these essential steps, you can simplify the process and ensure compliance with the IRS. Remember to gather all necessary documents and information, determine the filing status, calculate income and deductions, complete and sign the form, and file the form and pay any taxes due. By doing so, you can avoid costly penalties and fines, and ensure that the estate or trust's tax obligations are met.

We hope this article has provided you with a comprehensive guide to filing Form 1041. If you have any questions or concerns, please don't hesitate to comment below or share this article with others who may benefit from this information.

What is the deadline for filing Form 1041?

+The deadline for filing Form 1041 is typically April 15th of each year, but this can vary depending on the estate's or trust's tax obligations.

Do I need to file Form 1041 if the estate or trust has no income?

+No, you do not need to file Form 1041 if the estate or trust has no income. However, you may still need to file other tax forms, such as Form 706, to report the estate's or trust's tax obligations.