Filing taxes can be a daunting task, especially for those who are new to the process. However, understanding the necessary forms and requirements can make the experience less overwhelming. If you're a California resident, you'll need to file a state tax return, and one of the most common forms used is the Form 540 2EZ. In this article, we'll delve into the world of California tax returns and explore what you need to know about Form 540 2EZ.

California is known for its beautiful beaches, diverse cities, and innovative economy. However, it's also notorious for its complex tax system. With multiple forms and schedules to navigate, it's easy to get lost in the process. But don't worry, we're here to guide you through the Form 540 2EZ and help you understand what it entails.

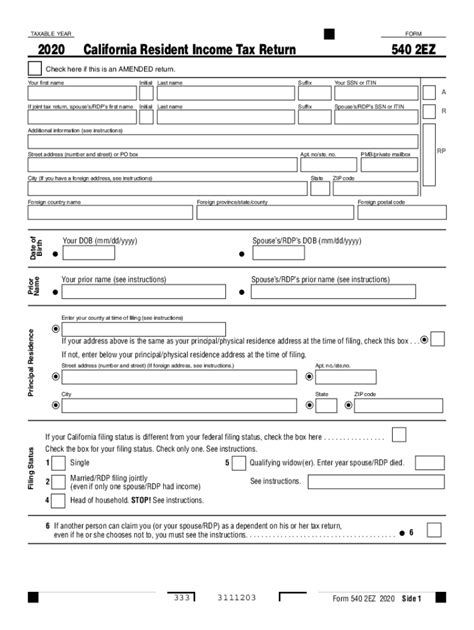

What is Form 540 2EZ?

Form 540 2EZ is a simplified tax form used by the California Franchise Tax Board (FTB) for individuals who meet specific requirements. It's designed for taxpayers with simple tax situations, such as those with only one source of income, no dependents, and no itemized deductions. The form is similar to the federal Form 1040EZ, but it's tailored to California's tax laws.

Who Can Use Form 540 2EZ?

To use Form 540 2EZ, you must meet the following requirements:

- You're a California resident

- You're single or married filing jointly

- You have only one source of income (e.g., W-2 wages, unemployment benefits, or Social Security benefits)

- You don't have any dependents

- You don't itemize deductions

- You don't have any self-employment income

- You're not claiming any credits or deductions other than the standard deduction

If you meet these requirements, you can use Form 540 2EZ to file your California tax return.

What Information Do I Need to Provide on Form 540 2EZ?

When completing Form 540 2EZ, you'll need to provide the following information:

- Your name, address, and Social Security number (or Individual Taxpayer Identification Number)

- Your filing status (single or married filing jointly)

- Your income from W-2 wages, unemployment benefits, or Social Security benefits

- Your standard deduction

- Any California tax withheld from your income

You'll also need to report any California income tax credits you're claiming, such as the California Earned Income Tax Credit (CalEITC).

How Do I File Form 540 2EZ?

You can file Form 540 2EZ electronically or by mail. If you're filing electronically, you can use the California FTB's online filing system or a tax preparation software. If you're filing by mail, you'll need to send the completed form to the FTB address listed on the form.

What Are the Benefits of Using Form 540 2EZ?

Using Form 540 2EZ can simplify the tax filing process and reduce the time it takes to complete your return. Here are some benefits of using this form:

- Faster filing: Form 540 2EZ is a simplified form that requires less information than other California tax forms.

- Easier to complete: The form is designed for taxpayers with simple tax situations, making it easier to complete.

- Reduced errors: The form's simplicity reduces the risk of errors, which can delay processing or result in penalties.

- Quicker refunds: If you're due a refund, using Form 540 2EZ can help you receive it faster.

Common Mistakes to Avoid When Using Form 540 2EZ

While Form 540 2EZ is designed to be simple, there are still some common mistakes to avoid:

- Failing to report all income: Make sure to report all income, including W-2 wages, unemployment benefits, and Social Security benefits.

- Incorrect filing status: Ensure you're filing as single or married filing jointly, as required by the form.

- Incorrect standard deduction: Verify you're claiming the correct standard deduction for your filing status.

Conclusion: Filing Your California Tax Return with Form 540 2EZ

Filing your California tax return with Form 540 2EZ can be a straightforward process if you meet the requirements and provide the necessary information. By understanding what this form entails and avoiding common mistakes, you can simplify the tax filing process and receive your refund faster. Remember to consult the California FTB's website or a tax professional if you have any questions or concerns.

What is the deadline for filing Form 540 2EZ?

+The deadline for filing Form 540 2EZ is typically April 15th, but it may vary depending on your specific situation. Check the California FTB's website for more information.

Can I use Form 540 2EZ if I have dependents?

+No, Form 540 2EZ is designed for taxpayers with no dependents. If you have dependents, you'll need to use a different form, such as Form 540.

How do I get a copy of Form 540 2EZ?

+You can download Form 540 2EZ from the California FTB's website or pick up a copy at a local FTB office. You can also use tax preparation software to access the form.