The world of tax compliance can be a complex and overwhelming one, especially for businesses and individuals who are not familiar with the various forms and regulations that govern the industry. One such form that is crucial for compliance in North Carolina is the NC Dor E-595E form. In this article, we will delve into the details of this form, its purpose, and the steps you need to take to ensure compliance.

The NC Dor E-595E form is a crucial document for businesses and individuals who are required to file taxes in North Carolina. The form is used to report and pay the state's withholding tax, which is a type of tax that is withheld from an employee's wages and paid to the state on their behalf. The form is typically filed on a quarterly basis, and it is essential to understand the requirements and deadlines associated with it to avoid any penalties or fines.

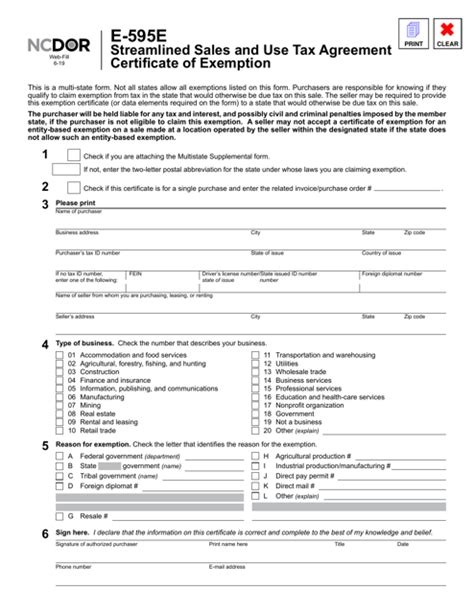

Understanding the NC Dor E-595E Form

The NC Dor E-595E form is a multi-page document that requires businesses and individuals to provide detailed information about their withholding tax obligations. The form is divided into several sections, each of which requires specific information and calculations. The main sections of the form include:

- Business Information: This section requires the business's name, address, and federal tax identification number.

- Withholding Tax Liability: This section requires the calculation of the business's withholding tax liability, which is based on the amount of wages paid to employees during the quarter.

- Payment Information: This section requires the payment of the withholding tax liability, which can be made by check or electronic funds transfer.

Benefits of Filing the NC Dor E-595E Form

Filing the NC Dor E-595E form is essential for businesses and individuals who are required to file taxes in North Carolina. Some of the benefits of filing this form include:

- Avoidance of Penalties: Filing the form on time and accurately can help avoid penalties and fines associated with late or incorrect filing.

- Compliance with State Regulations: Filing the form demonstrates compliance with state regulations and requirements, which can help avoid any potential issues or audits.

- Accurate Record-Keeping: Filing the form requires accurate record-keeping, which can help businesses and individuals keep track of their withholding tax obligations and payments.

Steps to File the NC Dor E-595E Form

Filing the NC Dor E-595E form requires several steps, which are outlined below:

- Obtain the Form: The form can be obtained from the North Carolina Department of Revenue website or by contacting the department directly.

- Gather Required Information: Gather all the required information, including business information, withholding tax liability, and payment information.

- Complete the Form: Complete the form accurately and in its entirety, making sure to sign and date it.

- Submit the Form: Submit the form to the North Carolina Department of Revenue by the required deadline, which is typically the last day of the month following the end of the quarter.

- Make Payment: Make payment of the withholding tax liability, which can be made by check or electronic funds transfer.

Common Mistakes to Avoid

When filing the NC Dor E-595E form, it is essential to avoid common mistakes that can result in penalties or fines. Some of the common mistakes to avoid include:

- Late Filing: Filing the form late can result in penalties and fines, so it is essential to file the form by the required deadline.

- Inaccurate Information: Providing inaccurate information can result in penalties and fines, so it is essential to ensure that all information is accurate and complete.

- Insufficient Payment: Making insufficient payment can result in penalties and fines, so it is essential to ensure that the correct amount is paid.

Conclusion

In conclusion, the NC Dor E-595E form is a crucial document for businesses and individuals who are required to file taxes in North Carolina. By understanding the purpose and requirements of the form, businesses and individuals can ensure compliance with state regulations and avoid any potential penalties or fines. Remember to file the form accurately and on time, and make payment of the withholding tax liability to avoid any issues.

We hope this guide has been informative and helpful in understanding the NC Dor E-595E form. If you have any questions or need further assistance, please do not hesitate to contact us.

What is the NC Dor E-595E form used for?

+The NC Dor E-595E form is used to report and pay the state's withholding tax, which is a type of tax that is withheld from an employee's wages and paid to the state on their behalf.

How often do I need to file the NC Dor E-595E form?

+The NC Dor E-595E form is typically filed on a quarterly basis, with deadlines being the last day of the month following the end of the quarter.

What are the consequences of late filing or non-compliance?

+Late filing or non-compliance can result in penalties and fines, so it is essential to file the form accurately and on time, and make payment of the withholding tax liability.