Understanding the W-4P form is crucial for individuals receiving pension, annuity, or other deferred compensation payments. This article will guide single individuals through the process of filling out the W-4P form in five easy steps.

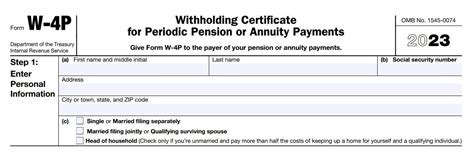

The W-4P form, also known as the "Withholding Certificate for Pension or Annuity Payments," is used by payers to determine the amount of federal income tax to withhold from certain types of payments. The form is typically provided by the payer, but it's essential to understand how to complete it accurately to avoid any potential tax issues.

Completing the W-4P form correctly ensures that the right amount of taxes is withheld from your payments, reducing the likelihood of owing taxes when you file your tax return. In this article, we'll walk you through the process of filling out the W-4P form as a single individual.

Step 1: Determine Your Filing Status

The first step in filling out the W-4P form is to determine your filing status. As a single individual, you will select "Single" under the "Filing Status" section. This information will help determine the amount of taxes to withhold from your payments.

Step 2: Claim Your Allowances

Next, you'll need to claim your allowances. Allowances reduce the amount of taxes withheld from your payments. As a single individual, you are entitled to one allowance. However, you can claim additional allowances if you meet specific conditions, such as having dependents or being eligible for the blind exemption.

To claim additional allowances, you'll need to complete the "Dependents" section and/or check the box indicating you are blind. Keep in mind that claiming too many allowances can result in under-withholding, which may lead to owing taxes when you file your tax return.

Step 3: Report Additional Income or Deductions

In this step, you'll report any additional income or deductions that may affect the amount of taxes withheld from your payments. This includes:

- Other income, such as wages or self-employment income

- Itemized deductions, such as mortgage interest or charitable contributions

- Tax credits, such as the earned income tax credit (EITC)

Reporting additional income or deductions will help ensure that the correct amount of taxes is withheld from your payments.

Step 4: Choose Your Withholding Option

You have two withholding options:

- Option A: Withhold federal income tax based on the standard withholding rate.

- Option B: Withhold federal income tax based on a specific amount or percentage.

If you choose Option B, you'll need to specify the amount or percentage of taxes to withhold. Keep in mind that this option may require additional calculations and may not be suitable for everyone.

Step 5: Sign and Date the Form

The final step is to sign and date the W-4P form. Make sure to review the form carefully before signing to ensure accuracy. If you're completing the form electronically, follow the prompts to sign and date the form digitally.

Tips and Reminders:

- Complete the W-4P form accurately to avoid any potential tax issues.

- Review and update the form as necessary to reflect changes in your income, deductions, or filing status.

- Keep a copy of the completed form for your records.

By following these five easy steps, single individuals can complete the W-4P form with confidence. Remember to review and update the form as necessary to ensure accurate withholding and avoid any potential tax issues.

We hope this article has been helpful in guiding you through the process of filling out the W-4P form as a single individual. If you have any questions or concerns, please leave a comment below or share this article with someone who may find it helpful.

What is the purpose of the W-4P form?

+The W-4P form is used to determine the amount of federal income tax to withhold from pension, annuity, or other deferred compensation payments.

How often do I need to complete the W-4P form?

+You typically need to complete the W-4P form when you start receiving payments or when your filing status, income, or deductions change.

Can I claim additional allowances on the W-4P form?

+Yes, you can claim additional allowances if you meet specific conditions, such as having dependents or being eligible for the blind exemption.