Filing corporate taxes can be a daunting task, especially for those who are new to the process. As a corporate taxpayer, it's essential to understand the Form 1120-PC instructions to ensure accurate and timely filing. In this article, we'll break down the Form 1120-PC instructions into a step-by-step guide, covering the essential information you need to know.

Why Accurate Corporate Tax Filing Matters

Accurate corporate tax filing is crucial for avoiding penalties, fines, and potential audits. The IRS takes tax compliance seriously, and failure to follow the correct procedures can result in severe consequences. Moreover, accurate filing helps you avoid overpaying taxes, which can negatively impact your business's bottom line. By understanding the Form 1120-PC instructions, you'll be able to navigate the corporate tax filing process with confidence.

What is Form 1120-PC?

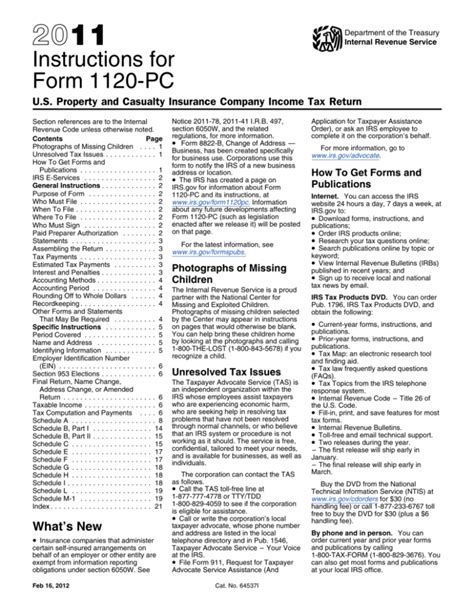

Form 1120-PC is a corporate income tax return filed by property and casualty insurance companies. This form is used to report the company's income, deductions, and credits for the tax year. The form is comprised of multiple schedules and attachments, which provide detailed information about the company's financial activities.

Step 1: Gather Required Documents and Information

Before starting the filing process, gather all necessary documents and information, including:

- Company financial statements (balance sheet and income statement)

- Tax returns from previous years

- W-2 and 1099 forms for employees and contractors

- Depreciation schedules

- Business expense records

Step 2: Complete the Form 1120-PC

The Form 1120-PC is divided into several sections, including:

- Part I: Income: Report the company's gross income from various sources, such as premiums earned and investment income.

- Part II: Deductions: Claim deductions for business expenses, such as salaries, wages, and benefits.

- Part III: Tax and Credits: Calculate the company's tax liability and claim credits for items like foreign tax credits.

Step 3: Complete Schedules and Attachments

In addition to the main form, you'll need to complete various schedules and attachments, including:

- Schedule A: Cost of Goods Sold: Report the company's cost of goods sold, including direct costs and indirect costs.

- Schedule D: Capital Gains and Losses: Report the company's capital gains and losses from the sale of assets.

- Schedule K: Other Information: Provide additional information about the company's financial activities, such as related-party transactions.

Step 4: Calculate Tax Liability and Credits

Using the information from the previous steps, calculate the company's tax liability and claim credits. This includes:

- Tax Liability: Calculate the company's total tax liability based on its taxable income.

- Credits: Claim credits for items like foreign tax credits, research and development credits, and other applicable credits.

Step 5: Review and Sign the Return

Carefully review the completed return for accuracy and completeness. Ensure that all required schedules and attachments are included. Once satisfied, sign and date the return.

Conclusion

Filing corporate taxes can be a complex process, but by following the Form 1120-PC instructions, you'll be able to navigate the process with confidence. Remember to gather all necessary documents and information, complete the form accurately, and review the return carefully before signing. By doing so, you'll avoid potential penalties and fines, ensuring a smooth and stress-free filing experience.

FAQs

What is the deadline for filing Form 1120-PC?

+The deadline for filing Form 1120-PC is typically March 15th for calendar-year taxpayers. However, this deadline may vary depending on the company's fiscal year-end.

Can I file Form 1120-PC electronically?

+What are the penalties for late filing of Form 1120-PC?

+The penalties for late filing of Form 1120-PC can be significant, including a penalty of 5% of the unpaid tax for each month or part of a month, up to a maximum of 25%. Additionally, you may be subject to interest on the unpaid tax.