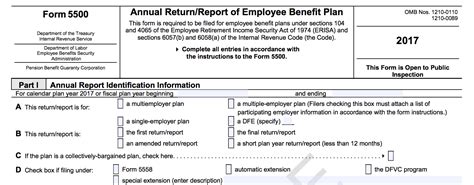

Mastering Form 5500 instructions is a crucial step for plan administrators and sponsors of employee benefit plans, as it ensures compliance with the Employee Retirement Income Security Act of 1974 (ERISA) and the Internal Revenue Code. The Form 5500 is an annual information return that must be filed with the Department of Labor (DOL) and the Internal Revenue Service (IRS) to report the financial condition and operations of employee benefit plans. In this article, we will provide a step-by-step guide to help you master Form 5500 instructions and ensure accurate and timely filing.

Understanding the Purpose and Scope of Form 5500

The Form 5500 is a critical reporting requirement for employee benefit plans, including pension, health, and welfare plans. The purpose of the form is to provide the DOL and the IRS with information about the plan's financial condition, investments, and operations. The form is used to monitor plan compliance with ERISA and the Internal Revenue Code, and to identify potential issues or abuses.

Who Must File Form 5500?

Form 5500 must be filed by plan administrators and sponsors of employee benefit plans, including:

- Pension plans, such as 401(k) and defined benefit plans

- Health plans, such as group health insurance plans

- Welfare plans, such as life insurance and disability plans

- Multiemployer plans, such as union plans

- Governmental plans, such as federal, state, and local government plans

Step 1: Determine the Filing Deadline and Requirements

The Form 5500 filing deadline is typically July 31st of each year, with an option to file an extension until October 15th. However, the filing requirements may vary depending on the type of plan and the number of participants. For example, small plans with fewer than 100 participants may be eligible for simplified reporting requirements.

Filing Requirements

The Form 5500 requires plan administrators and sponsors to provide detailed information about the plan's financial condition, investments, and operations. The form must be filed electronically through the DOL's EFAST2 system, and must include the following information:

- Plan name and number

- Plan administrator and sponsor information

- Number of participants and beneficiaries

- Plan assets and liabilities

- Investment information

- Administrative expenses

- Claims and benefit payments

Step 2: Gather Required Documents and Information

To complete the Form 5500, plan administrators and sponsors must gather a range of documents and information, including:

- Plan documents, such as the plan instrument and summary plan description

- Financial statements, such as the plan's balance sheet and income statement

- Investment information, such as account statements and investment reports

- Administrative expense records, such as invoices and payment records

- Claims and benefit payment records

Best Practices for Document Management

To ensure accurate and timely filing, plan administrators and sponsors should implement best practices for document management, including:

- Maintaining a centralized document management system

- Ensuring timely and accurate updating of plan documents and records

- Implementing a secure and confidential storage system for sensitive information

Step 3: Complete the Form 5500

Once the required documents and information have been gathered, plan administrators and sponsors can complete the Form 5500. The form consists of several schedules and attachments, including:

- Schedule H: Financial Information

- Schedule I: Insurance Information

- Schedule R: Retirement Plan Information

- Attachment 1: Plan Administrator and Sponsor Information

- Attachment 2: Plan Documents

Common Filing Mistakes to Avoid

Plan administrators and sponsors should be aware of common filing mistakes to avoid, including:

- Inaccurate or incomplete information

- Failure to file required schedules and attachments

- Late or untimely filing

- Failure to maintain required records and documentation

Step 4: Review and Edit the Form 5500

Before filing the Form 5500, plan administrators and sponsors should review and edit the form to ensure accuracy and completeness. This includes:

- Verifying plan information and financial data

- Reviewing schedules and attachments for completeness

- Checking for mathematical errors and inconsistencies

Best Practices for Quality Control

To ensure high-quality filing, plan administrators and sponsors should implement best practices for quality control, including:

- Conducting regular audits and reviews of plan documents and records

- Implementing a system of checks and balances to prevent errors

- Providing training and support for plan administrators and sponsors

Step 5: File the Form 5500 Electronically

The Form 5500 must be filed electronically through the DOL's EFAST2 system. Plan administrators and sponsors can file the form themselves or engage a third-party service provider.

Electronic Filing Requirements

Electronic filing requires plan administrators and sponsors to:

- Register for an EFAST2 account

- Obtain a PIN and password

- Submit the Form 5500 and required schedules and attachments

- Receive confirmation of filing

Step 6: Maintain Required Records and Documentation

Plan administrators and sponsors must maintain required records and documentation to support the Form 5500 filing. This includes:

- Plan documents and records

- Financial statements and reports

- Investment information and records

- Administrative expense records

Best Practices for Record-Keeping

To ensure compliance and accuracy, plan administrators and sponsors should implement best practices for record-keeping, including:

- Maintaining a centralized document management system

- Ensuring timely and accurate updating of plan documents and records

- Implementing a secure and confidential storage system for sensitive information

Step 7: Respond to DOL and IRS Inquiries

Plan administrators and sponsors must respond to DOL and IRS inquiries and requests for information. This includes:

- Responding to audit requests and inquiries

- Providing additional information and documentation

- Correcting errors and omissions

Best Practices for Responding to Inquiries

To ensure timely and accurate response to DOL and IRS inquiries, plan administrators and sponsors should implement best practices, including:

- Maintaining open communication with the DOL and IRS

- Providing clear and concise responses to inquiries

- Engaging a third-party service provider to assist with responses

Who must file Form 5500?

+Form 5500 must be filed by plan administrators and sponsors of employee benefit plans, including pension, health, and welfare plans.

What is the filing deadline for Form 5500?

+The Form 5500 filing deadline is typically July 31st of each year, with an option to file an extension until October 15th.

How do I file Form 5500 electronically?

+The Form 5500 must be filed electronically through the DOL's EFAST2 system. Plan administrators and sponsors can file the form themselves or engage a third-party service provider.

In conclusion, mastering Form 5500 instructions is a critical step for plan administrators and sponsors of employee benefit plans. By following these 7 steps, you can ensure accurate and timely filing, and maintain compliance with ERISA and the Internal Revenue Code.