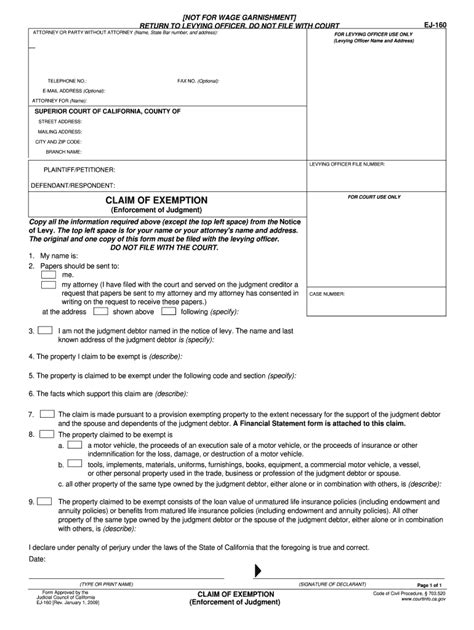

Filing a claim of exemption is a crucial step in the legal process, allowing individuals to protect their assets from creditors or debt collectors. The Claim of Exemption form, also known as form EJ-160, is a standardized document used in the state of California to facilitate this process. In this article, we will guide you through the 5 essential steps to fill out the Claim of Exemption form EJ-160 accurately and efficiently.

Understanding the Claim of Exemption Process

Before diving into the steps, it's essential to understand the purpose of the Claim of Exemption form. This document allows individuals to claim exemptions on specific assets, such as primary residences, personal effects, or retirement accounts, which are protected by law from creditor claims. By filing this form, individuals can safeguard their essential assets and ensure a stable financial foundation.

Step 1: Gathering Required Information and Documents

To fill out the Claim of Exemption form EJ-160, you will need to gather the necessary information and documents. These may include:

- Your name and contact information

- The case number and court name associated with the claim

- A list of the assets you wish to claim exemptions for, including descriptions and values

- Supporting documentation, such as receipts, invoices, or account statements

Step 2: Identifying Exempt Assets and Completing Section 1

Section 1 of the Claim of Exemption form EJ-160 requires you to identify the assets you wish to claim exemptions for. These may include:

- Primary residence (up to a certain value)

- Personal effects, such as household items, clothing, or jewelry

- Retirement accounts, including 401(k), IRA, or pension plans

- Other exempt assets, such as burial plots or cemetery lots

Be sure to accurately describe each asset and provide its corresponding value.

Types of Exempt Assets

- Primary residence

- Personal effects

- Retirement accounts

- Other exempt assets

Step 3: Completing Sections 2 and 3

Sections 2 and 3 of the Claim of Exemption form EJ-160 require you to provide additional information about the assets you are claiming exemptions for. This may include:

- The location and address of the exempt assets

- The date and method of acquisition

- Any outstanding debts or liens associated with the assets

Be sure to provide accurate and detailed information to avoid any potential issues with your claim.

Step 4: Signing and Dating the Form

Once you have completed the Claim of Exemption form EJ-160, be sure to sign and date it. This is a critical step, as an unsigned or undated form may be deemed invalid.

Step 5: Filing the Claim of Exemption Form

The final step is to file the completed Claim of Exemption form EJ-160 with the court. Be sure to follow the court's specific filing procedures and requirements, including any applicable filing fees.

Common Mistakes to Avoid When Filing a Claim of Exemption

- Failing to accurately identify exempt assets

- Providing incomplete or inaccurate information

- Failing to sign and date the form

- Missing the filing deadline

Conclusion: Final Thoughts and Next Steps

Filing a Claim of Exemption form EJ-160 is a crucial step in protecting your assets from creditor claims. By following these 5 essential steps, you can ensure a smooth and efficient process. Remember to gather all required information and documents, accurately complete the form, and file it with the court in a timely manner. If you are unsure about any aspect of the process, consider consulting with a qualified attorney or financial advisor.

Additional Resources

- California Courts: Claim of Exemption Form EJ-160

- California Department of Finance: Exemptions from Creditors

- National Foundation for Credit Counseling: Credit Counseling and Debt Management

FAQ Section

What is a Claim of Exemption form EJ-160?

+A Claim of Exemption form EJ-160 is a standardized document used in the state of California to claim exemptions on specific assets, such as primary residences, personal effects, or retirement accounts, which are protected by law from creditor claims.

What are the most common types of exempt assets?

+The most common types of exempt assets include primary residence, personal effects, retirement accounts, and other exempt assets, such as burial plots or cemetery lots.

How do I file a Claim of Exemption form EJ-160?

+To file a Claim of Exemption form EJ-160, you will need to complete the form accurately, sign and date it, and file it with the court in a timely manner. Be sure to follow the court's specific filing procedures and requirements, including any applicable filing fees.