New York withholding tax is a crucial aspect of state taxation that affects both employers and employees. For employers, it's essential to understand the process of filing New York withholding tax form to avoid penalties and ensure compliance with state regulations. In this article, we will explore the different ways to file New York withholding tax form, providing you with a comprehensive guide to navigate this complex process.

Understanding New York Withholding Tax

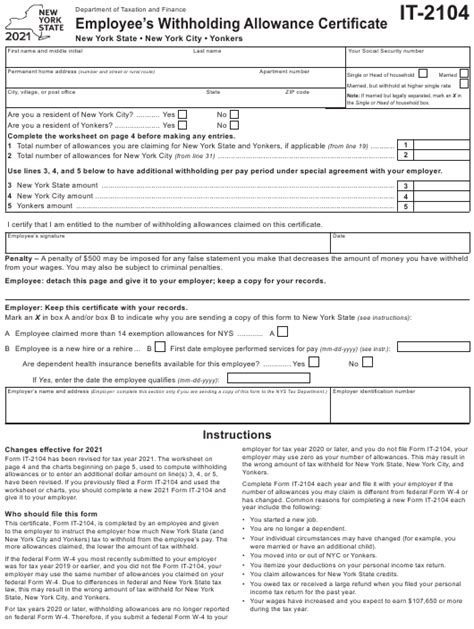

Before diving into the filing process, it's essential to understand the basics of New York withholding tax. New York withholding tax is a state tax that employers must withhold from their employees' wages and remit to the state. The tax rate varies depending on the employee's income level and tax filing status. Employers must file a withholding tax return with the New York State Department of Taxation and Finance (DTF) to report the taxes withheld.

5 Ways to File New York Withholding Tax Form

Fortunately, the DTF offers various options for filing New York withholding tax form, making it convenient for employers to comply with state regulations. Here are five ways to file New York withholding tax form:

Filing Online through the NYS Tax Department Website

The most convenient way to file New York withholding tax form is through the NYS Tax Department website. Employers can file online using the Web File system, which is available 24/7. To file online, employers need to create an account, gather required documents, and follow the online instructions.

Benefits of Online Filing

- Fast and convenient

- 24/7 availability

- Automatic calculation of tax due

- Option to schedule payment

Filing by Phone

Employers can also file New York withholding tax form by phone using the DTF's automated phone system. This option is available Monday through Friday, 8:00 AM to 5:00 PM. To file by phone, employers need to have their tax information ready and follow the phone prompts.

Benefits of Phone Filing

- Convenient for those without internet access

- Quick and easy

- Option to schedule payment

Filing by Mail

Employers can also file New York withholding tax form by mail using a paper return. This option is available for those who prefer to file manually or do not have access to the internet. To file by mail, employers need to complete the required forms, attach supporting documents, and mail the return to the DTF.

Benefits of Mail Filing

- Option for those without internet access

- Paper trail for record-keeping

- Can be more secure than online filing

Filing through a Tax Professional

Employers can also hire a tax professional to file New York withholding tax form on their behalf. This option is ideal for those who are not familiar with the filing process or prefer to outsource their tax compliance. Tax professionals can ensure accuracy and timeliness of the filing.

Benefits of Filing through a Tax Professional

- Expert knowledge of tax laws and regulations

- Time-saving and convenient

- Reduced risk of errors and penalties

Filing through a Third-Party Software Provider

Finally, employers can also file New York withholding tax form through a third-party software provider. This option is ideal for those who use payroll software or other tax compliance solutions. Third-party software providers can ensure accuracy and timeliness of the filing.

Benefits of Filing through a Third-Party Software Provider

- Integration with payroll software

- Automatic calculation of tax due

- Option to schedule payment

Conclusion

Filing New York withholding tax form is a critical aspect of state taxation that requires attention to detail and timely compliance. By understanding the different ways to file New York withholding tax form, employers can choose the method that best suits their needs. Whether filing online, by phone, by mail, through a tax professional, or through a third-party software provider, employers can ensure accuracy and timeliness of their tax compliance.

What's Next?

Take the first step towards compliance by selecting a filing method that works for you. If you have any questions or concerns, feel free to comment below or share this article with your network.

FAQ Section

What is the deadline for filing New York withholding tax form?

+The deadline for filing New York withholding tax form is the 15th day of the month following the end of the quarter.

Can I file New York withholding tax form online?

+What is the penalty for late filing of New York withholding tax form?

+The penalty for late filing of New York withholding tax form is 5% of the tax due, plus interest.