As we navigate the complexities of retirement planning, it's essential to understand the various financial tools at our disposal. One such tool is the AIG annuity withdrawal form, which allows individuals to access their annuity funds when needed. In this article, we'll delve into the world of annuities, exploring the benefits and processes surrounding AIG annuity withdrawals. Whether you're a seasoned investor or just starting to plan for retirement, this guide will walk you through the steps involved in withdrawing from your AIG annuity.

Annuities have become a popular choice for retirees seeking a steady income stream during their golden years. By providing a predictable revenue source, annuities can help alleviate concerns about outliving one's assets. AIG, a leading insurance company, offers a range of annuity products designed to cater to diverse financial needs. However, accessing these funds requires a thorough understanding of the withdrawal process. In the following sections, we'll break down the AIG annuity withdrawal form, highlighting key aspects and offering practical advice.

Understanding Annuity Withdrawals

Before we dive into the AIG annuity withdrawal form, it's crucial to grasp the basics of annuity withdrawals. When you purchase an annuity, you essentially enter into a contract with the insurance company, exchanging a lump sum or series of payments for a guaranteed income stream. This income can be paid out over a set period or for the rest of your life, depending on the annuity type.

Withdrawals from an annuity can be made in various ways, including:

- Surrender: Withdrawing a portion or the entire annuity value, which may incur surrender charges.

- Systematic withdrawals: Receiving regular payments over a set period or for life.

- Lump-sum withdrawals: Taking a single payment from the annuity.

Each withdrawal method has its implications, and it's essential to understand the terms and conditions of your specific annuity contract.

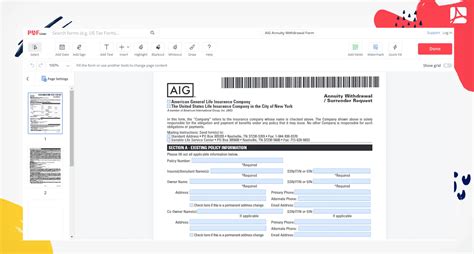

AIG Annuity Withdrawal Form: What You Need to Know

When it comes to withdrawing from an AIG annuity, you'll need to complete the AIG annuity withdrawal form. This document serves as a formal request to access your annuity funds. Here are the key aspects to consider:

- Form requirements: The AIG annuity withdrawal form typically requires your personal and annuity details, including your name, address, annuity contract number, and withdrawal amount.

- Withdrawal options: You'll need to specify the withdrawal method, such as surrender, systematic, or lump-sum.

- Tax implications: Depending on your withdrawal method, you may be subject to tax penalties or income tax on the withdrawn amount.

Step-by-Step Guide to Completing the AIG Annuity Withdrawal Form

To ensure a smooth withdrawal process, follow these steps when completing the AIG annuity withdrawal form:

- Gather required documents: Make sure you have your annuity contract, identification, and any other necessary documents readily available.

- Choose your withdrawal option: Carefully consider your withdrawal method, taking into account any potential tax implications or surrender charges.

- Complete the form: Fill out the AIG annuity withdrawal form accurately, ensuring all required fields are completed.

- Review and sign: Double-check your form for errors, then sign and date it.

- Submit the form: Return the completed form to AIG via mail, fax, or online submission, depending on the available options.

Tips for AIG Annuity Withdrawal Form

To avoid any potential issues or delays, keep the following tips in mind when completing the AIG annuity withdrawal form:

- Understand your annuity contract: Familiarize yourself with the terms and conditions of your annuity contract to avoid any surprises.

- Consult with a financial advisor: If you're unsure about any aspect of the withdrawal process, consider consulting with a financial advisor.

- Carefully review the form: Double-check your form for errors or omissions to avoid delays or rejection.

AIG Annuity Withdrawal Form FAQs

Still have questions about the AIG annuity withdrawal form? Here are some frequently asked questions to help you better understand the process:

- Q: How long does it take to process an AIG annuity withdrawal? A: The processing time may vary depending on the withdrawal method and AIG's internal procedures. Generally, it can take several weeks to a few months.

- Q: Are there any fees associated with AIG annuity withdrawals? A: Yes, you may incur surrender charges, administrative fees, or other expenses, depending on your annuity contract and withdrawal method.

- Q: Can I withdraw from my AIG annuity online? A: AIG may offer online submission options for the annuity withdrawal form. However, it's best to check with their customer service or website to confirm.

Conclusion

Withdrawing from an AIG annuity can be a straightforward process if you understand the requirements and implications. By following the step-by-step guide outlined in this article, you'll be well on your way to completing the AIG annuity withdrawal form. Remember to carefully review your annuity contract, consider seeking professional advice, and ensure accurate completion of the form to avoid any potential issues.

Share your experiences or ask questions about the AIG annuity withdrawal form in the comments section below. Don't forget to share this article with others who may benefit from this information.

What is the AIG annuity withdrawal form?

+The AIG annuity withdrawal form is a document used to request withdrawals from an AIG annuity contract.

How do I submit the AIG annuity withdrawal form?

+You can submit the form via mail, fax, or online submission, depending on the available options.

Are there any fees associated with AIG annuity withdrawals?

+Yes, you may incur surrender charges, administrative fees, or other expenses, depending on your annuity contract and withdrawal method.