As a business owner in Wisconsin, it's essential to understand the importance of filing taxes correctly to avoid penalties and ensure compliance with state regulations. One of the most critical tax forms for Wisconsin businesses is the ST-12, also known as the Wisconsin Sales and Use Tax Return. In this article, we will provide you with five valuable tips to help you file Wisconsin Form ST-12 correctly and avoid common mistakes.

Understanding the Purpose of Form ST-12

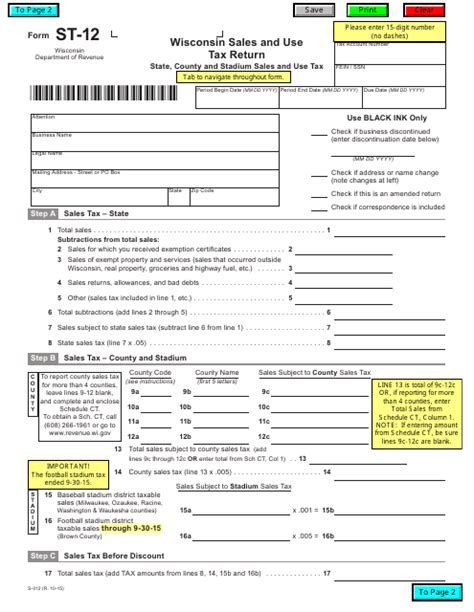

Before we dive into the tips, it's crucial to understand the purpose of Form ST-12. This form is used to report and pay sales and use taxes to the Wisconsin Department of Revenue. As a business owner, you are required to file this form if you have a sales tax permit or use tax certificate and have made taxable sales or purchases during the reporting period.

Tip 1: Ensure Accurate Reporting of Sales and Use Tax

One of the most critical aspects of filing Form ST-12 is accurately reporting sales and use tax. This includes reporting all taxable sales, including those made online, and any use tax due on purchases. To ensure accuracy, it's essential to maintain detailed records of all sales and purchases, including invoices, receipts, and bank statements.

Common Mistakes to Avoid

- Failing to report all taxable sales, including online sales

- Not reporting use tax on purchases

- Incorrectly calculating sales and use tax due

Tip 2: Understand the Different Types of Sales and Use Tax

Wisconsin has different types of sales and use tax, including:

- Sales tax: Tax on sales of tangible personal property and certain services

- Use tax: Tax on the use of tangible personal property and certain services

- Exempt sales: Sales that are exempt from sales tax

It's essential to understand the different types of sales and use tax to ensure accurate reporting and compliance with state regulations.

Exempt Sales

- Sales of food and food ingredients for human consumption

- Sales of prescription drugs and medical equipment

- Sales of machinery and equipment used in manufacturing

Tip 3: File Form ST-12 on Time

Form ST-12 is due on the 20th day of the month following the end of the reporting period. It's essential to file the form on time to avoid penalties and interest.

Penalties for Late Filing

- 5% of the tax due for each month or fraction of a month, up to a maximum of 25%

Tip 4: Use the Correct Filing Frequency

The filing frequency for Form ST-12 depends on the amount of sales and use tax due. The Wisconsin Department of Revenue provides the following filing frequencies:

- Monthly: If the tax due is $1,000 or more per month

- Quarterly: If the tax due is less than $1,000 per month

It's essential to use the correct filing frequency to avoid penalties and ensure compliance with state regulations.

Consequences of Incorrect Filing Frequency

- Penalties and interest on underpaid tax

- Delayed refunds

Tip 5: Seek Professional Help if Needed

Filing Form ST-12 can be complex, especially for businesses with multiple locations or complex tax situations. If you're unsure about how to file the form or need help with a specific issue, it's essential to seek professional help.

Benefits of Seeking Professional Help

- Accurate reporting and compliance with state regulations

- Minimized risk of penalties and interest

- Maximized refunds

By following these five tips, you can ensure accurate and timely filing of Wisconsin Form ST-12 and avoid common mistakes that can result in penalties and interest.

Take Action Today!

Don't wait until the last minute to file Form ST-12. Take action today by reviewing your sales and use tax records, understanding the different types of sales and use tax, and seeking professional help if needed. By doing so, you can ensure compliance with state regulations and minimize the risk of penalties and interest.

What is the purpose of Form ST-12?

+Form ST-12 is used to report and pay sales and use taxes to the Wisconsin Department of Revenue.

What is the deadline for filing Form ST-12?

+Form ST-12 is due on the 20th day of the month following the end of the reporting period.

What are the consequences of incorrect filing frequency?

+The consequences of incorrect filing frequency include penalties and interest on underpaid tax and delayed refunds.