New York State income tax returns are due on April 15th of each year, but sometimes taxpayers may need more time to gather necessary documents or address complex tax issues. If you're a New York State taxpayer who needs more time to file your return, you'll need to submit a New York State income tax extension form. In this article, we'll break down the process of filing a New York State income tax extension form, making it easy for you to navigate the process.

Why File a New York State Income Tax Extension?

There are several reasons why you may need to file a New York State income tax extension. Some common reasons include:

- Needing more time to gather necessary documents, such as W-2 forms or 1099 forms

- Dealing with complex tax issues, such as self-employment income or investment income

- Experiencing personal or family emergencies that make it difficult to file on time

- Requiring more time to resolve tax disputes or audits

How to File a New York State Income Tax Extension

Filing a New York State income tax extension is a relatively straightforward process. Here are the steps you need to follow:

Filing an Automatic Six-Month Extension

To file an automatic six-month extension, you'll need to submit Form IT-370, Application for Automatic Six-Month Extension of Time to File for New York State Personal Income Tax. You can file this form online or by mail.

- Online: You can file Form IT-370 online through the New York State Department of Taxation and Finance website. You'll need to create an account or log in to your existing account to access the form.

- By Mail: You can also file Form IT-370 by mail. You'll need to print out the form, complete it, and mail it to the address listed on the form.

What to Include with Your Extension Form

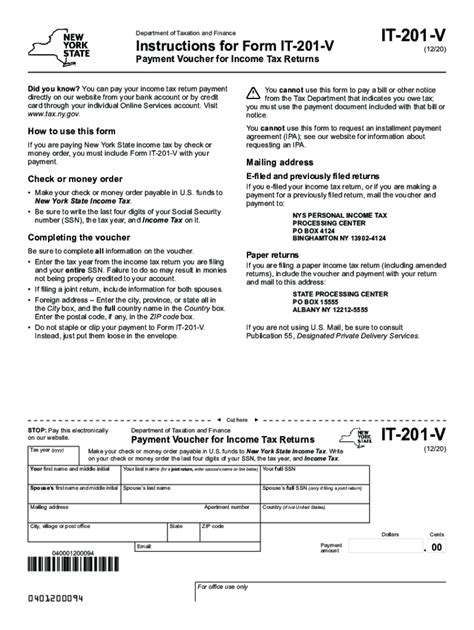

When filing your extension form, you'll need to include the following information:

- Your name and address

- Your Social Security number or ITIN

- Your spouse's name and Social Security number or ITIN (if applicable)

- An estimate of your tax liability

- Payment for any estimated tax due

Estimating Your Tax Liability

When filing your extension form, you'll need to estimate your tax liability. This is an estimate of the amount of tax you owe for the year. You can use Form IT-370 to estimate your tax liability.

- If you're using tax software, such as TurboTax or H&R Block, you can use the software to estimate your tax liability.

- If you're filing manually, you can use the tax tables in the Form IT-370 instructions to estimate your tax liability.

Payment Options

When filing your extension form, you'll need to make a payment for any estimated tax due. You can make a payment online, by phone, or by mail.

- Online: You can make a payment online through the New York State Department of Taxation and Finance website.

- By Phone: You can make a payment by phone by calling the New York State Department of Taxation and Finance at (518) 457-5431.

- By Mail: You can make a payment by mail by sending a check or money order with your extension form.

Penalties and Interest for Late Payment

If you fail to make a payment or underpay your estimated tax, you may be subject to penalties and interest.

- Penalties: The penalty for late payment is 14.5% of the unpaid tax.

- Interest: Interest accrues on the unpaid tax at a rate of 6% per year.

How to Avoid Penalties and Interest

To avoid penalties and interest, make sure to:

- File your extension form on time

- Make a payment for any estimated tax due

- Pay any remaining balance when you file your tax return

Additional Tips and Reminders

Here are some additional tips and reminders to keep in mind:

- Make sure to keep a copy of your extension form and payment for your records.

- If you're filing an extension, you'll still need to file your tax return by the extended deadline.

- If you're unable to pay your tax bill, you may be eligible for a payment plan.

Frequently Asked Questions

What is the deadline for filing a New York State income tax extension?

+The deadline for filing a New York State income tax extension is April 15th of each year.

How do I file a New York State income tax extension?

+You can file a New York State income tax extension online or by mail using Form IT-370.

What happens if I fail to make a payment or underpay my estimated tax?

+If you fail to make a payment or underpay your estimated tax, you may be subject to penalties and interest.

By following these steps and tips, you can easily file a New York State income tax extension and avoid penalties and interest. Remember to file your extension form on time, make a payment for any estimated tax due, and pay any remaining balance when you file your tax return.