In the world of real estate and mortgage financing, there are numerous forms and documents that play a crucial role in the process. One such form is Form 72 Freddie Mac, also known as the Uniform Residential Loan Application. This form is a standardized document used by Freddie Mac, a government-sponsored enterprise that provides liquidity to the mortgage market, to collect information from borrowers who are seeking to obtain a mortgage loan. In this article, we will delve into the requirements of Form 72 Freddie Mac and provide a comprehensive understanding of its significance in the mortgage lending process.

Freddie Mac is a vital component of the US mortgage market, providing financing for millions of homebuyers and renters. To ensure that borrowers are able to obtain mortgage loans that meet their needs, Freddie Mac requires lenders to use Form 72, which is designed to provide a clear and consistent format for collecting borrower information.

What is Form 72 Freddie Mac?

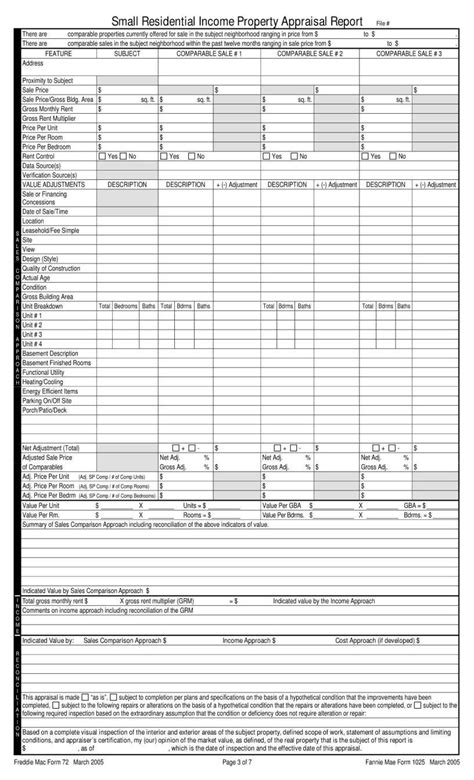

Form 72 Freddie Mac is a four-page document that requires borrowers to provide detailed information about their income, employment, assets, credit history, and other relevant factors. The form is used to assess the borrower's creditworthiness and determine their eligibility for a mortgage loan. Lenders use the information provided on Form 72 to evaluate the borrower's ability to repay the loan and make informed decisions about loan approval.

Key Components of Form 72 Freddie Mac

Form 72 Freddie Mac consists of several key components that lenders use to evaluate borrower creditworthiness. These components include:

- Borrower information: name, address, Social Security number, and date of birth

- Employment information: job title, employer, income, and length of employment

- Income information: gross income, net income, and sources of income

- Asset information: bank accounts, investments, and other assets

- Credit history: credit score, credit accounts, and payment history

- Loan information: loan amount, interest rate, and loan term

Benefits of Using Form 72 Freddie Mac

The use of Form 72 Freddie Mac offers several benefits to lenders, borrowers, and the mortgage industry as a whole. Some of the key benefits include:

- Standardization: Form 72 provides a standardized format for collecting borrower information, making it easier for lenders to evaluate creditworthiness and make informed loan decisions.

- Efficiency: The use of Form 72 streamlines the loan application process, reducing the time and effort required to gather borrower information.

- Accuracy: The form helps to ensure that lenders collect accurate and complete information from borrowers, reducing the risk of errors and misrepresentations.

- Compliance: Form 72 helps lenders to comply with regulatory requirements and industry standards, reducing the risk of non-compliance and reputational damage.

Requirements for Completing Form 72 Freddie Mac

To complete Form 72 Freddie Mac, borrowers must provide accurate and complete information about their financial situation. Lenders must also ensure that the form is completed correctly and that all required information is provided. Some of the key requirements for completing Form 72 include:

- Borrowers must sign and date the form

- Lenders must verify borrower information through documentation and credit reports

- The form must be completed in its entirety, with all required information provided

- Borrowers must disclose all relevant financial information, including income, assets, and credit history

Consequences of Inaccurate or Incomplete Form 72 Freddie Mac

Inaccurate or incomplete information on Form 72 Freddie Mac can have serious consequences for borrowers and lenders. Some of the potential consequences include:

- Loan denial: Inaccurate or incomplete information can lead to loan denial, causing borrowers to miss out on mortgage opportunities.

- Delays: Inaccurate or incomplete information can cause delays in the loan processing and approval process, leading to frustration and additional costs for borrowers.

- Regulatory action: Lenders who fail to comply with regulatory requirements and industry standards may face regulatory action, including fines and reputational damage.

- Reputation damage: Borrowers who provide inaccurate or incomplete information may damage their credit reputation, making it more difficult to obtain mortgage loans in the future.

Tips for Completing Form 72 Freddie Mac

To ensure that Form 72 Freddie Mac is completed accurately and correctly, borrowers and lenders should follow these tips:

- Read the form carefully: Borrowers should read the form carefully and ensure that they understand what information is required.

- Provide accurate information: Borrowers must provide accurate and complete information about their financial situation.

- Verify information: Lenders must verify borrower information through documentation and credit reports.

- Use clear and concise language: Borrowers should use clear and concise language when completing the form, avoiding ambiguity and confusion.

Conclusion

Form 72 Freddie Mac is a critical component of the mortgage lending process, providing lenders with the information they need to evaluate borrower creditworthiness and make informed loan decisions. By understanding the requirements of Form 72 and providing accurate and complete information, borrowers can increase their chances of obtaining a mortgage loan and achieving their homeownership goals. Lenders must also ensure that the form is completed correctly and that all required information is provided, to avoid regulatory action and reputational damage.

We invite you to share your thoughts and experiences with Form 72 Freddie Mac. Have you encountered any challenges or obstacles when completing the form? Do you have any tips or advice for borrowers and lenders? Share your comments below and let's continue the conversation.

FAQ Section:

What is the purpose of Form 72 Freddie Mac?

+Form 72 Freddie Mac is used to collect information from borrowers who are seeking to obtain a mortgage loan. The form is designed to provide a clear and consistent format for collecting borrower information, which lenders use to evaluate creditworthiness and make informed loan decisions.

What information is required on Form 72 Freddie Mac?

+Form 72 Freddie Mac requires borrowers to provide detailed information about their income, employment, assets, credit history, and other relevant factors. The form consists of several key components, including borrower information, employment information, income information, asset information, and credit history.

What are the consequences of inaccurate or incomplete Form 72 Freddie Mac?

+Inaccurate or incomplete information on Form 72 Freddie Mac can have serious consequences for borrowers and lenders, including loan denial, delays, regulatory action, and reputation damage.