The world of tax preparation can be complex and time-consuming, especially when it comes to filing Form 1041, the U.S. Income Tax Return for Estates and Trusts. As an executor, trustee, or tax professional, you need to ensure that you are using the most efficient and accurate software solutions to prepare and file these returns. In this article, we will explore the top 5 Form 1041 software solutions that can help you streamline your workflow, reduce errors, and stay compliant with the IRS.

The Importance of Accurate Form 1041 Preparation

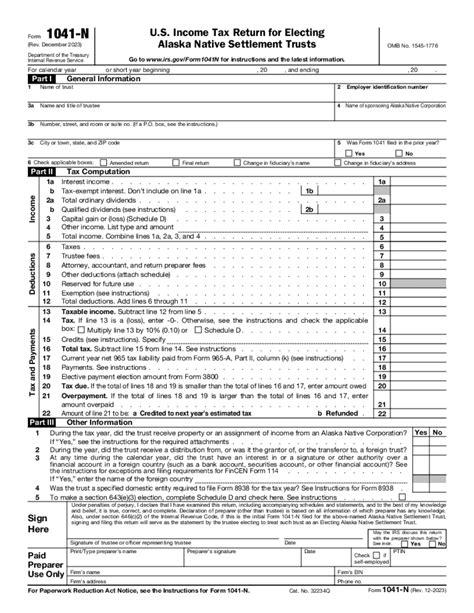

Form 1041 is a critical tax return that requires careful preparation and attention to detail. The IRS requires estates and trusts to file this return annually, reporting income, deductions, and credits. Accurate preparation is essential to avoid penalties, interest, and potential audits. With the right software solution, you can ensure that your Form 1041 returns are prepared correctly, reducing the risk of errors and delays.

Top 5 Form 1041 Software Solutions

Here are the top 5 Form 1041 software solutions that can help you prepare and file accurate returns:

1. TaxAct Professional

TaxAct Professional is a comprehensive tax preparation software that includes Form 1041 preparation and filing. This software is designed for tax professionals and offers advanced features, such as automated calculations, data import, and e-filing.

- Key features: Automated calculations, data import, e-filing, and unlimited returns

- Benefits: Streamlined workflow, reduced errors, and cost-effective

- Pricing: Competitive pricing for tax professionals, with discounts for bulk purchases

2. Drake Tax

Drake Tax is a popular tax preparation software that includes Form 1041 preparation and filing. This software is designed for tax professionals and offers advanced features, such as automated calculations, data import, and e-filing.

- Key features: Automated calculations, data import, e-filing, and integrated research library

- Benefits: Efficient workflow, reduced errors, and comprehensive research library

- Pricing: Competitive pricing for tax professionals, with discounts for bulk purchases

3. ATX Tax Software

ATX Tax Software is a comprehensive tax preparation software that includes Form 1041 preparation and filing. This software is designed for tax professionals and offers advanced features, such as automated calculations, data import, and e-filing.

- Key features: Automated calculations, data import, e-filing, and integrated research library

- Benefits: Streamlined workflow, reduced errors, and comprehensive research library

- Pricing: Competitive pricing for tax professionals, with discounts for bulk purchases

4. CCH Axcess Tax

CCH Axcess Tax is a cloud-based tax preparation software that includes Form 1041 preparation and filing. This software is designed for tax professionals and offers advanced features, such as automated calculations, data import, and e-filing.

- Key features: Automated calculations, data import, e-filing, and integrated research library

- Benefits: Efficient workflow, reduced errors, and comprehensive research library

- Pricing: Competitive pricing for tax professionals, with discounts for bulk purchases

5. GoSystem Tax RS

GoSystem Tax RS is a comprehensive tax preparation software that includes Form 1041 preparation and filing. This software is designed for tax professionals and offers advanced features, such as automated calculations, data import, and e-filing.

- Key features: Automated calculations, data import, e-filing, and integrated research library

- Benefits: Streamlined workflow, reduced errors, and comprehensive research library

- Pricing: Competitive pricing for tax professionals, with discounts for bulk purchases

Conclusion and Next Steps

Choosing the right Form 1041 software solution can significantly impact your workflow, accuracy, and compliance. By considering the top 5 software solutions outlined in this article, you can make an informed decision that meets your specific needs. Take the next step by exploring each software solution in more detail, and don't hesitate to contact the providers for a demo or trial.

FAQs

What is Form 1041?

+Form 1041 is the U.S. Income Tax Return for Estates and Trusts, which must be filed annually by estates and trusts.

Who needs to file Form 1041?

+Estates and trusts must file Form 1041 annually, reporting income, deductions, and credits.

What are the benefits of using Form 1041 software?

+Form 1041 software can help streamline your workflow, reduce errors, and ensure compliance with the IRS.