Sales tax - the bane of many a business owner's existence. But fear not, dear entrepreneurs! Filling out sales tax forms doesn't have to be a daunting task. With a little know-how and the right guidance, you'll be navigating the world of sales tax forms like a pro in no time. In this comprehensive guide, we'll break down the ins and outs of sales tax forms, providing you with the knowledge and confidence to tackle even the most complex tax returns.

Understanding Sales Tax

Before we dive into the nitty-gritty of sales tax forms, it's essential to understand the basics of sales tax itself. Sales tax is a type of consumption tax levied on the sale of goods and services. Businesses are required to collect sales tax from customers and remit it to the relevant state or local government. The rate of sales tax varies depending on the location, with some states and localities imposing a higher rate than others.

Types of Sales Tax Forms

There are several types of sales tax forms, each with its own specific purpose. The most common types of sales tax forms include:

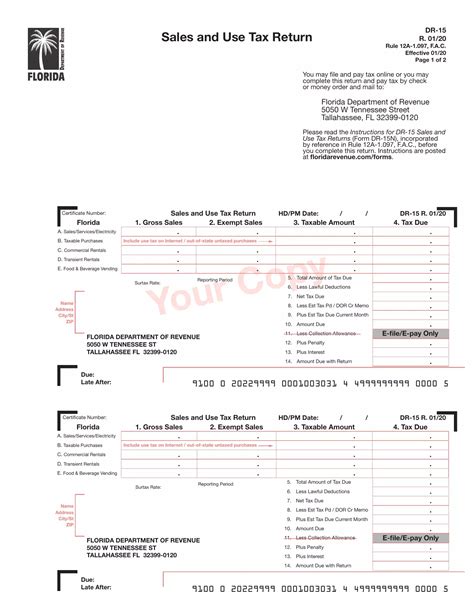

- Sales Tax Return: This is the most common type of sales tax form, used to report and remit sales tax to the state or local government.

- Exemption Certificate: This form is used to claim exemption from sales tax on certain purchases.

- Resale Certificate: This form is used to claim exemption from sales tax on purchases made for resale.

Step-by-Step Guide to Filling Out Sales Tax Forms

Filling out sales tax forms can be a complex process, but by breaking it down into smaller steps, you'll be able to navigate it with ease. Here's a step-by-step guide to filling out sales tax forms:

Step 1: Gather Necessary Information

Before you begin filling out your sales tax form, you'll need to gather some necessary information. This includes:

- Your business's tax ID number

- Your business's address and contact information

- The tax period for which you're filing

- The total amount of sales tax collected during the tax period

Step 2: Determine Your Filing Frequency

The frequency at which you need to file sales tax forms varies depending on the state or locality in which you operate. Some states require monthly filings, while others require quarterly or annual filings. Be sure to check with your state or local government to determine your filing frequency.

Step 3: Complete the Sales Tax Return Form

Once you've gathered the necessary information and determined your filing frequency, you can begin filling out the sales tax return form. This form will ask for information such as:

- Your business's tax ID number

- The tax period for which you're filing

- The total amount of sales tax collected during the tax period

- The amount of sales tax due

Step 4: Calculate Your Sales Tax Liability

To calculate your sales tax liability, you'll need to multiply the total amount of sales tax collected during the tax period by the applicable sales tax rate.

Step 5: Remit Payment

Once you've calculated your sales tax liability, you'll need to remit payment to the state or local government. Be sure to check with your state or local government to determine the accepted payment methods.

Common Mistakes to Avoid

When filling out sales tax forms, it's easy to make mistakes that can result in penalties and fines. Here are some common mistakes to avoid:

- Failing to file on time: Be sure to file your sales tax forms by the designated deadline to avoid penalties and fines.

- Incorrectly calculating sales tax liability: Make sure to accurately calculate your sales tax liability to avoid overpaying or underpaying.

- Failing to remit payment: Be sure to remit payment to the state or local government to avoid penalties and fines.

Tips for Managing Sales Tax Forms**

Managing sales tax forms can be a complex and time-consuming process. Here are some tips to help you streamline the process:

- Use sales tax software: Sales tax software can help you automate the process of filing sales tax forms, reducing errors and saving time.

- Keep accurate records: Keep accurate records of all sales tax transactions to ensure you're accurately reporting sales tax.

- Consult with a tax professional: If you're unsure about any aspect of the sales tax form filing process, consider consulting with a tax professional.

Sales Tax Forms FAQ

What is the deadline for filing sales tax forms?

+The deadline for filing sales tax forms varies depending on the state or locality in which you operate. Be sure to check with your state or local government to determine the deadline.

What happens if I fail to file sales tax forms on time?

+If you fail to file sales tax forms on time, you may be subject to penalties and fines. Be sure to file your sales tax forms by the designated deadline to avoid these consequences.

Can I file sales tax forms online?

+Yes, many states and localities offer online filing options for sales tax forms. Be sure to check with your state or local government to determine if online filing is available.

By following these tips and guidelines, you'll be well on your way to mastering the art of filling out sales tax forms. Remember to stay organized, keep accurate records, and consult with a tax professional if you're unsure about any aspect of the process. With a little practice, you'll be filling out sales tax forms like a pro in no time.