If you're married and filing a joint tax return, you may be aware of the concept of "injured spouse" relief. This provision allows one spouse to claim their share of a tax refund if the other spouse's debt or other financial obligations are causing the refund to be withheld. In this article, we'll delve into the world of TurboTax injured spouse form, exploring what it is, how it works, and how you can claim your refund today.

The concept of injured spouse relief was introduced to help individuals who are not responsible for their spouse's debt or financial obligations. When a joint tax return is filed, the Internal Revenue Service (IRS) may withhold the refund if one spouse has outstanding debt, such as back taxes, student loans, or child support. However, if the other spouse is not responsible for this debt, they may be able to claim their share of the refund using the injured spouse relief provision.

What is the TurboTax Injured Spouse Form?

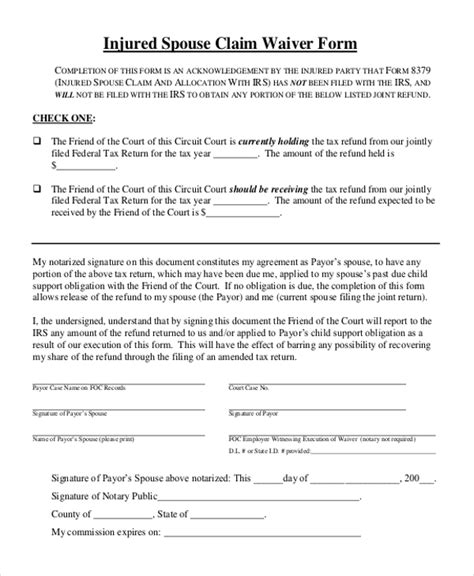

The TurboTax injured spouse form, also known as Form 8379, is a document that allows one spouse to claim their share of a tax refund when the other spouse's debt or financial obligations are causing the refund to be withheld. This form is used to request that the IRS allocate the refund to the injured spouse, rather than applying it to the other spouse's debt.

How Does the TurboTax Injured Spouse Form Work?

To claim injured spouse relief using the TurboTax injured spouse form, you'll need to follow these steps:

- File a joint tax return: To be eligible for injured spouse relief, you must file a joint tax return with your spouse.

- Complete Form 8379: You'll need to complete Form 8379, which can be found on the IRS website or through TurboTax.

- Submit the form: Once you've completed the form, submit it to the IRS along with your joint tax return.

- Wait for processing: The IRS will review your application and process your refund accordingly.

Benefits of Using the TurboTax Injured Spouse Form

Using the TurboTax injured spouse form can provide several benefits, including:

- Claiming your share of the refund: By completing Form 8379, you can claim your share of the refund, even if your spouse has outstanding debt.

- Avoiding debt: If your spouse has debt, using the injured spouse form can help you avoid being held responsible for that debt.

- Simplified process: TurboTax makes it easy to complete and submit Form 8379, streamlining the process and reducing the risk of errors.

Common Mistakes to Avoid When Using the TurboTax Injured Spouse Form

When using the TurboTax injured spouse form, there are several common mistakes to avoid, including:

- Failing to file a joint tax return: To be eligible for injured spouse relief, you must file a joint tax return with your spouse.

- Not completing Form 8379 correctly: Make sure to complete Form 8379 accurately and thoroughly to avoid delays or rejection.

- Not submitting the form on time: Submit Form 8379 along with your joint tax return to avoid delays in processing your refund.

Alternatives to the TurboTax Injured Spouse Form

If you're not using TurboTax, there are alternative methods for claiming injured spouse relief, including:

- Using tax preparation software: Other tax preparation software, such as H&R Block or TaxAct, may also offer injured spouse relief forms and guidance.

- Consulting a tax professional: A tax professional can help you complete and submit Form 8379, ensuring accuracy and compliance.

- Contacting the IRS: You can contact the IRS directly to request injured spouse relief and complete Form 8379.

Statistical Data on Injured Spouse Relief

According to the IRS, in 2020, over 1.3 million taxpayers claimed injured spouse relief, resulting in refunds totaling over $1.1 billion. This highlights the importance of understanding and utilizing the injured spouse relief provision to claim your rightful refund.

Conclusion

The TurboTax injured spouse form is a valuable tool for individuals who are not responsible for their spouse's debt or financial obligations. By understanding how to use this form and avoiding common mistakes, you can claim your share of the refund and avoid being held responsible for your spouse's debt. Don't wait – claim your refund today using the TurboTax injured spouse form.

What is the purpose of the TurboTax injured spouse form?

+The TurboTax injured spouse form, also known as Form 8379, is used to request that the IRS allocate the refund to the injured spouse, rather than applying it to the other spouse's debt.

How do I complete the TurboTax injured spouse form?

+To complete the TurboTax injured spouse form, you'll need to file a joint tax return, complete Form 8379, and submit it to the IRS along with your joint tax return.

What are the benefits of using the TurboTax injured spouse form?

+Using the TurboTax injured spouse form can provide several benefits, including claiming your share of the refund, avoiding debt, and simplifying the process.