The annual ritual of filing taxes can be a daunting task for many individuals. One of the most common forms used for personal income tax returns is the IRS Form 1040. In this comprehensive guide, we will walk you through the process of filling out the Form 1040, making it easier for you to navigate the complex world of tax filing.

Understanding the Importance of Form 1040

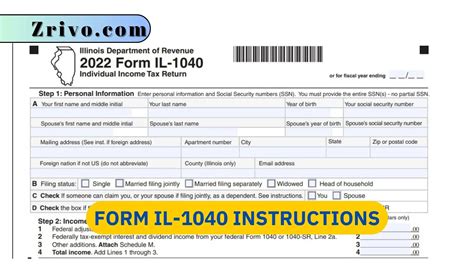

The Form 1040 is the standard form used by the Internal Revenue Service (IRS) for personal income tax returns. It is used to report an individual's income, claim deductions and credits, and calculate their tax liability. The form is typically filed by April 15th of each year, covering the income earned in the previous tax year.

Benefits of Filing Form 1040

Filing Form 1040 has numerous benefits, including:

- Reporting income: Accurately reporting your income helps you avoid any potential penalties or fines.

- Claiming deductions and credits: By claiming eligible deductions and credits, you can reduce your tax liability and potentially receive a refund.

- Calculating tax liability: Filing Form 1040 helps you determine your tax liability, ensuring you pay the correct amount of taxes.

Who Needs to File Form 1040?

Not everyone needs to file Form 1040. The following individuals are required to file:

- U.S. citizens or resident aliens with a gross income above a certain threshold (typically $12,950 for single filers and $25,900 for joint filers).

- Self-employed individuals with a net earnings from self-employment of $400 or more.

- Individuals who received unemployment compensation.

- Individuals who received dividends or capital gains income.

Step-by-Step Guide to Filing Form 1040

To make the filing process easier, we have broken it down into a step-by-step guide. Follow these steps to ensure accurate and complete filing.

Step 1: Gather Required Documents

Before starting the filing process, gather the necessary documents:

- W-2 forms from employers

- 1099 forms for freelance work or other income

- Interest statements from banks and investments

- Dividend statements

- Charitable donation receipts

- Medical expense records

Step 2: Determine Your Filing Status

Your filing status affects your tax liability. Choose from the following:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Step 3: Report Income

Report all income earned during the tax year, including:

- Wages, salaries, and tips

- Self-employment income

- Interest and dividends

- Capital gains

- Unemployment compensation

Step 4: Claim Deductions and Credits

Claim eligible deductions and credits to reduce your tax liability:

- Standard deduction or itemized deductions

- Personal exemptions

- Mortgage interest and property taxes

- Charitable donations

- Earned Income Tax Credit (EITC)

Step 5: Calculate Tax Liability

Calculate your tax liability using the tax tables or the IRS's online tax calculator.

Step 6: Complete Schedules and Attachments

Complete any required schedules and attachments, such as:

- Schedule A for itemized deductions

- Schedule B for interest and dividends

- Schedule C for business income and expenses

- Form 8962 for Premium Tax Credit

Step 7: Sign and Date the Form

Sign and date the Form 1040, ensuring it is accurate and complete.

Step 8: File the Form

File the Form 1040 by the deadline (April 15th) using one of the following methods:

- E-file through the IRS website or a tax software provider

- Mail a paper copy to the IRS address listed in the instructions

Tips and Tricks for Filing Form 1040

To make the filing process smoother, keep the following tips in mind:

- Use tax software to simplify the process and reduce errors.

- Double-check calculations and ensure accuracy.

- Keep records of supporting documents for at least three years.

- Consider hiring a tax professional if you are unsure about the filing process.

Common Mistakes to Avoid

Avoid common mistakes that can delay processing or result in penalties:

- Inaccurate or missing Social Security numbers

- Incorrect filing status

- Failure to report income

- Incomplete or missing schedules and attachments

IRS Form 1040A and Form 1040EZ

The IRS also offers Form 1040A and Form 1040EZ for simpler tax returns:

- Form 1040A: For individuals with no dependents and limited income sources.

- Form 1040EZ: For single filers with no dependents and limited income sources.

These forms are designed for individuals with straightforward tax situations, but it is essential to ensure you meet the eligibility requirements before using them.

Audit and Amended Returns

If you are audited or need to make changes to your return, follow these steps:

- Respond to audit notices promptly and provide required documentation.

- File Form 1040X to amend your return, if necessary.

Conclusion

Filing Form 1040 can seem overwhelming, but breaking it down into smaller steps makes the process more manageable. By following this guide and staying informed about tax laws and regulations, you can ensure accurate and complete filing. Remember to take advantage of deductions and credits, and seek professional help if needed.

What is the deadline for filing Form 1040?

+The deadline for filing Form 1040 is typically April 15th of each year.

Do I need to file Form 1040 if I am self-employed?

+Yes, self-employed individuals must file Form 1040 and report their net earnings from self-employment.